Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[Insights] Memory Spot Price Update: DDR4 Spot Prices Climb as Samsung Holds EOL Line

According to TrendForce’s latest memory spot price trend report, regarding DRAM, the price increase for DDR4 remains more significant compared to DDR5, and Samsung has clearly stated it will not defer its EOL plan. As a result, supply will decline rapidly for DDR4 in 2026, leading to the highest per-Gb price. Meanwhile, in NAND, spot prices have further risen under the expectation of increasing contract prices for 1Q26, though transaction remains limited. Details are as follows:

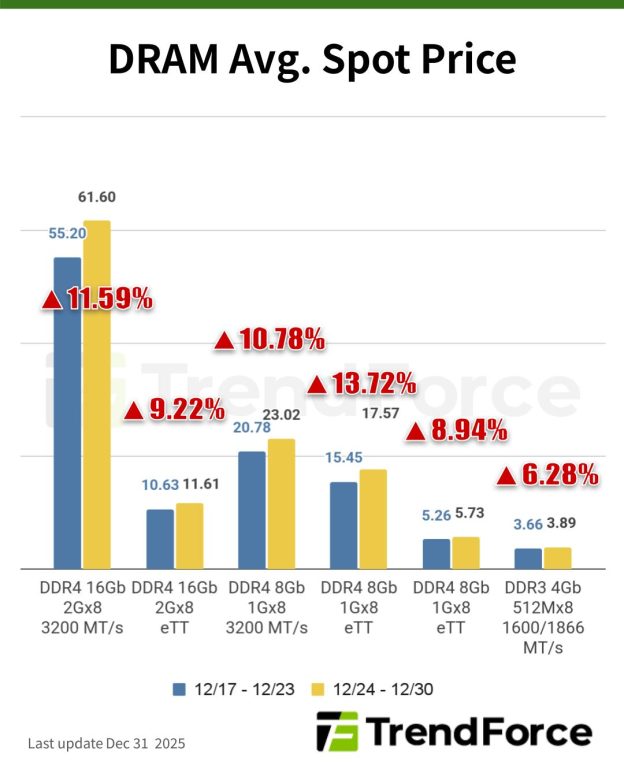

DRAM Spot Price:

Although year-end has arrived, with factories conducting successive inventory checks and some profit-taking intentions, purchasing momentum has slightly moderated. However, this does not alter the current trend of rising spot prices. The price increase for DDR4 remains more significant compared to DDR5, and Samsung has clearly stated it will not defer its EOL plan. As a result, supply will decline rapidly for DDR4 in 2026, leading to the highest per-Gb price. Overall, spot prices remain strong. The average spot price of mainstream chips (i.e., DDR4 1Gx8 3200MT/s) has increased by 6.80% from US$22.235 last week (Dec. 24) to US$23.746 this week (Dec. 30).

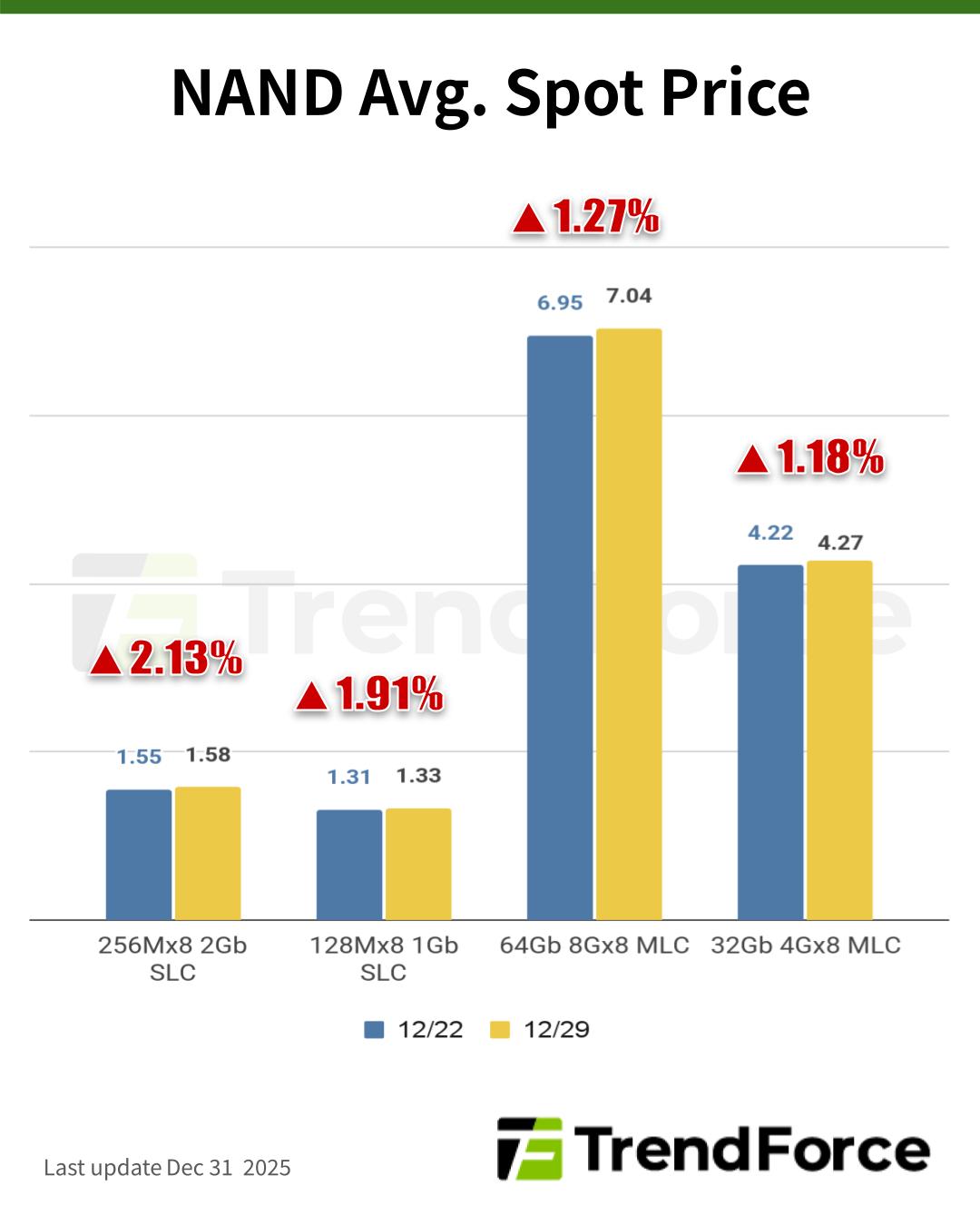

NAND Flash Spot Price:

Spot prices have further risen under the expectation of increasing contract prices for 1Q26. However, some of the buyers are on the fence due to the relatively higher spot prices right now, together with the weak extent of consumer demand, as well as how fabs are soon to go on holiday as Chinese New Year approaches. Spot traders have also not compromised on prices for shipment due to their optimism on subsequent price trends, thus resulting in sluggish market transactions. Spot prices of 512Gb TLC wafers have risen by 13.35% this week, arriving at US$13.055.