Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[Insights] Memory Spot Price Update: DDR4 Rally Builds on 16Gb Strength; DDR5, DDR3 See Mild Pullbacks

According to TrendForce’s latest memory spot price trend report, regarding DRAM, DDR5 and DDR3 spot prices saw a mild pullback this week as the rapid surge prompted some year-end profit-taking among traders, while DDR4 prices continue to climb—particularly 16Gb products. Meanwhile, in NAND, key support lies on the supply side, where suppliers—who have not released additional wafers as year-end approaches—have pushed spot prices to continuous all-time highs amid constrained market activity. Details are as follows:

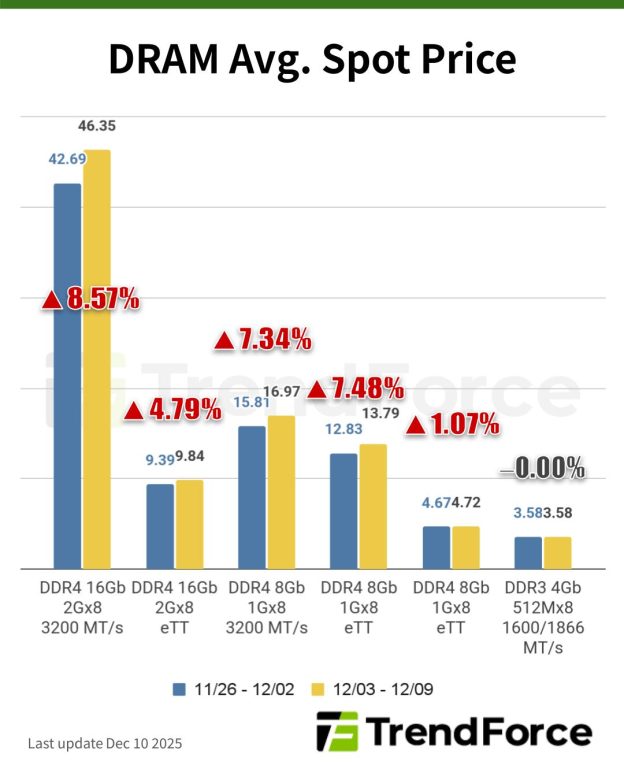

DRAM Spot Price:

DDR5 and DDR3 prices have eased slightly this week after a sharp rally that proved too aggressive recently. TrendForce observes that some traders are making adjustments to profits as year-end approaches, however it will not influence the overall tight market conditions. DDR4 prices continue to rise, especially the 16Gb products. Recent changes to spot prices have not influenced the forecast that contract prices will continue to rise significantly. The average spot price of mainstream chips (i.e., DDR4 1Gx8 3200MT/s) has increased by 2.00% from US$16.729 last week (December 3) to US$17.064 this week (December 9).

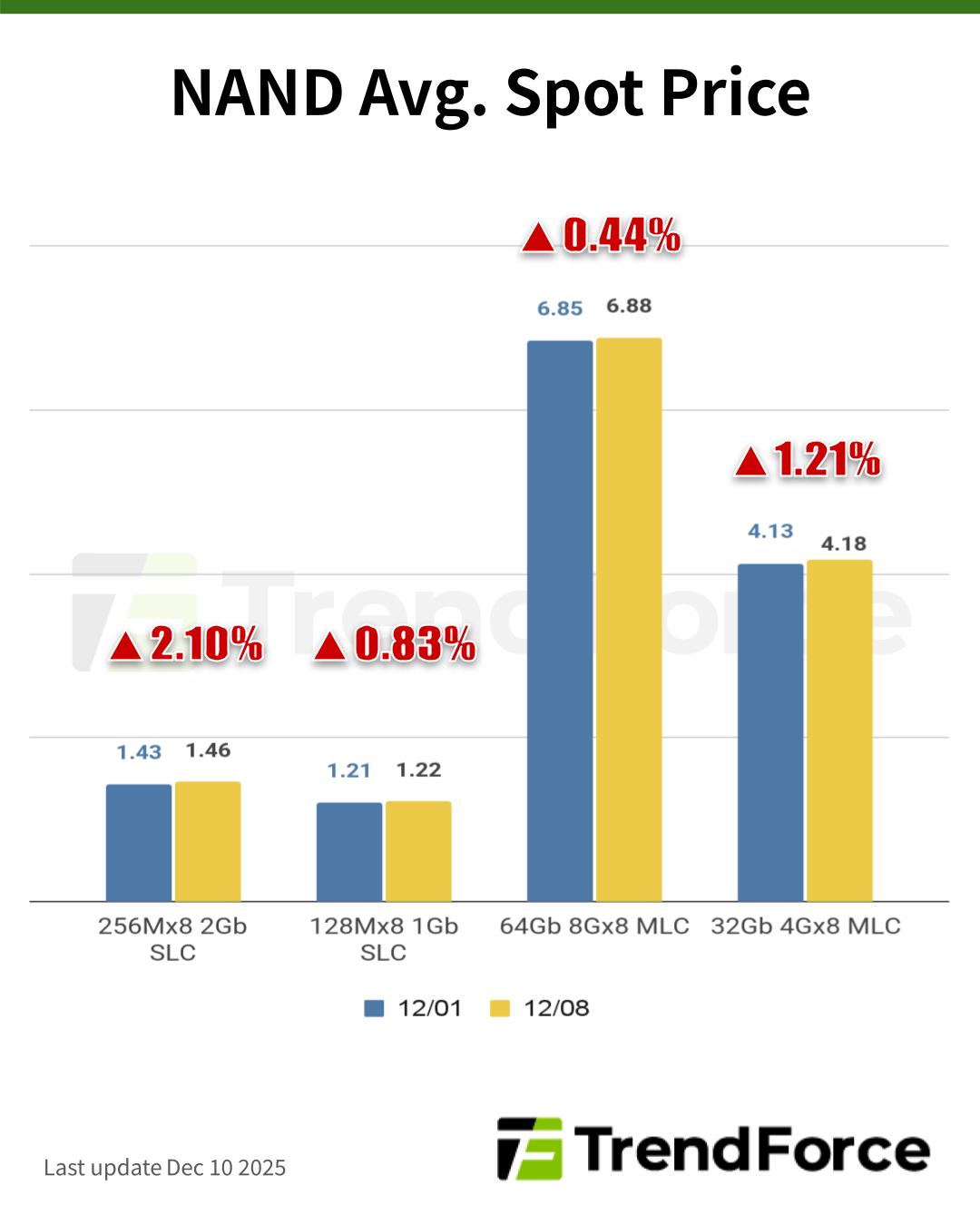

NAND Flash Spot Price:

The wafer market was seen with subsided price hikes but persistently strong prices this week. Due to the excessive hike previously, the market is now under temporal revisions and adjustments, though TrendForce points out that the key support lies on the provision end, where suppliers, who have not released additional wafers as the end of the year approaches, resulted in continuous all-time highs of spot prices under constrained market activities. Spot prices of 512Gb TLC wafers rose by 0.28% this week (December 9), arriving at US$9.634.