Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[Insights] Memory Spot Price Update: SanDisk’s 10% Price Hike Meets Demand-Side Resistance

According to TrendForce’s latest memory spot price trend report, regarding DRAM, suppliers continue to raise DDR4 quotes, encouraged by Nanya’s strong August revenue, but buyers show limited acceptance of the hikes. In NAND, SanDisk’s push for a 10% increase to lift market sentiment has met resistance from the demand side, keeping suppliers’ price adjustments constrained within channels. Details are as follows:

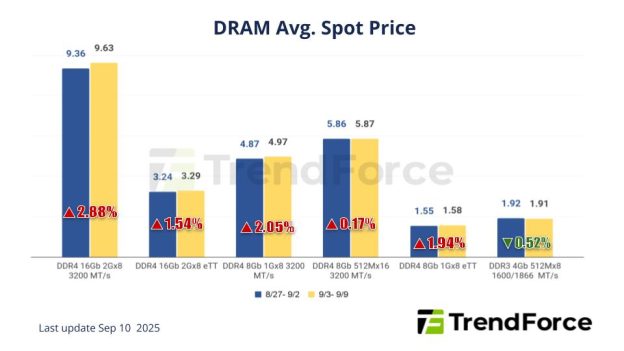

DRAM Spot Price:

In the spot market, sellers continue to raise quotes for DDR4 products, spurred by Nanya’s strong revenue growth in August. However, the acceptance of price hikes on the buyers’ side is limited, resulting in shrinking transaction volumes. The spot trading of DDR5 products remains tepid, with no notable change compared with preceding weeks. The average spot price of mainstream chips (i.e., DDR4 1Gx8 3200MT/s) has increased by 3.31% from US$4.896 last week to US$5.058 this week.

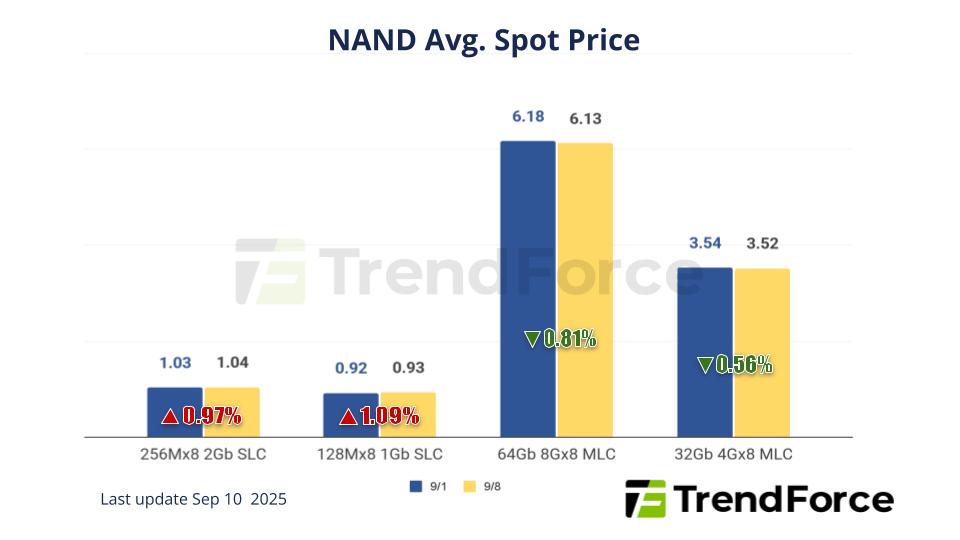

NAND Flash Spot Price:

SanDisk aims to elevate market prospect by a 10% price increase, which has however been met with resistance from the demand end. With the peak season of stocking activities having concluded, the withering degree of end demand for the time being is unable to provide a support for prices, thus restricting suppliers’ price hikes within channels, and have yet to branch out to the retail market. Subsequent effects on contract prices remain to be seen. Spot prices of 512Gb TLC wafers rose by 1.50% this week, arriving at US$2.840.