Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] U.S. Reportedly Mulls Stakes in CHIPS Act Recipients after Intel, Raising Risks for TSMC, Samsung

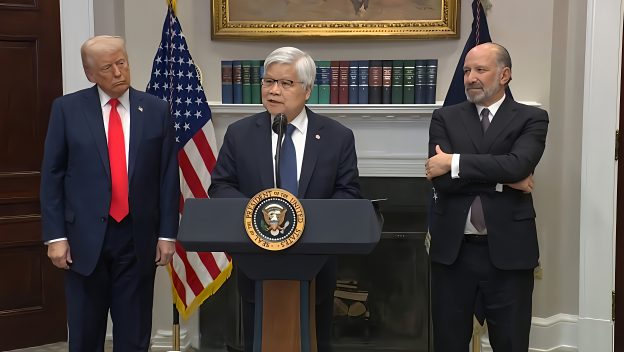

While U.S. Commerce Secretary Howard Lutnick confirmed in a CNBC interview that the administration is pursuing a 10% stake in Intel, Washington is considering going further. According to Reuters, Lutnick is exploring a plan to take equity stakes in other CHIPS Act recipients—such as TSMC, Samsung, and Micron—in exchange for the subsidies they receive.

According to CNBC, Lutnick stressed the Intel stake would be nonvoting, clarifying that the plan is not about governance but about converting a grant into equity for the American people. Nonetheless, as White House press secretary Karoline Leavitt called it a “creative” move to put U.S. security and economic needs first, Reuters brings up concerns that such a deal would be unprecedented—signaling a new level of U.S. influence over major chipmakers.

CHIPS Act Winners at Risk?

Since much of the funding has yet to be disbursed, the move would allow Washington to not only boost domestic chip production but also share directly in the companies’ future growth, Reuters adds.

Notably, in the final weeks of the Biden administration, the Commerce Department finalized over $33 billion in awards, including $4.75 billion for Samsung, up to $7.86 billion for Intel (for domestic investments), $6.6 billion for TSMC, and $6.2 billion for Micron.

As per NBC4i, Intel has received $2.2 billion from CHIPS Act subsidies, all reportedly disbursed before President Trump took office.

Meanwhile, TSMC’s subsidiaries—including TSMC Arizona, ESMC, JASM, and TSMC Nanjing—received government subsidies totaling NT$67.1 billion for the six months ended June 30, 2025, up from NT$7.95 billion a year earlier. TSMC Arizona is also eligible for a 25% investment grant on qualified projects. As Commercial Times reported in March, TSMC confirmed receiving $1.5 billion in CHIPS Act funding in Q4 2024.

Chosun Biz, on the other hand, warns that the U.S. government’s latest move could shake up South Korean chipmakers’ U.S. plans. For Samsung and SK hynix, already committed to major local investments, changing subsidy terms and Intel-focused support may bring new risks.

The report notes that turning subsidies into equity would increase uncertainty over investment conditions and invite potential government influence. A research fellow cited by the report added that using shareholding as a policy tool could pressure foreign firms to perform advanced semiconductor processes on U.S. soil.

Read more

- [News] TSMC Arizona Delivers 2Q25 Investment Income; as Kumamoto Fab Struggles with Losses

- [News] TSMC Reportedly Delays Kumamoto 2nd Fab Launch to 2029 Amid U.S. Expansion Push

(Photo credit: The White House)