Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

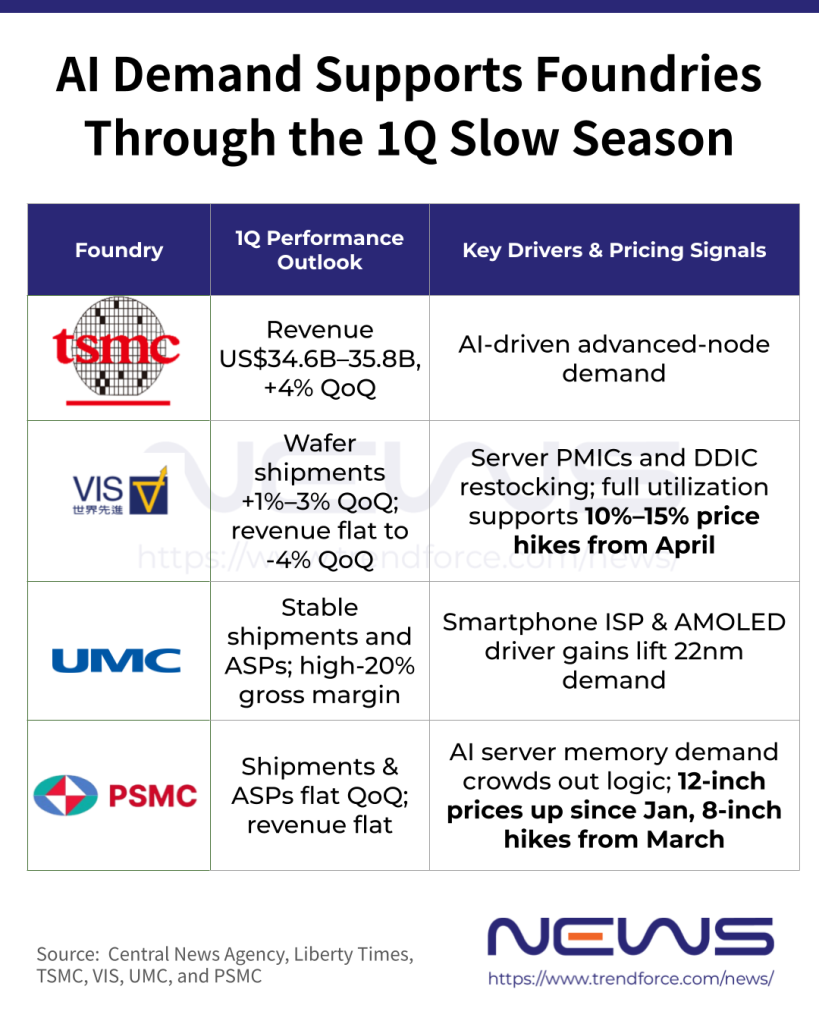

[News] AI Demand Blunts Foundry Seasonality: TSMC Sees 4% 1Q Growth; VIS, PSMC Raise Prices

AI demand powers foundries through the slow season. According to Central News Agency, the first quarter is traditionally a slow season for foundries, but this year is benefiting from strong AI demand alongside a recovery in panel driver IC orders. As a result, foundries including TSMC are expected to see first-quarter operations remain resilient despite seasonal headwinds.

As the report notes, driven by strong demand for advanced processes from AI-related applications, TSMC is expected to post first-quarter 2026 revenue between US$34.6 billion and US$35.8 billion, marking a record high. This would represent 4% quarter-over-quarter growth, positioning TSMC as the best-performing foundry in the first quarter.

Vanguard Sees Strong Volumes, Moves to Price Hikes as Capacity Tightens

TSMC’s affiliate, Vanguard International Semiconductor, is seeing solid first-quarter momentum, with shipments of server power management ICs remaining strong, the report states. Inventory restocking and replenishment in the TV and e-reader markets are also supporting a recovery in display driver IC demand, with first-quarter wafer shipments expected to grow 1% to 3% quarter over quarter, according to the report.

However, amid changes in the product mix, Vanguard’s average selling prices in the first quarter are expected to decline by around 3% to 5%, resulting in first-quarter revenue estimated to be flat to down 4% from the fourth quarter of 2025, the report adds.

Notably, according to Liberty Times, Vanguard has been operating at full capacity and, following selective price hikes in the first quarter, has recently notified customers of a second round of across-the-board foundry price increases starting in April, with hikes ranging from 10% to 15%. The industry expects these increases to further lift Vanguard’s gross margin.

PSMC Signals Price Hikes as AI-Driven Demand Tightens Capacity

PSMC is also eyeing price hikes. As noted by Liberty Times, the company signaled upcoming increases during its investor conference last week, citing strong AI server–driven memory demand since January, which has partially crowded out logic capacity. As a result, wafer foundry prices for 12-inch display driver ICs (DDICs) and image sensors (CIS)—which were priced off a low base—have begun to rise since January, Liberty Times highlights. The report adds that power device demand tied to AI servers and edge computing—such as MOSFETs—has not only held up but increased, prompting PSMC to begin raising 8-inch wafer foundry prices from March.

UMC Holds Steady Through the Slow Season

Alongside its peers, Central News Agency notes that UMC is expected to maintain stable operating performance in the first quarter. Wafer shipments and average selling prices are both projected to remain flat, resulting in flat first-quarter revenue—a stronger-than-usual seasonal outcome compared with the company’s typical 8%–9% quarter-on-quarter decline in past first quarters.

Central News Agency adds that continued gains in market share in smartphone image signal processors and active-matrix organic light-emitting diode (AMOLED) driver ICs are expected to support growth in UMC’s 22nm process business, which is emerging as a key driver of overall performance growth.

Read more

- [News] TSMC 2nm Reportedly Tight Amid Mobile, HPC Demand; NVIDIA May Be First to Adopt 1.6nm in 2028

- [News] 8-Inch Foundries May Raise Prices 5–20%, Benefiting UMC, PSMC, Vanguard

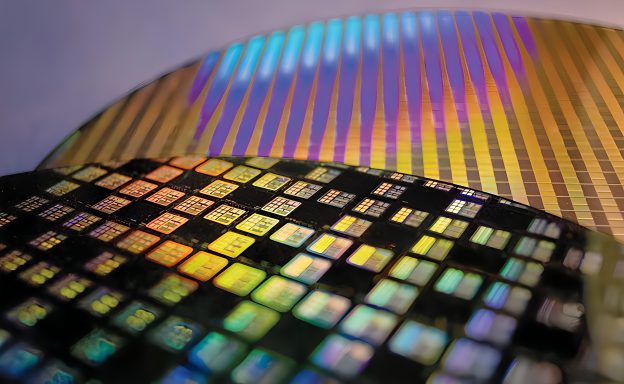

(Photo credit: TSMC)