Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] Volume-Locked, Price-Flexible LTAs Gain Ground in DRAM, Nanya, Winbond Reportedly Extend Contracts

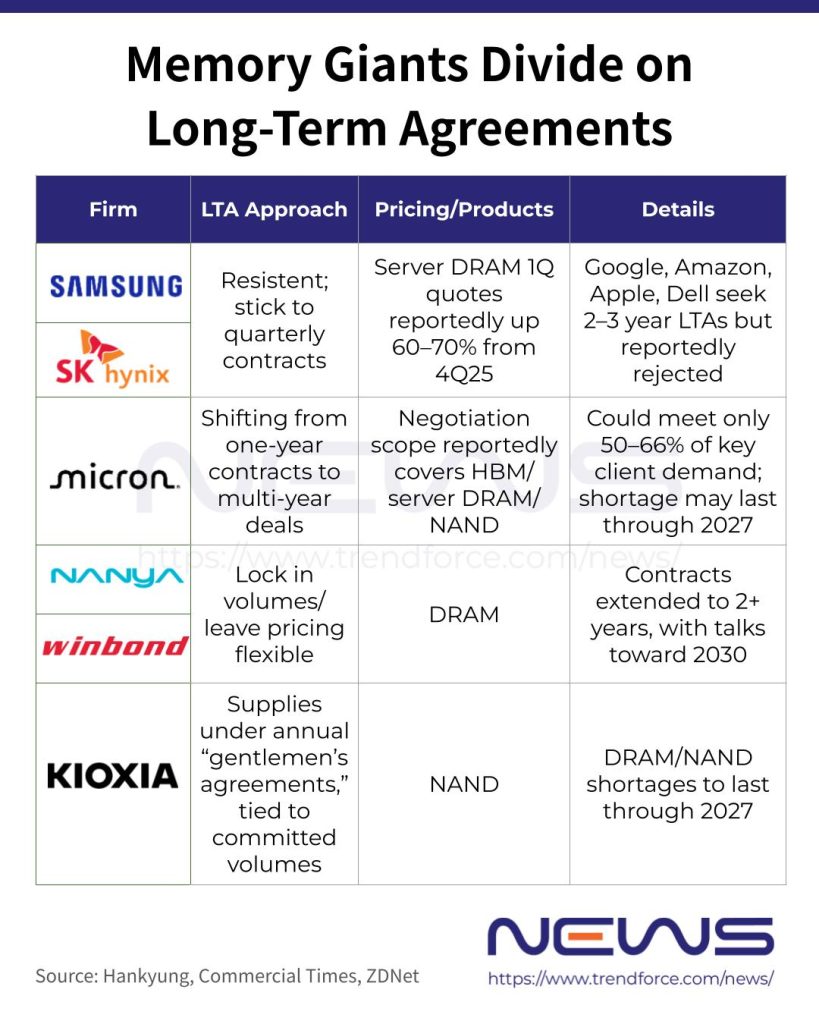

Memory prices continue to surge amid tight supply, pushing both makers and buyers into a delicate balancing act. According to Commercial Times, long-term supply agreements (LTAs) are shifting away from the old model that locked in both price and volume, as the trend favors deals that guarantee committed volumes but leave prices flexible.

As noted by Commercial Times, Taiwan’s DRAM players, including Winbond and Nanya Technology, are leading the way, mostly signing LTAs that lock in volumes but leave pricing flexible. Reportedly, contract terms have also been extended—from one year to at least two—while some key customers are negotiating frameworks stretching as far as 2030, according to Commercial Times.

However, while this approach secures production priority and stable shipments and allows prices to swing, Commercial Times notes that such LTAs—though providing baseline profitability and steadier capacity use—also cap upside margins, effectively a “no losses, but limited gains” model.

This partly explains why certain memory giants remain cautious. According to Hankyung, while major tech players like Google, Amazon, Apple, and Dell have been pursuing LTAs that guarantee volumes over the next two to three years, Samsung and SK hynix are sticking to quarterly contracts instead, as rising DRAM prices through 2027 make long-term deals less attractive, the report notes.

Far from embracing LTAs, Samsung and SK hynix have quoted first-quarter prices for key server DRAM customers that soar 60–70% above fourth-quarter levels, with similar hikes extended to PC and smartphone DRAM buyers, Hankyung reported in early January.

In general, Commercial Times suggests with 2026 prices staying high, HBM crowding-out effects continuing, and potential new supply emerging in 2027, the DRAM industry is poised for a structural turning point, with the supply-demand rebalancing inflection likely around 2027. Industry sources cited by the report say DRAM tightness will persist through the end of 2026, with server DRAM supply shortfall expected around 15%.

Micron and Kioxia’s Approach

On the other hand, other memory giants are also rethinking LTAs. Micron CEO Sanjay Mehrotra, as per B!z Watch, stated that the company is moving away from traditional one-year contracts, negotiating multi-year deals with major customers. The scope now goes beyond HBM to include server DRAM and NAND flash, he added. Despite this, Mehrotra noted the company can currently meet only 50% to 66% of demand from several key clients, highlighting strong market pressure, B!z Watch reported.

Meanwhile, Japanese NAND giant Kioxia, according to ZDNet, confirms global IT big tech’s AI infrastructure push is prolonging DRAM and NAND flash shortages, with the company expecting the trend to last through 2027.

The report, citing Executive Director Shunsuke Naito, notes that Kioxia now supplies products based on an annual “gentlemen’s agreement” with key customers, planning production and deliveries around committed volumes. Naito added that even when some customers offer higher prices, Kioxia prioritizes long-term partnerships with clients they can grow alongside, as per ZDNet.

Read more

- [News] Samsung, SK Reportedly Hike Server DRAM Prices 60-70% – Google, Microsoft in the Queue

- [News] Nanya Tech Posts Record Q4 EPS NT$3.58, Flags Tight DDR5/4/3 Supply and 1Q Price Hikes

(Photo credit: Nanya Tech)