Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] Lutnick Reportedly Signals 100% Memory Tariff on Non-U.S. Output, Pressuring Samsung and SK hynix

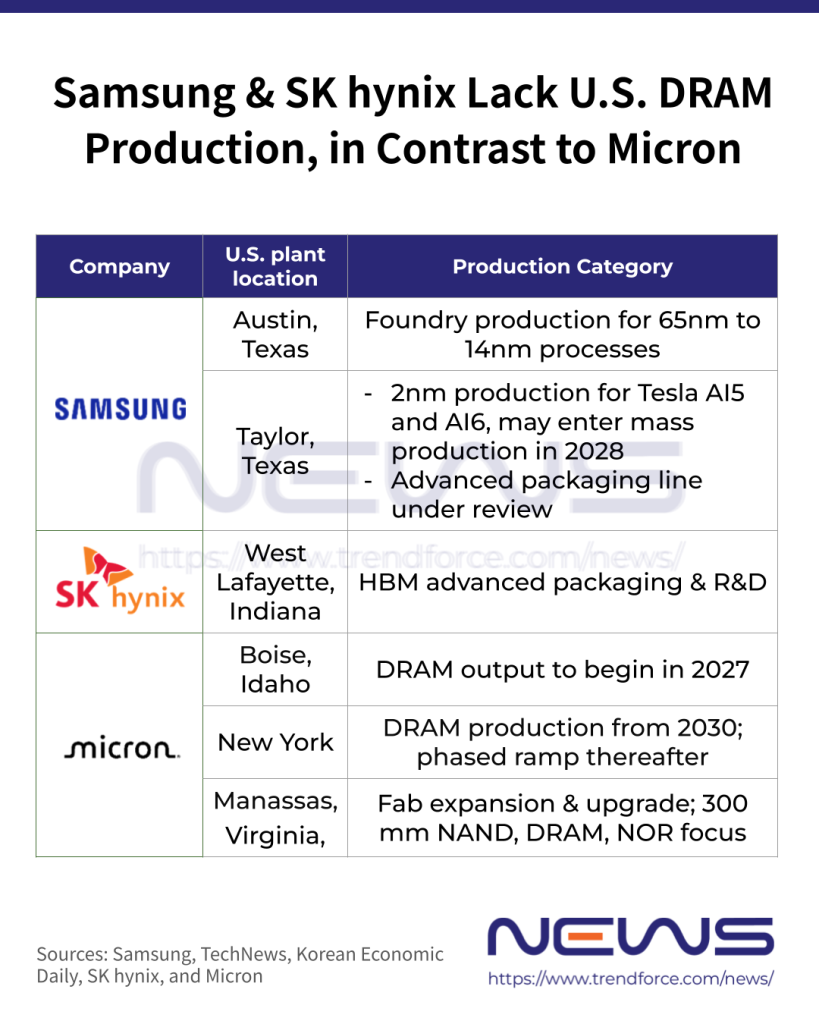

A potential risk may be emerging for the memory industry, with Korean memory makers increasingly exposed to U.S. policy developments. According to Wccftech, speaking at Micron’s New York fab groundbreaking ceremony, U.S. Commerce Secretary Howard Lutnick said that memory producers without domestic manufacturing could potentially face tariffs of up to 100%. The report highlights that while some memory makers have committed to investing in the U.S., a key concern is that these investments may not include DRAM manufacturing.

As the report notes, while Samsung Electronics has announced semiconductor investment commitments covering both front-end and back-end operations, it has yet to outline plans for a dedicated memory fabrication plant. Similarly, SK hynix recently unveiled a $4 billion investment in West Lafayette, Indiana, but the project focuses on 2.5D advanced packaging and R&D, with DRAM production lines not included. The report adds that the only major company currently producing, or planning to produce, DRAM in the U.S. is Micron.

Meanwhile, Wccftech adds that Taiwanese memory makers such as Nanya Technology and Winbond Electronics, which play key roles in the DRAM supply chain, could also potentially face so-called “memory tariffs,” posing significant challenges for the industry.

Market Reality Tempers Tariff Impact on DRAM Leaders

Establishing DRAM manufacturing capacity in the U.S. could prove challenging for Samsung Electronics and SK hynix. As noted by Chosun Biz, both companies are already committing hundreds of trillions of won to domestic investments tied to the Yongin Semiconductor Cluster, leaving limited flexibility for additional large-scale spending.

Still, Chosun Biz notes that some analysts believe the potential impact on Samsung Electronics and SK hynix may be limited. Together, the two companies account for roughly 70% of the global DRAM market, and the U.S. currently lacks near-term alternatives. Without their HBM supply, customers such as NVIDIA, Google, and AMD would struggle to produce high-performance AI chips. As a result, the analysts argue that steep memory tariffs could ultimately push costs onto U.S. companies or consumers.

Read more

- [News] Taiwan-U.S. Trade Deal Cuts Tariffs from 20% to 15%, Secures $250B Investment with TSMC at Center

- [News] Memory Price Rally May Run Past 2028 as Samsung, SK hynix Reportedly Cautious on Expansion

(Photo credit: Samsung)