Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

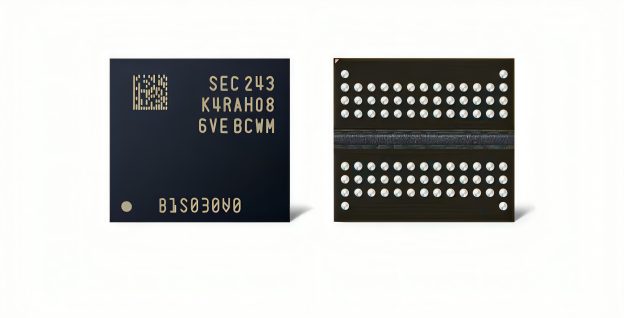

[News] Memory Price Rally May Run Past 2028 as Samsung, SK hynix Reportedly Cautious on Expansion

With DRAM prices climbing sharply and supply still constrained, Samsung and SK hynix are prioritizing profitability. According to Hankyung, the two companies—together commanding roughly 70% of the DRAM market—signaled caution toward aggressive capacity expansion during recent IR meetings with major global investment banks. This conservative stance is fueling expectations that the current “memory super-cycle” could stretch well past 2028, the report adds.

Samsung Takes Conservative Approach to DRAM Supply

As the report notes, citing industry sources, Samsung Electronics outlined a cautious semiconductor supply strategy during an investor presentation hosted by Morgan Stanley on the 23rd of last month. The company stressed that it would prioritize long-term profitability over rapid capacity expansion and said it aims to minimize oversupply risks through a CAPEX approach focused on balancing customer demand with pricing.

Meanwhile, as the shortage intensifies, Samsung’s memory division is reportedly taking a careful stance toward requests from major customers seeking long-term mobile DRAM supply agreements. The report adds that although clients are pushing for multi-year contracts, Samsung is hesitant to tie up large volumes with specific buyers amid sharply rising prices. It further notes that the division is currently able to fulfill only about 70% of incoming DRAM orders.

SK hynix Ramps 1c DRAM, Yet Shortages Loom

SK hynix is taking a similar stance. According to the report, the company told investors at a recent Bank of America Merrill Lynch IR session that it plans to convert roughly half of its commodity DRAM production capacity to its latest 10-nanometer-class, sixth-generation (1c) DRAM. Even so, the report notes that SK hynix acknowledged this transition will still fall short of fully meeting customer demand.

As the report indicates, a company representative added that although SK hynix intends to invest around 30% of its revenue in capital expenditures in 2026 and accelerate its shift to 1c DRAM, these measures will not be enough to ease the current supply shortage. The report also notes that SK hynix expects DRAM prices to continue rising for several years and is responding to this outlook by relying on short-term contracts.

AI Demand Reshapes DRAM Supply–Demand Balance

The DRAM market’s supply–demand structure has fundamentally shifted as traditional PC and smartphone demand converges with massive new demand from AI and data centers, according to Money Today. In this supplier-driven environment, Samsung Electronics and SK hynix are securing significantly higher contract prices. The report notes that Samsung is closing fourth-quarter deals at unit prices roughly 40% above the previous quarter, while SK hynix has paused shipments and entered renegotiations that boost prices by a similar 40%.

Read more

- Global DRAM Revenue Jumps 30.9% in 3Q25, Micron’s Market Share Climbs by 3.7 Percentage Points, Says TrendForce

- [News] SK hynix Reportedly Poised for Over 70% Operating Margin for General-Purpose DRAM amid Tight Supply

(Photo credit: Samsung)