Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[Insights] Memory Spot Price Update: DRAM Module Sellers Mostly Halt Quotes as Mainstream DDR4 Soars 7%

According to TrendForce’s latest memory spot price trend report, regarding DRAM, module sellers have mostly halted quote offerings for now, with DDR4 supply scarcity being the most pronounced. The spot market overall shows a widespread reluctance to sell. Meanwhile, in NAND, prices continue to climb, especially for QLC NAND Flash and enterprise SSDs, which are seeing booming demand. Details are as follows:

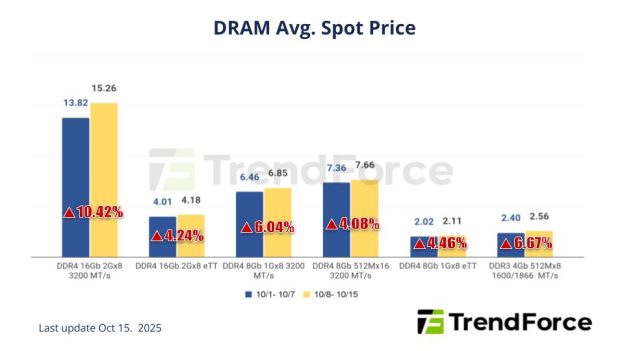

DRAM Spot Price:

Due to the strong price outlook, sellers in the spot market are holding back supply and waiting for better prices. Module sellers have mostly halted quote offerings for now, and supply scarcity is most pronounced for DDR4 products. DDR5 products, too, are experiencing rising prices at the same time. The spot market as a whole is characterized by a widespread reluctance to sell. The average spot price of mainstream chips (i.e., DDR4 1Gx8 3200MT/s) has increased by 7.21% from US$6.584 last week to US$7.059 this week.

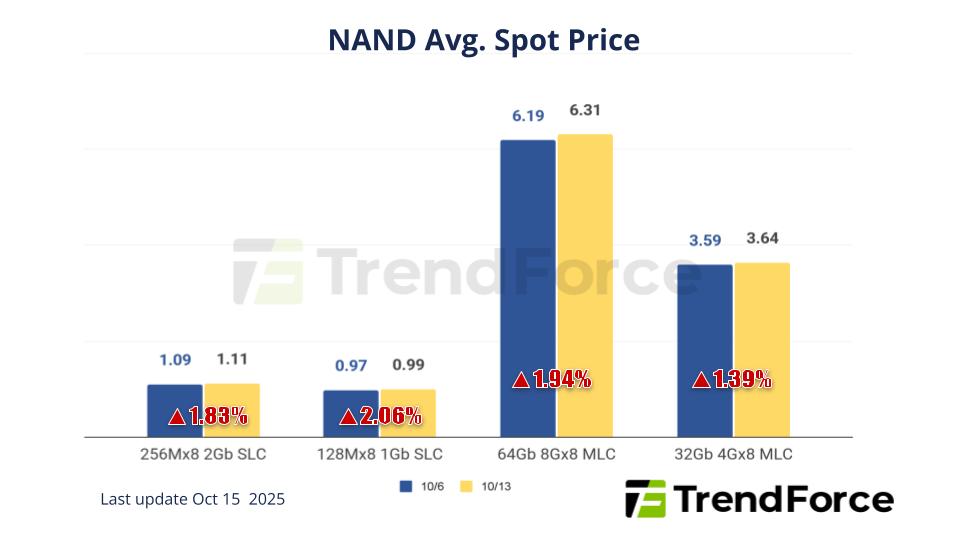

NAND Flash Spot Price:

The spot market continues to climb in prices, especially with QLC NAND Flash and enterprise SSD that are booming in demand. CSPs and AI server clients, who exhibit strong purchase sentiment, are digesting module houses’ existing wafer inventory, thus restricting the availability of spots. Some of the module houses have even temporarily halted their quotations when observing the trend of contract prices for 4Q25. Overall market is becoming reluctant in sales, and is still prone to increase in spot prices for the short term. Spots of 512Gb TLC wafers climbed by 3.50% this week, arriving at US$3.576.