Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[Insights] Memory Spot Price Update: DDR4 Spot Prices Surge Amid Tight Supply, Buyers Struggle to Keep Pace

According to TrendForce’s latest memory spot price trend report, regarding DRAM, although DDR4 supply remains tight, the price surge has made it difficult for buyers to keep up, leading to limited trading volumes despite the price hikes. In NAND, the spot market is seen with price increases, recovery in order inquiries, and risen transactions, especially for QLC products. Details are as follows:

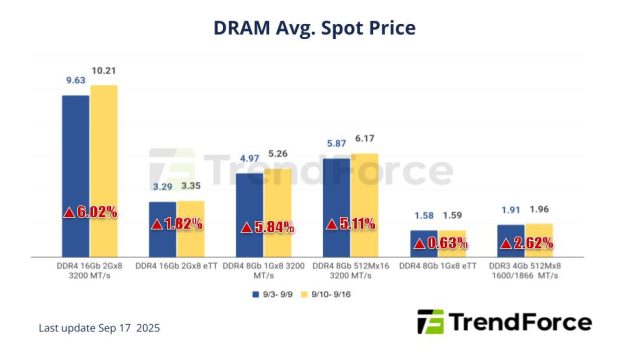

DRAM Spot Price:

The spot market primarily reflects the demand for consumer electronics, thus the trading momentum is not consistent with the contract market and appears relatively subdued. Although DDR4 supply remains tight, the price surge has made it difficult for buyers to keep up, leading to limited trading volumes despite the price hikes. Looking ahead, driven by the strong demand from CSPs mentioned earlier, the spot market is more likely to experience a trend where prices are prone to rise rather than fall. The average spot price of mainstream chips (i.e., DDR4 1Gx8 32000MT/s) have risen by 6.26% from US$5.111 last week to US$5.431 this week.

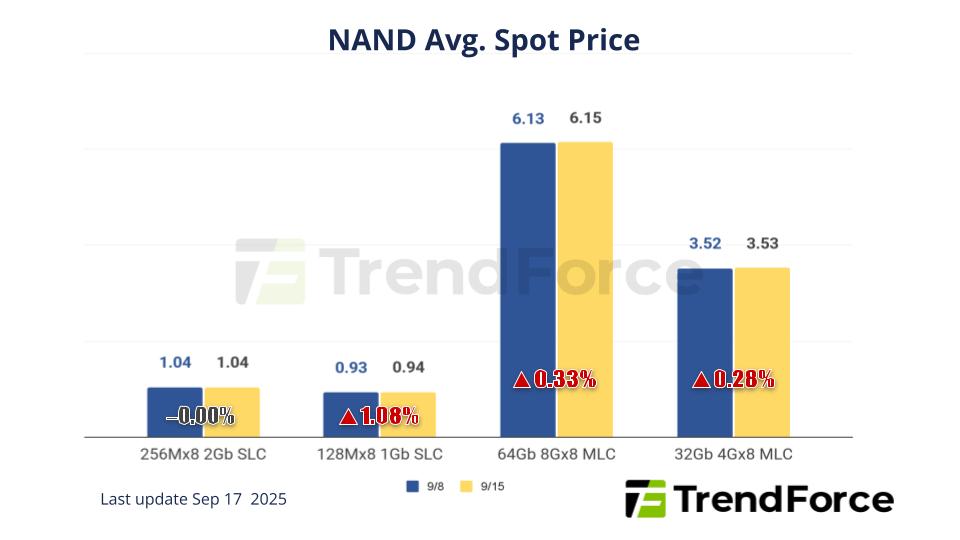

NAND Flash Spot Price:

The spot market is seen with price increases, recovery in order inquiries, and risen transactions, especially for QLC products, under the expectation of price hikes from the rebounded status of the contract market. Spot prices of 512Gb TLC wafers climbed by 0.53% this week, arriving at US$2.855.