Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[Insights] Memory Spot Price Update: DRAM Trading Slows as DDR4 Mainstream Prices Drop 2.4%

According to TrendForce’s latest memory spot price trend report, regarding DRAM, the spot market has remained fairly subdued in terms of trading activities, while the average spot price of the mainstream chips (i.e., DDR4 1Gx8 3200MT/s) slightly decreased by -2.40%. As for NAND flash, legacy products remain sought after among buyers for the spot market, with price inquiries and robustness of transactions both surpassing that of mainstream products. Details are as follows:

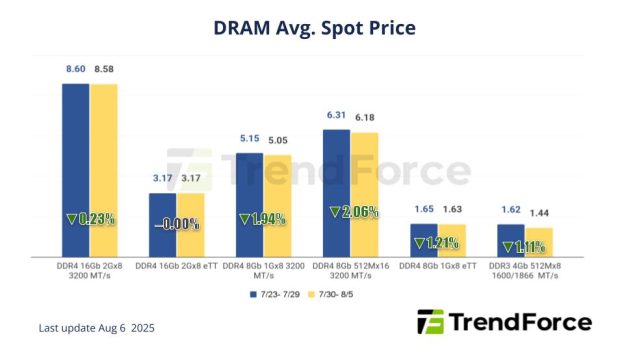

DRAM Spot Price:

Continuing from last week’s momentum, the spot market has remained fairly subdued in terms of trading activities. However, due to a bit of supply tightness, spot prices have not fallen significantly. Besides chips from suppliers, reball chips stripped from decommissioned modules have also seen slight but ongoing price drops. For 1Gx8 reball chips, the spot price has fallen from around US$1.53 last week to US$1.48 this week. The main factor that constrains prices from going up is the lack of demand visibility for 4Q25. The average spot price of the mainstream chips (i.e., DDR4 1Gx8 3200MT/s) slightly decreased by -2.40% from US$5.123 last week to US$5.000 this week.

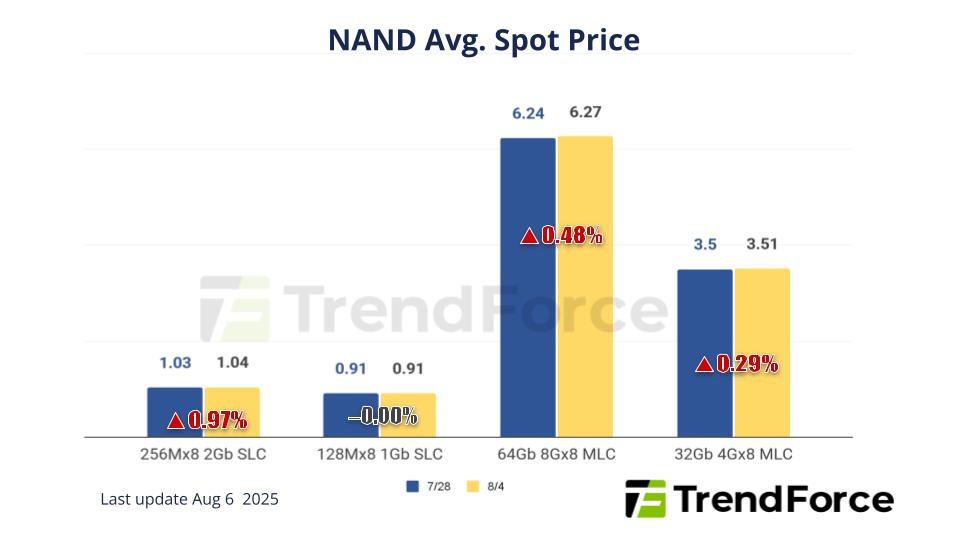

NAND Flash Spot Price:

Legacy products remain sought after among buyers for the spot market, with price inquiries and robustness of transactions both surpassing that of mainstream products, thus indicating how the market is still on the fence pertaining to overall demand. Spot prices of 512Gb TLC wafers slightly increased by 2.47% this week, arriving at US$2.784.