Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] ASML Confirms First High-NA EUV EXE:5200 Shipment, Reportedly Prepping for Intel’s 14A in 2027

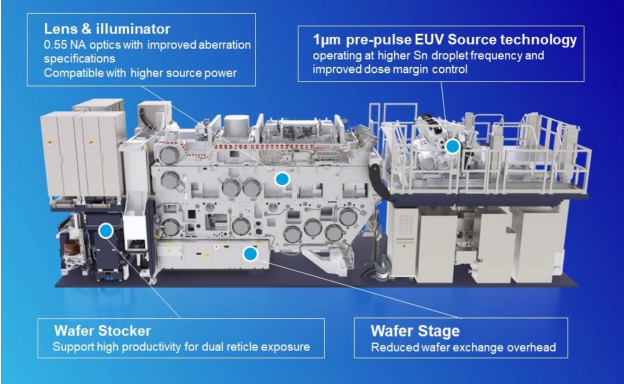

Despite warning that geopolitical risks could stall revenue growth in 2026, ASML still expects strong demand for both EUV and DUV tools this year. In its latest earnings call, the Dutch chipmaking equipment giant announced it has shipped the first EXE:5200 — a next-gen High-NA EUV system geared for high-volume manufacturing. Notably, ASML anticipates around a 30% jump in its EUV business in 2025.

ASML’s first High-NA EUV customer is confirmed to be Intel, which plans to use the technology for its 14A node, according to tweakers. While ASML has been shipping EXE:5000 systems since 2023 for test production and R&D, the delivery of the first EXE:5200B marks a key shift—High-NA EUV is now officially ready for volume manufacturing, as per the report.

CEO Christophe Fouquet, saying in an interview that the first EXE:5200B is now being installed, noted that the system is expected to deliver a 60% productivity boost over its predecessor, the EXE:5000. That amounts to 175 wafers per hour, which, according to ASML, is sufficient for volume production, as per tweakers.

However, it will be a while before High-NA EUV-based chips hit the market. As tweakers points out, only Intel has a clear timeline: risk production for its 14A node starts in 2027, with mass production expected the following year.

On the other hand, Wccftech suggests that TSMC might delay its adoption of High-NA EUV, with the company expected to bypass the tool for its A14 process and instead continue using 0.33-NA EUV, a move revealed by Senior Vice President Kevin Zhang at the NA Technology Symposium. According to TSMC’s roadmap, A14 is expected to enter mass production in 2028.

Meanwhile, Business Post suggests that Samsung has yet to set a timeline for using High-NA EUVs either, but is considering it for sub-2nm processes.

As ASML CEO Christophe Fouquet explained, AI is fueling the latest chip advances in both logic and DRAM. DRAM manufacturers are using more EUV layers on current and future nodes, which in turn is boosting demand for ASML’s EUV tools. Alongside a projected 30% growth in EUV business for 2025, the company also expects total sales to climb 15% year-over-year.

Read more

- [News] ASML’s High-NA EUV May Play a Smaller Role in Future Chipmaking, Intel Director Reportedly Claims

- [News] TSMC Reported to Skip High-NA EUV for A14, Giving Intel an Advantage

(Photo credit: ASML)