Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[Insights] Memory Spot Price Update: DDR4 Spot Prices See Mild Pullback after Steep Climb

According to TrendForce’s latest memory spot price trend report, regarding DRAM, while DDR4 spot prices have experienced intermittent rises, this mainly reflects a correction of previously excessive increases, rather than an indication of oversupply. As for NAND flash, demand from the consumer market has shown signs of fatigue, and buyers are now closely watching how U.S. tariffs may impact the next phase. Details are as follows:

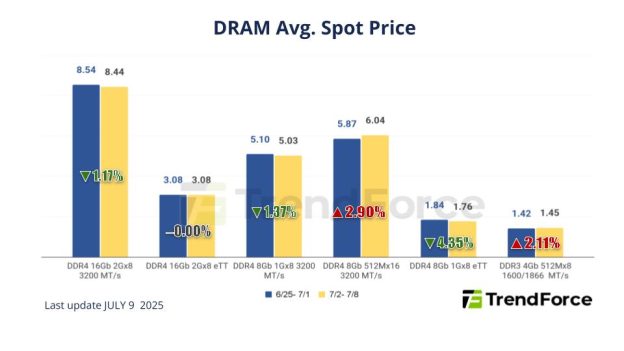

DRAM Spot Price:

In the spot market, the majority of transaction volumes are still related to DDR4 products. While spot prices have experienced intermittent rises, this mainly reflects a correction of previously excessive increases, rather than an indication of oversupply. Apart from DDR4, there are no significant price increases for other product categories. On the whole, the DRAM market may observe a gradual weakening of prices in 3Q25 due to loosening market conditions. Regarding mainstream chips (i.e., DDR4 1Gx8 3200MT/s), their average spot price has decreased by 1.09% from US$5.058 last week to US$5.003 this week.

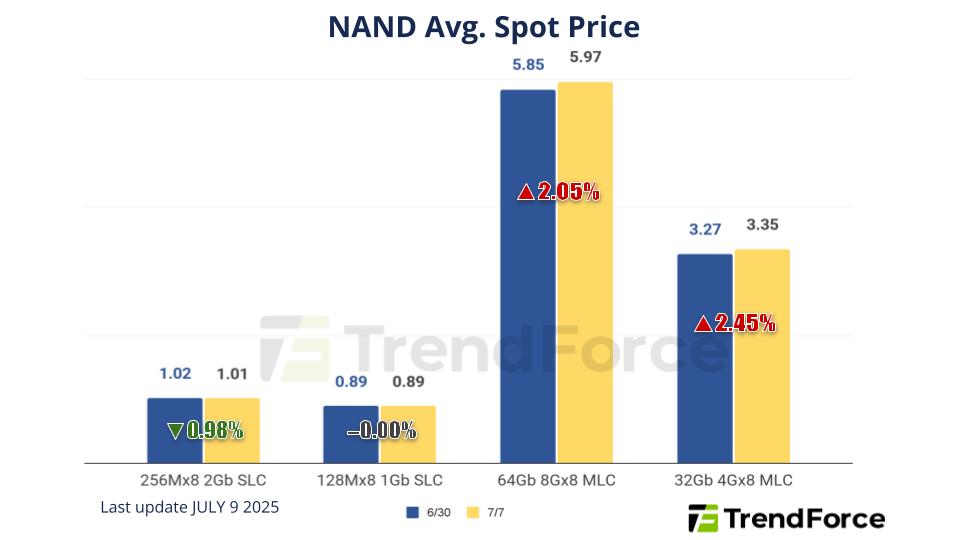

NAND Flash Spot Price:

The spot market has been sluggish in recent transactions mainly due to the higher level of current spot prices, as well as the diminishing effect from China’s national subsidy that supported market dynamics for 1H25, and the conclusion to the 618 shopping festival. These factors brought enervation to the demand for the consumer market, and buyers are starting to observe the subsequent development on US tariffs. Spot prices of 512Gb TLC wafers dropped by 0.15% this week, arriving at US$2.676.