Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[Insights] Memory Spot Price Update: DDR4 Module Prices Overtake DDR5; Tariff Fears May Trigger Panic Buying

According to TrendForce’s latest memory spot price trend report, regarding DRAM, prices of DDR4 modules have climbed above those of DDR5 modules. Looking ahead, a key short-term focus is whether new U.S. tariffs will be imposed—potentially sparking another wave of panic buying. As for NAND flash, due to early pull-in demand driven by national subsidies, the 618 shopping festival had a weaker-than-expected impact on NAND Flash spot prices and transactions. Details are as follows:

DRAM Spot Price:

Prices have risen significantly in the spot market. Furthermore, prices of DDR4 modules have climbed above those of DDR5 modules, thereby slightly slowing down demand this week. However, the tight supply for DDR4 products is much more severe than that for DDR5 products. Looking ahead, the US could issue new tariffs or restrictions related to production capacity against China. This, in turn, may trigger another round of panic buying. Whether such an event will occur will be a key point of observation in the short term. The average spot price of mainstream chips (i.e., DDR4 1Gx8 3200MT/s) has risen by 12.7% from US$4.575 last week to US$5.155this week.

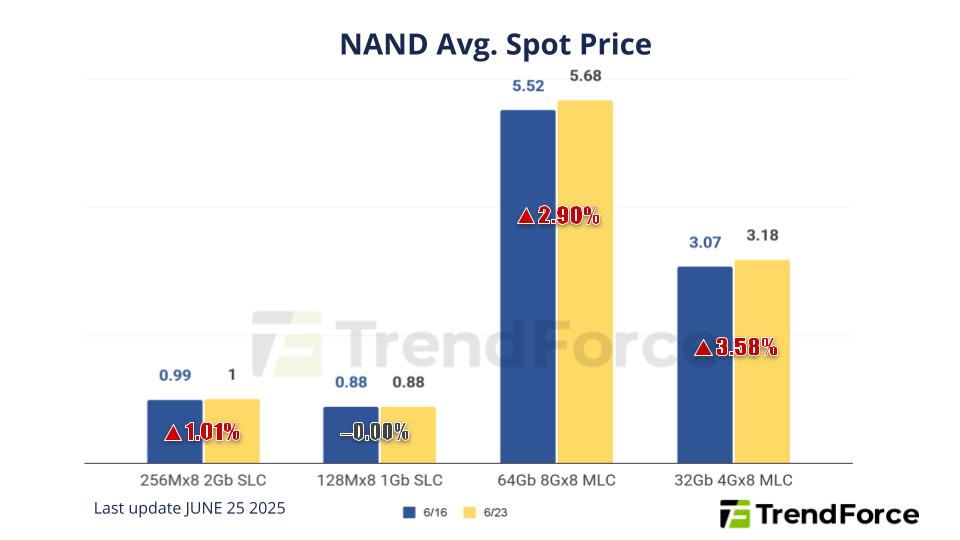

NAND Flash Spot Price:

Electronics sales are worse than expected from the 618 shopping festival this year as demand was ascended by the policy of national subsidies in advance. Sluggishness in spot prices and transactions of NAND Flash is an indication on how the spot market is currently on the fence towards subsequent development. Spot prices of 512Gb TLC wafers have dropped by 0.37% this week, arriving at US$2.683.