Surging Memory, Panel, and Precious Metal Prices Weigh on TV Brand Profitability; 2026 Global Shipments Face Further Downward Revision

Last Modified

2026-01-29

Update Frequency

Aperiodically

Format

Market Flash is a dedicated membership program that provides clients with access to special reports on display-related markets, offering timely insights and exclusive research updates through a secure delivery platform. Reports are typically provided in PDF format and released on an ad-hoc basis.

Key Highlights

- Global TV shipments in 2026 are projected at 194.81 million units, down 0.6% YoY

- Concurrent price hikes in memory, display panels, and precious metals are pushing up TV production costs, making retail price increases for new models increasingly likely

- Memory’s share of TV BOM cost is expected to rise from 2.5–3% to 6–7% amid the current price surge

<Total Pages: 5>

Category: LCD , OLED , Panel Industry , Display Supply Chain

Spotlight Report

-

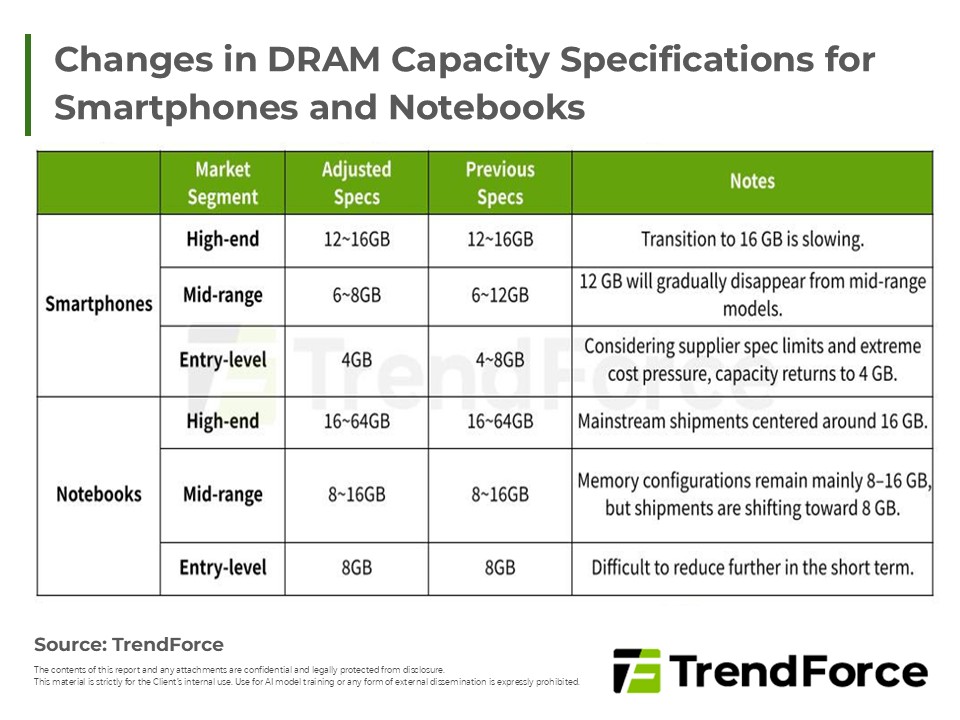

Soaring Memory Prices Impact End Products, Specification Downgrading Becomes a Trend

2025/12/09

Display

PDF

-

Memory Surge Raises BOM, Trims 2026 Phone and NB View

2025/11/14

Display

PDF

-

Monthly Panel Price Book Plus - 2H Nov. 2025

2025/11/20

Display

EXCEL

-

Monthly Panel Price Forecast - Nov. 2025

2025/11/28

Display

EXCEL

-

Monthly Panel Price Book Plus - 1H Feb. 2026

2026/02/05

Display

EXCEL

-

Monthly Panel Price Forecast - Dec. 2025

2025/12/30

Display

EXCEL

Display Market FlashRelated Reports

Download Report

Membership

Spotlight Report

-

Soaring Memory Prices Impact End Products, Specification Downgrading Becomes a Trend

2025/12/09

Display

PDF

-

Memory Surge Raises BOM, Trims 2026 Phone and NB View

2025/11/14

Display

PDF

-

Monthly Panel Price Book Plus - 2H Nov. 2025

2025/11/20

Display

EXCEL

-

Monthly Panel Price Forecast - Nov. 2025

2025/11/28

Display

EXCEL

-

Monthly Panel Price Book Plus - 1H Feb. 2026

2026/02/05

Display

EXCEL

-

Monthly Panel Price Forecast - Dec. 2025

2025/12/30

Display

EXCEL