AI Infra Market Bulletin - Jan. 29, 2026

Last Modified

2026-01-29

Update Frequency

Biweekly

Format

Google integrates TPU v7/v8, Ironwood racks, and Apollo OCS into a unified fabric, shifting the scaling unit from servers to racks. This drives 800G+ optical module penetration above 60% by 2026. Supply chain focus has shifted to laser chips and MEMS capacity. Strategic decisions must now track 800G/1.6T transceiver deployments, alongside GPU/TPU shipments, to accurately gauge the AI compute cycle.

Key Highlights

- Google is consolidating its proprietary TPUs, Ironwood racks, 3D Torus topology, and the Apollo OCS optical backbone into a unified high-speed interconnect architecture. As a result, the focus of cluster planning is shifting from individual servers to modular designs centered on racks and Superpods.

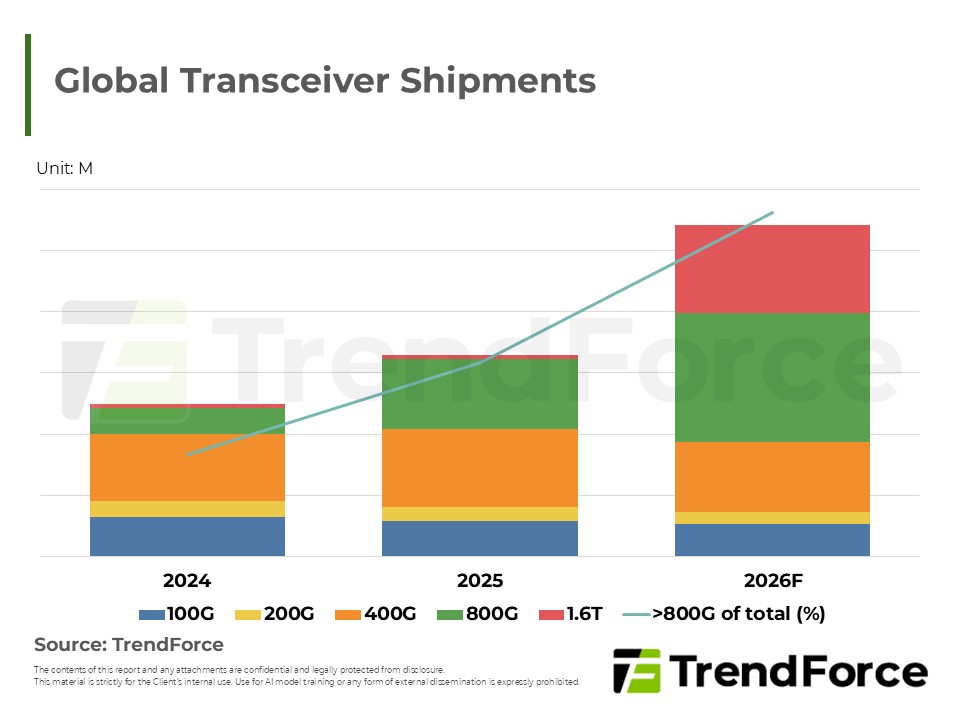

- Under this architecture, the share of 800G+ high-speed optical modules in data centers deployments is projected to grow from roughly 20% in 2024 to over 60% by 2026. No longer an optional upgrade, these modules are becoming the baseline configuration for next-generation clusters, driving annual demand into the millions.

- For the optical interconnect supply chain, 800G+ optical modules and OCS systems are becoming critical elements deeply integrated with Google’s infrastructure. Between 2026 and 2028, supply tightness and profitability within the sector will be primarily driven by the available production capacity and yield rates of lasers and MEMS.

- For industry strategists and investors, assessing the market outlook over the coming years requires looking beyond GPU and TPU shipments. It is equally important to track the shipment volume and penetration of 800G/1.6T optical modules to fully understand the structural shifts between computing power deployment and high-speed interconnect investments.

Table of Contents

- Executive Summary

- TrendForce’s View

- Google Fabric Architecture

- High‑Speed Optics & Supply Chain Dynamics

- Scenario Analysis

- Analyst Checkpoints

< Total Pages: 12>

Category: AI/HBM/Server , Optical Telecommunication

Spotlight Report

-

AI Reshapes Memory: Market Revenue to Peak by 2027

2026/01/20

Semiconductors

PDF

-

Micron to Acquire PSMC’s Tongluo P5 Fab to Contribute to DRAM Supply for 2027

2026/01/18

Semiconductors

PDF

-

DRAM Monthly Datasheet Jan. 2026

2026/01/15

Semiconductors

EXCEL

-

NAND Flash Monthly Datasheet Jan. 2026

2026/01/14

Semiconductors

PDF

-

HBM Industry Analysis - 1Q26

2026/02/04

Semiconductors

PDF

-

1Q26 Memory Price Forecast

2025/12/30

Semiconductors

PDF

AI Infra BulletinRelated Reports

Download Report

USD $12,000

Membership

Spotlight Report

-

AI Reshapes Memory: Market Revenue to Peak by 2027

2026/01/20

Semiconductors

PDF

-

Micron to Acquire PSMC’s Tongluo P5 Fab to Contribute to DRAM Supply for 2027

2026/01/18

Semiconductors

PDF

-

DRAM Monthly Datasheet Jan. 2026

2026/01/15

Semiconductors

EXCEL

-

NAND Flash Monthly Datasheet Jan. 2026

2026/01/14

Semiconductors

PDF

-

HBM Industry Analysis - 1Q26

2026/02/04

Semiconductors

PDF

-

1Q26 Memory Price Forecast

2025/12/30

Semiconductors

PDF