(Revised) PC-Client OEM SSD Contract Price 1Q26

Last Modified

2026-02-09

Update Frequency

Quarterly

Format

Note: According the latest market supply and demand status, TrendForce adjusts our 1Q26 price projection.

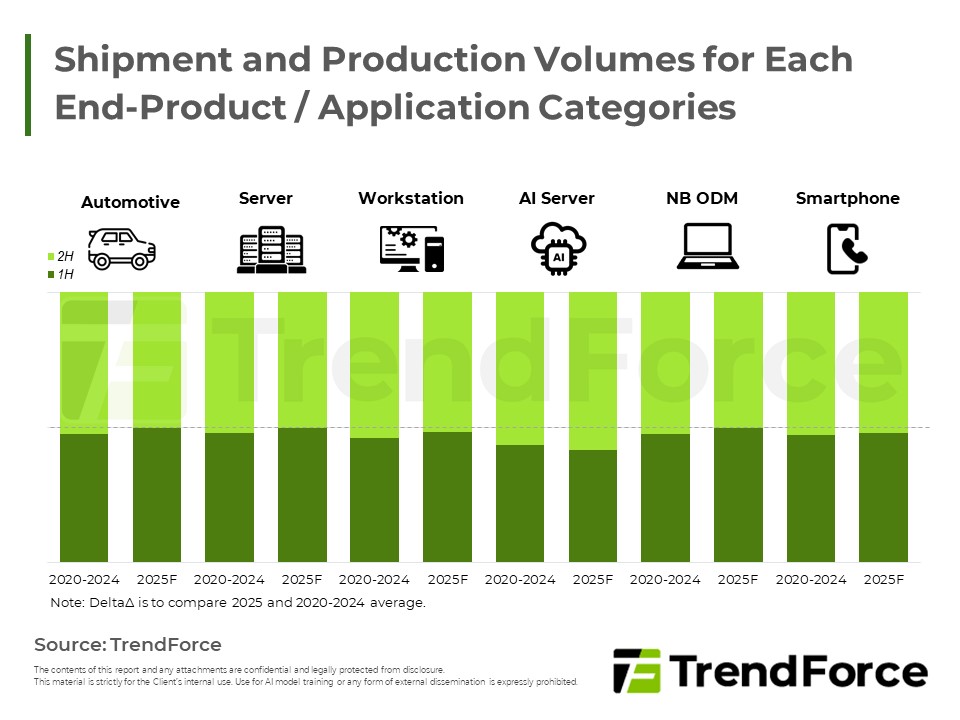

In Q1 2026, robust Server and AI demand crowded out Client SSD capacity as suppliers prioritized high-margin enterprise products. Coupled with low OEM inventory and replacement cycle needs, contract prices surged significantly. Tight supply is expected to persist, though rising costs may dampen PC shipments.

Key Highlights

- Capacity Crowding Out: Suppliers prioritized high-margin Server and AI orders, causing a severe squeeze on Client SSD availability and creating tight supply conditions.

- Price Surge: Driven by Windows 10 replacement cycles and inventory restocking, strong demand triggered a sharp rise in contract prices across all specifications despite the off-season.

- Market Outlook: The upward price trend is expected to continue into the next quarter. However, soaring BOM costs may force OEMs to hike prices or downgrade specs, negatively impacting consumer interest and accelerating the decline in PC shipments.

Table of Contents

- Client SSD Contract Prices Surge as Increasing Demand Related to Servers and AI Has Resulted in Production Capacity Crunch

- Client SSD Contract Price Update

<Total Pages: 2>

Category: NAND Flash

Spotlight Report

-

AI Reshapes Memory: Market Revenue to Peak by 2027

2026/01/20

Semiconductors

PDF

-

Micron to Acquire PSMC’s Tongluo P5 Fab to Contribute to DRAM Supply for 2027

2026/01/18

Semiconductors

PDF

-

DRAM Monthly Datasheet Feb. 2026

2026/02/12

Semiconductors

EXCEL

-

(Revised) NAND Flash Monthly Datasheet Feb. 2026

2026/02/23

Semiconductors

PDF

-

HBM Industry Analysis - 1Q26

2026/02/04

Semiconductors

PDF

-

1Q26 Memory Price Forecast

2025/12/30

Semiconductors

PDF

PC-Client OEM SSD Contract PriceRelated Reports

Download Report

USD $3,500

Membership

Spotlight Report

-

AI Reshapes Memory: Market Revenue to Peak by 2027

2026/01/20

Semiconductors

PDF

-

Micron to Acquire PSMC’s Tongluo P5 Fab to Contribute to DRAM Supply for 2027

2026/01/18

Semiconductors

PDF

-

DRAM Monthly Datasheet Feb. 2026

2026/02/12

Semiconductors

EXCEL

-

(Revised) NAND Flash Monthly Datasheet Feb. 2026

2026/02/23

Semiconductors

PDF

-

HBM Industry Analysis - 1Q26

2026/02/04

Semiconductors

PDF

-

1Q26 Memory Price Forecast

2025/12/30

Semiconductors

PDF