PC-Client OEM SSD Contract Price 3Q25

Last Modified

2025-07-24

Update Frequency

Quarterly

Format

Q3 PC-Client SSD prices are supported by commercial models replacements and limited supply, while demand of consumer models remains weak, leading to market divergence. With diminishing policy benefits, prices hike percentage matches the previous quarter. New applications create opportunities, but further growth depends on future market and end-user demand trends.

Key Highlights

- Q3 OEM client SSD prices increase, driven by enterprise refresh and tight NAND supply.

- Policy tailwinds fading; consumer notebook demand remains weak.

- Manufacturers focus on high-margin, advanced SSDs; promote high-capacity QLC products.

- AI-related demand supports only limited market growth.

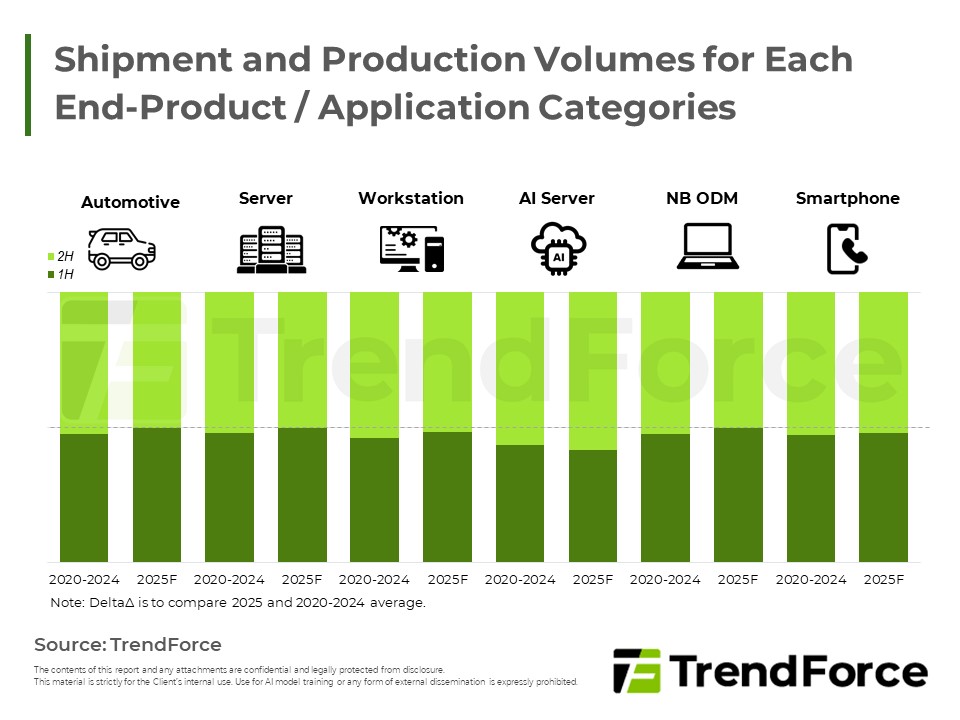

- New applications—premium Chromebooks, automotive systems—boost SSD adoption.

- Module makers’ higher costs prevent aggressive price competition.

- Price trends will depend on global economic outlook and inventory digestion; further increases are not guaranteed.

Table of Contents

- Client SSD Prices for 3Q25 Show Same QoQ Hikes Compared with 2Q25 as Inventory Replenishment and Enterprises' Device Upgrade Demand Have Been Offset by Weakening Demand for Consumer NBs

- Enterprises' Device Replacements Will Prop Up Demand in Short Term; Future Growth Potential Lies in Emerging Applications

- PC-Client OEM SSD Contract Price Update

<Total Pages: 3>

Category: NAND Flash

Spotlight Report

-

DRAM Monthly Datasheet Jan. 2026

2026/01/15

Semiconductors

EXCEL

-

AI Reshapes Memory: Market Revenue to Peak by 2027

2026/01/20

Semiconductors

PDF

-

NAND Flash Monthly Datasheet Jan. 2026

2026/01/14

Semiconductors

PDF

-

Micron to Acquire PSMC’s Tongluo P5 Fab to Contribute to DRAM Supply for 2027

2026/01/18

Semiconductors

PDF

-

HBM Industry Analysis - 1Q26

2026/02/04

Semiconductors

PDF

-

1Q26 Memory Price Forecast

2025/12/30

Semiconductors

PDF

PC-Client OEM SSD Contract PriceRelated Reports

Download Report

USD $3,500

Membership

Spotlight Report

-

DRAM Monthly Datasheet Jan. 2026

2026/01/15

Semiconductors

EXCEL

-

AI Reshapes Memory: Market Revenue to Peak by 2027

2026/01/20

Semiconductors

PDF

-

NAND Flash Monthly Datasheet Jan. 2026

2026/01/14

Semiconductors

PDF

-

Micron to Acquire PSMC’s Tongluo P5 Fab to Contribute to DRAM Supply for 2027

2026/01/18

Semiconductors

PDF

-

HBM Industry Analysis - 1Q26

2026/02/04

Semiconductors

PDF

-

1Q26 Memory Price Forecast

2025/12/30

Semiconductors

PDF