MLCC Market Bulletin - Nov. 26, 2025

Last Modified

2025-11-26

Update Frequency

Aperiodically

Format

Seasonal stocking falls short, 1Q26 MLCC demand weakens, ODM shipments decline. Consumer markets in China and US weaken, orders for mobiles and laptops fall, DRAM prices rise. Suppliers control production, MLCC demand soft. AI demand steady, major suppliers expand capacity.

Key Highlights

- China’s consumer demand weakens, deflation slows spending, national subsidies' effect weakens.

- US tariffs impact essentials, policy adjustment, Black Friday expected strong but growth slowing.

- China-US consumer markets face challenges, individuals adjust or reduce spending.

- ODM shipments decline, iPhone 17 stocking normalizes.

- ICT orders decline, 1Q26 demand falls short, mobile and laptop orders decrease.

- DRAM prices rise, raising whole device cost, increasing risk of global smartphone and laptop shipment reduction.

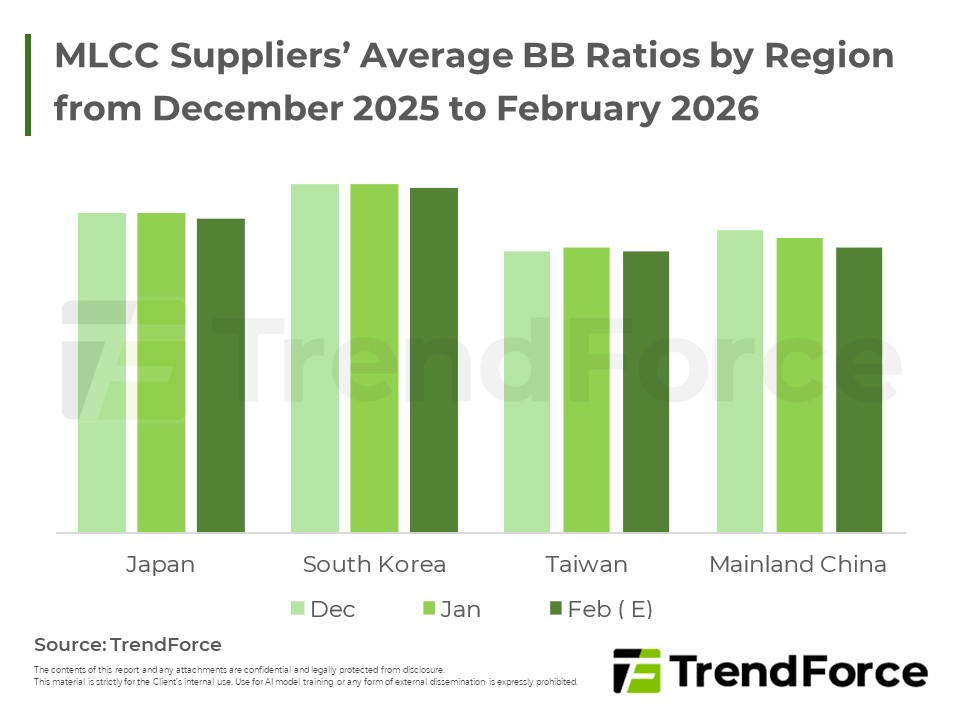

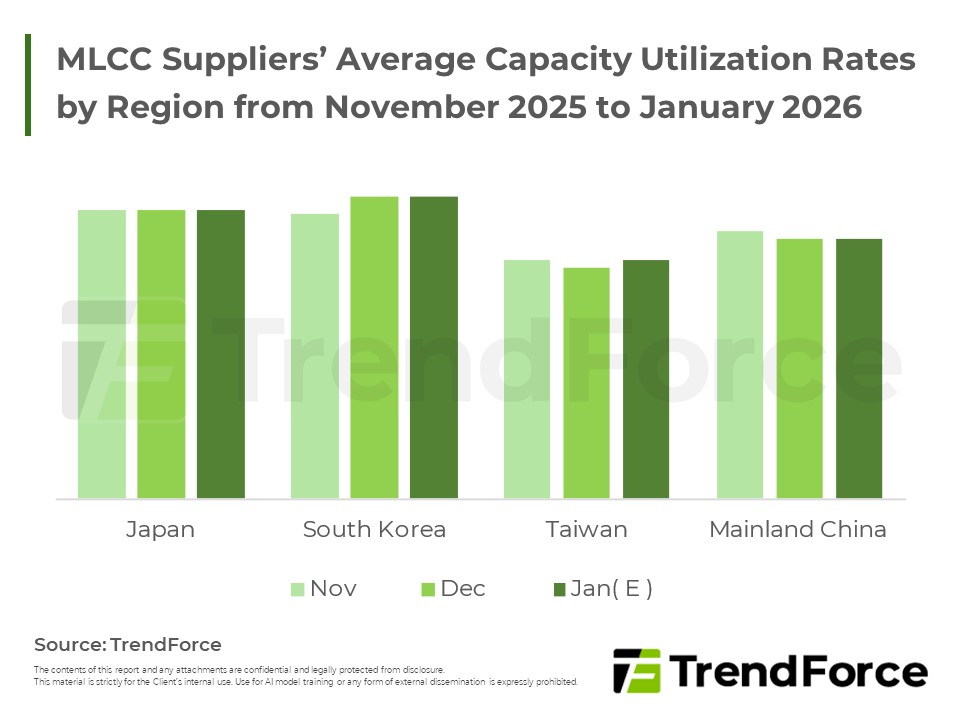

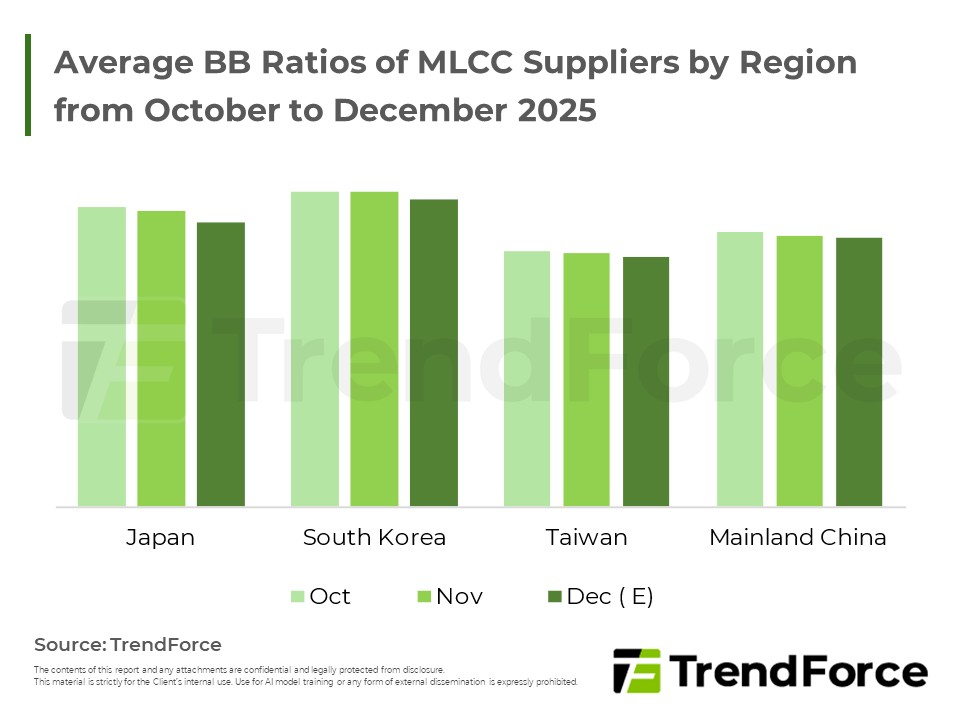

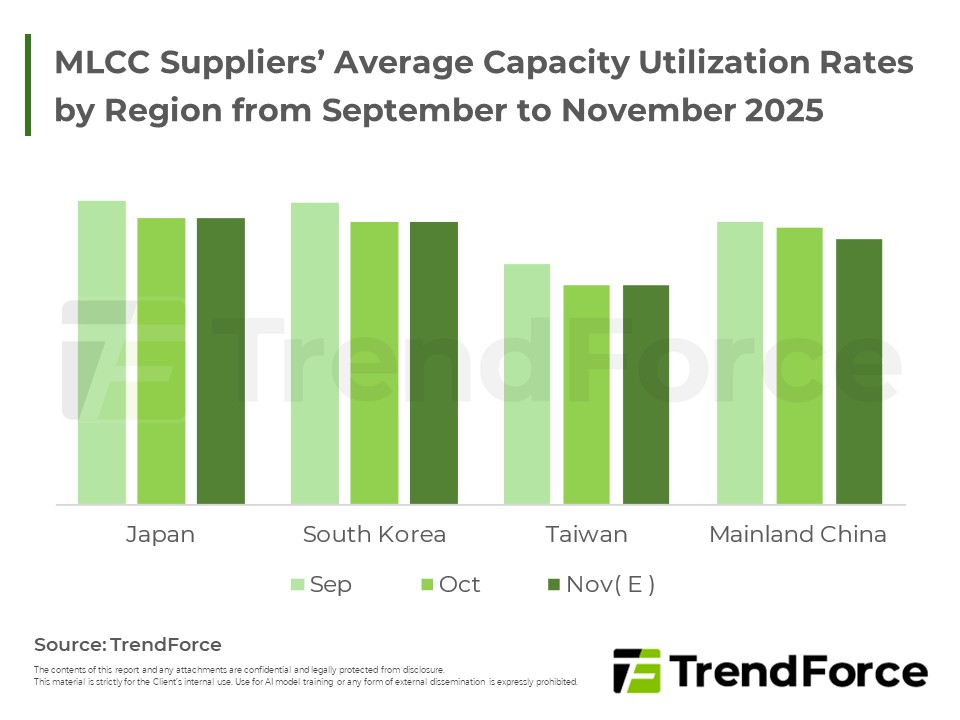

- MLCC suppliers manage capacity, demand soft, Japanese, Korean, Taiwanese, and Chinese factories reduce production rates.

- AI infrastructure orders support, major suppliers expand capacity for next year’s opportunities.

Table of Contents

- Market Update

- Trendforce's View

<Total Pages: 3>

Category: MLCC

Spotlight Report

-

AI Reshapes Memory: Market Revenue to Peak by 2027

2026/01/20

Semiconductors

PDF

-

Micron to Acquire PSMC’s Tongluo P5 Fab to Contribute to DRAM Supply for 2027

2026/01/18

Semiconductors

PDF

-

DRAM Monthly Datasheet Feb. 2026

2026/02/12

Semiconductors

EXCEL

-

(Revised) NAND Flash Monthly Datasheet Feb. 2026

2026/02/23

Semiconductors

PDF

-

HBM Industry Analysis - 1Q26

2026/02/04

Semiconductors

PDF

-

1Q26 Memory Price Forecast

2025/12/30

Semiconductors

PDF

MLCC Market BulletinRelated Reports

Download Report

USD $4,500

Membership

Spotlight Report

-

AI Reshapes Memory: Market Revenue to Peak by 2027

2026/01/20

Semiconductors

PDF

-

Micron to Acquire PSMC’s Tongluo P5 Fab to Contribute to DRAM Supply for 2027

2026/01/18

Semiconductors

PDF

-

DRAM Monthly Datasheet Feb. 2026

2026/02/12

Semiconductors

EXCEL

-

(Revised) NAND Flash Monthly Datasheet Feb. 2026

2026/02/23

Semiconductors

PDF

-

HBM Industry Analysis - 1Q26

2026/02/04

Semiconductors

PDF

-

1Q26 Memory Price Forecast

2025/12/30

Semiconductors

PDF