Mobile DRAM Contract Price 4Q25

Last Modified

2025-11-04

Update Frequency

Quarterly

Format

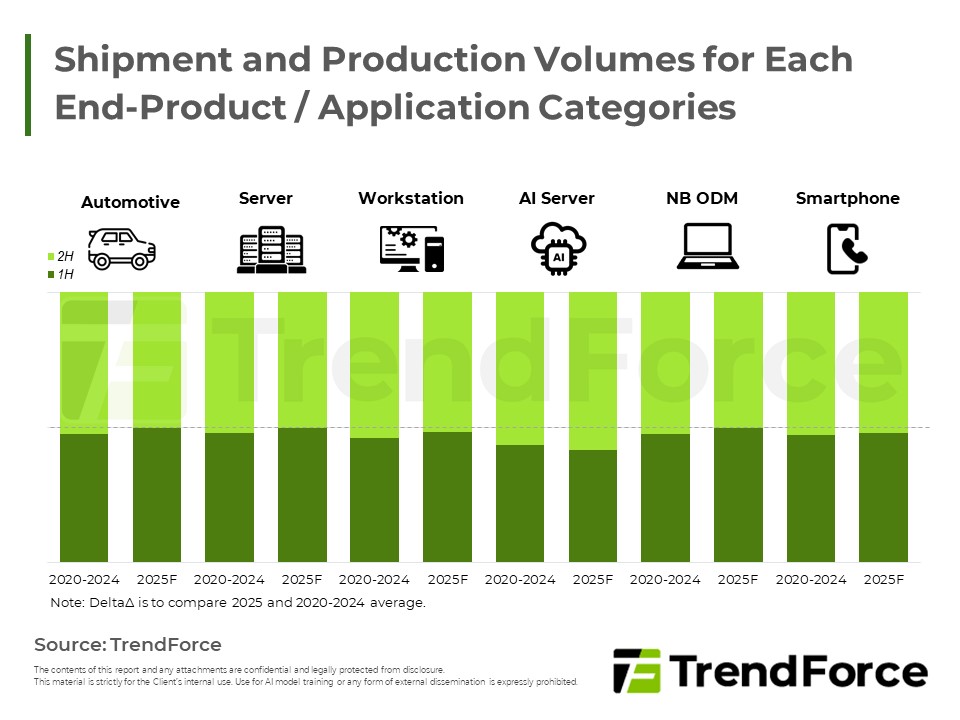

4Q25 mobile DRAM contract prices have risen sharply due to tight supply-demand and competitive bidding among chipmakers, with smartphone applications seeing particularly large increases. This upward trend is expected to continue into 2026. The recent steep DRAM price rises may force up retail prices of end products and weigh on demand.

Key Highlights

- 4Q25 mobile DRAM contract prices are facing another round of upward adjustments due to supply tightness and competition among chipmakers.

- Supplier bidding has amplified the price increases—especially after some chipmakers paused quoting, the price gains for smartphone applications widened significantly.

- Overall DRAM market tightness is expected to persist, prompting applications to pay premiums to secure supply.

- This upward momentum is expected to continue into the next quarter.

- The recent sharp rise in DRAM prices risks pushing up consumer-product prices and dampening purchasing demand.

Table of Contents

- Mobile DRAM Enlarged in Price Hikes during 4Q25 under Continuity of Supply-Demand Void and Price Competitions among Suppliers

- LPDDR5(X) Price Premium between NBs and Smartphone

- Price Hikes of Mobile DRAM to Persist until 2026 amidst Ongoing Supply-Demand Void

- Mobile DRAM Contract Price Update

<Total Pages: 3>

Category: DRAM , NAND Flash

Spotlight Report

-

DRAM Monthly Datasheet Jan. 2026

2026/01/15

Semiconductors

EXCEL

-

NAND Flash Monthly Datasheet Jan. 2026

2026/01/14

Semiconductors

PDF

-

1Q26 Memory Price Forecast

2025/12/30

Semiconductors

PDF

-

Soaring Memory Prices Impact End Products, Specification Downgrading Becomes a Trend

2025/12/09

Semiconductors

PDF

-

DRAM/NAND Flash 2026 Capex: AI-Driven Revisions, Capacity Limited

2025/11/07

Semiconductors

PDF

-

Memory Surge Raises BOM, Trims 2026 Phone and NB View

2025/11/14

Semiconductors

PDF

Mobile Contract PriceRelated Reports

Download Report

Membership

Spotlight Report

-

DRAM Monthly Datasheet Jan. 2026

2026/01/15

Semiconductors

EXCEL

-

NAND Flash Monthly Datasheet Jan. 2026

2026/01/14

Semiconductors

PDF

-

1Q26 Memory Price Forecast

2025/12/30

Semiconductors

PDF

-

Soaring Memory Prices Impact End Products, Specification Downgrading Becomes a Trend

2025/12/09

Semiconductors

PDF

-

DRAM/NAND Flash 2026 Capex: AI-Driven Revisions, Capacity Limited

2025/11/07

Semiconductors

PDF

-

Memory Surge Raises BOM, Trims 2026 Phone and NB View

2025/11/14

Semiconductors

PDF