eMMC/UFS Contract Price 4Q25

Last Modified

2025-10-23

Update Frequency

Quarterly

Format

Supply bottlenecks and migration curb NAND output; enterprise SSD crowds out eMMC/UFS, lifting prices into next year.

Key Highlights

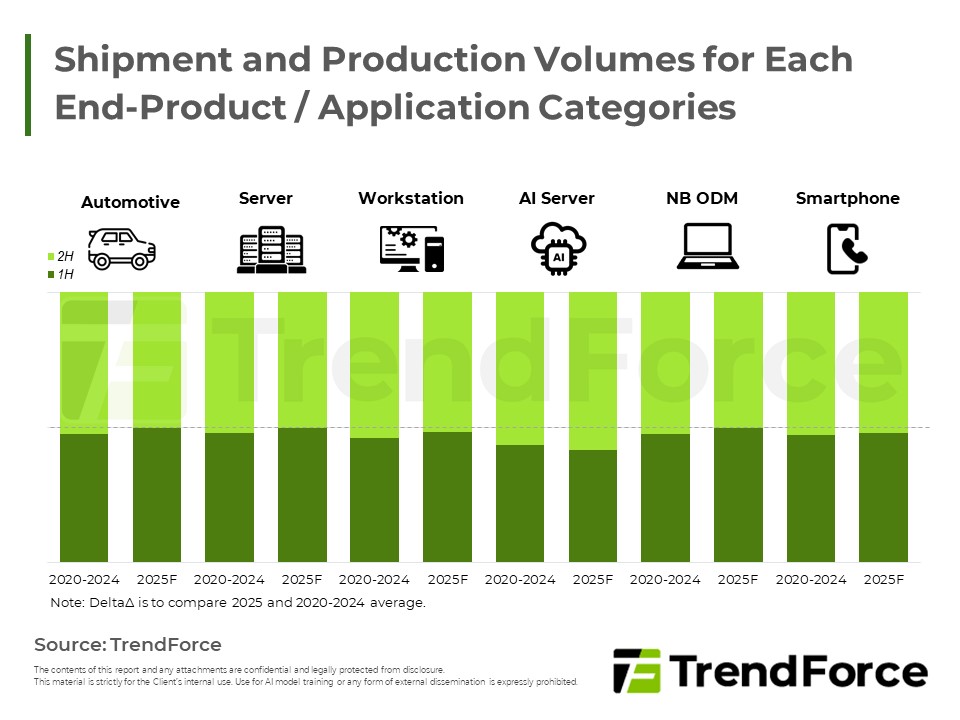

- End demand weak; smartphones/tablets miss peak, new uses still small

- Node shifts and supply bottlenecks cut bit output

- HDD delays push CSPs to enterprise SSD, squeezing eMMC/UFS supply

- Sellers hold pricing power; eMMC outpaces UFS

- Uptrend likely extends into next year despite softer demand

Table of Contents

- Supply Chain Bottlenecks Become More Severe, Squeezing NAND Flash Production Capacity and Resulting in Across-the-Board Price Hikes of 5-10%

- eMMC: Suppliers’ Process Upgrades Impact Output, and Their Prioritization of Enterprise SSD Orders Is Also Having Pronounced Constraining Effect on Supply of Other NAND Flash Products

- UFS: Tight Supply Has Offset Weak End-Product Demand, Leading to Modest Price Hikes

- As Tight Supply Drives Prices Upward, Market Concern Is Now on Slumping Demand

- MMC/UFS Contract Price Update

<Total Pages: 3>

Category: DRAM , NAND Flash

Spotlight Report

-

DRAM Monthly Datasheet Jan. 2026

2026/01/15

Semiconductors

EXCEL

-

NAND Flash Monthly Datasheet Jan. 2026

2026/01/14

Semiconductors

PDF

-

1Q26 Memory Price Forecast

2025/12/30

Semiconductors

PDF

-

Soaring Memory Prices Impact End Products, Specification Downgrading Becomes a Trend

2025/12/09

Semiconductors

PDF

-

DRAM/NAND Flash 2026 Capex: AI-Driven Revisions, Capacity Limited

2025/11/07

Semiconductors

PDF

-

Memory Surge Raises BOM, Trims 2026 Phone and NB View

2025/11/14

Semiconductors

PDF

Mobile Contract PriceRelated Reports

Download Report

Membership

Spotlight Report

-

DRAM Monthly Datasheet Jan. 2026

2026/01/15

Semiconductors

EXCEL

-

NAND Flash Monthly Datasheet Jan. 2026

2026/01/14

Semiconductors

PDF

-

1Q26 Memory Price Forecast

2025/12/30

Semiconductors

PDF

-

Soaring Memory Prices Impact End Products, Specification Downgrading Becomes a Trend

2025/12/09

Semiconductors

PDF

-

DRAM/NAND Flash 2026 Capex: AI-Driven Revisions, Capacity Limited

2025/11/07

Semiconductors

PDF

-

Memory Surge Raises BOM, Trims 2026 Phone and NB View

2025/11/14

Semiconductors

PDF