MLCC Price Sep. 2025

Last Modified

2025-09-30

Update Frequency

Monthly

Format

US August employment data significantly missed expectations, with unemployment rate rising to historic high and weak domestic demand. OEMs and ODMs showed cautious new order planning, indicating unstable consumption demand. FED cut rates to combat recession, leading to currency volatility and pricing challenges for suppliers. US-China tariffs exacerbate economic pressures, with global consumer demand likely to remain subdued.

Key Highlights

- US August employment data significantly missed expectations; unemployment rate rose to historic high and weak domestic demand.

- Consumer spending remained flat or declined; wage growth lagged behind price increases; tariffs raised costs.

- Despite inflation risks, the FED cut interest rates, signaling necessary adjustments based on economic data.

- OEMs' order planning was cautious; ODMs showed flattening restocking momentum; consumer product demand declined.

- FED's rate cut led to currency market volatility; MLCC prices faced pressure; Japanese and Korean suppliers restrained from aggressive pricing.

- US policies had far-reaching effects; consumer confidence fell due to economic and inflation concerns.

- China's economy affected by US tariffs, with both CPI and PPI declining, indicating weak domestic and external demand.

- Year-end festive consumption demand faced pressure; suppliers need proactive risk management for operations.

Table of Contents

- Fourth Quarter Is Expected to See Weak Demand for ICT Products, While AI-Related Orders Sustain the MLCC Market

- Strong Momentum Will Continue for AI-Related Orders in 4Q25, but Sliding Demand for ICT Products Will Limit ODMs’ Bargaining Power

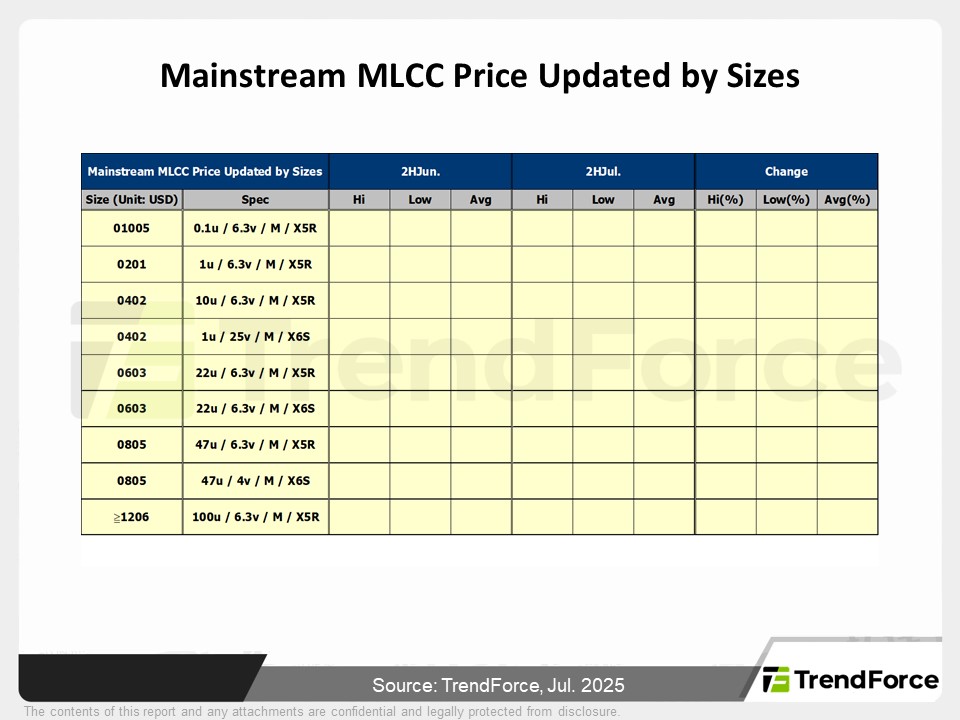

- Prices of Consumer MLCCs Stagnate, While Price Declines Have Moderated Significantly for High-End and Automotive MLCCs; Suppliers’ Consensus Is to Maintain Stable Pricing

- Trendforce's View

<Total Pages: 3>

Category: MLCC

Spotlight Report

-

AI Reshapes Memory: Market Revenue to Peak by 2027

2026/01/20

Semiconductors

PDF

-

Micron to Acquire PSMC’s Tongluo P5 Fab to Contribute to DRAM Supply for 2027

2026/01/18

Semiconductors

PDF

-

DRAM Monthly Datasheet Jan. 2026

2026/01/15

Semiconductors

EXCEL

-

NAND Flash Monthly Datasheet Feb. 2026

2026/02/11

Semiconductors

PDF

-

HBM Industry Analysis - 1Q26

2026/02/04

Semiconductors

PDF

-

1Q26 Memory Price Forecast

2025/12/30

Semiconductors

PDF

MLCC Price InformationRelated Reports

Download Report

USD $3,500

Membership

Spotlight Report

-

AI Reshapes Memory: Market Revenue to Peak by 2027

2026/01/20

Semiconductors

PDF

-

Micron to Acquire PSMC’s Tongluo P5 Fab to Contribute to DRAM Supply for 2027

2026/01/18

Semiconductors

PDF

-

DRAM Monthly Datasheet Jan. 2026

2026/01/15

Semiconductors

EXCEL

-

NAND Flash Monthly Datasheet Feb. 2026

2026/02/11

Semiconductors

PDF

-

HBM Industry Analysis - 1Q26

2026/02/04

Semiconductors

PDF

-

1Q26 Memory Price Forecast

2025/12/30

Semiconductors

PDF