Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[Insights] Memory Spot Price Update: Lunar New Year Slows DRAM Spot Trading; Price Gap Narrows

According to TrendForce’s latest memory spot price trend report, regarding DRAM, with the Lunar New Year approaching, DRAM spot trading has slowed, as most traders hold off on quotes and purchases. Since spot prices are well above contract levels, TrendForce expects short-term gains to be modest. Meanwhile, in NAND, fabs that have been going on holiday and halting operations successively with the upcoming Chinese New Year holiday, together with the relatively high spot prices, are lowering purchase sentiment. Details are as follows:

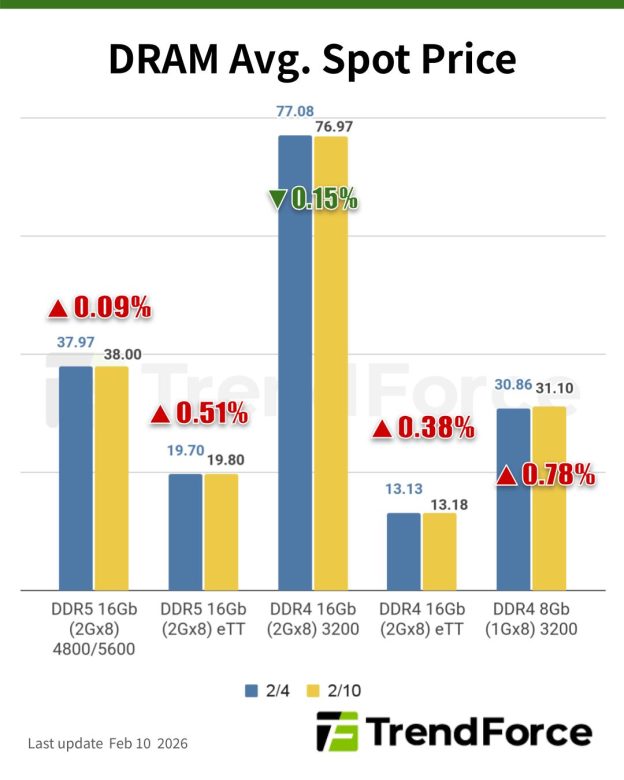

DRAM Spot Price:

Similar to last week’s update, as most traders are focused on the upcoming Lunar New Year holiday, quotation and purchasing activities have been relatively sluggish. Given that current spot prices are significantly higher than contract prices, TrendForce expects short-term spot price increases will be more moderate, allowing the price gap between the two to gradually converge. The average spot price of mainstream chips (i.e., DDR4 1Gx8 3200MT/s) has increased by 0.78% from US$30.86 last week (2/4) to US$31.10 this week (2/10).

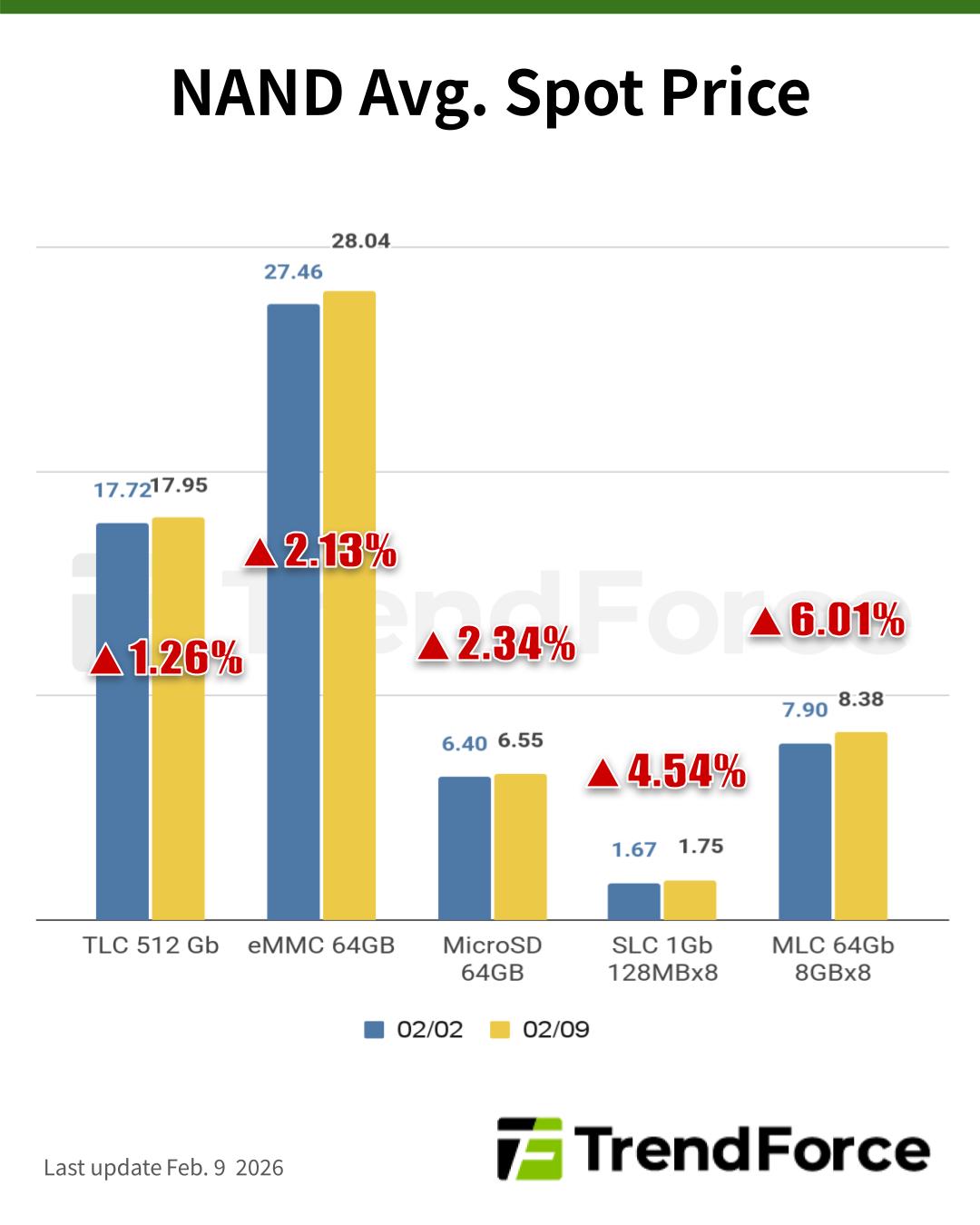

NAND Flash Spot Price:

Fabs that have been going on holiday and halting operations successively with the upcoming Chinese New Year holiday, together with the relatively high spot prices, are lowering purchase sentiment of the spot market, thus bringing down the level of transactions. Some of the traders decided to truncate their products for cash prior to the Chinese New Year holiday, which have not affected the confidence of the supply’s end on market prices on the whole, and most players are still leaning towards reluctance of sales. Spot prices of 512Gb TLC wafers rose by 1.26% this week (2/9), arriving at US$17.948.