Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[Insights] Memory Spot Price Update: DRAM Stalls Ahead of Late-Feb Contract Price Settlements

According to TrendForce’s latest memory spot price trend report, regarding DRAM, since current spot prices remain well above average contract levels, the market will need to wait for late-February contract announcements to see if another round of spot price increases emerges. Meanwhile, in NAND, the supply side remains confident in the price trend, generally holding their quotes rather than cutting prices to boost volume, leaving the market largely inactive. Details are as follows:

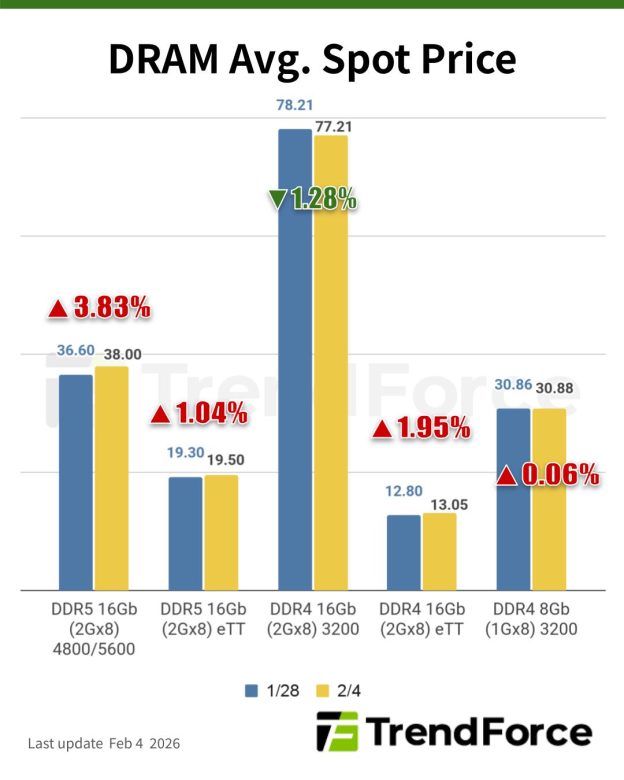

DRAM Spot Price:

As contract price negotiations are still ongoing, spot price increases have begun to stagnate in recent days, though no significant loosening has been observed. It is assessed that since current spot prices are far higher than average contract prices, we will need to wait until contract prices are announced after late February to determine whether another round of spot price increases will occur. The mainstream DDR4 1Gx8 3200MT/s chip saw a price increase of 0.06% this week (from US$30.86 to US$30.88).

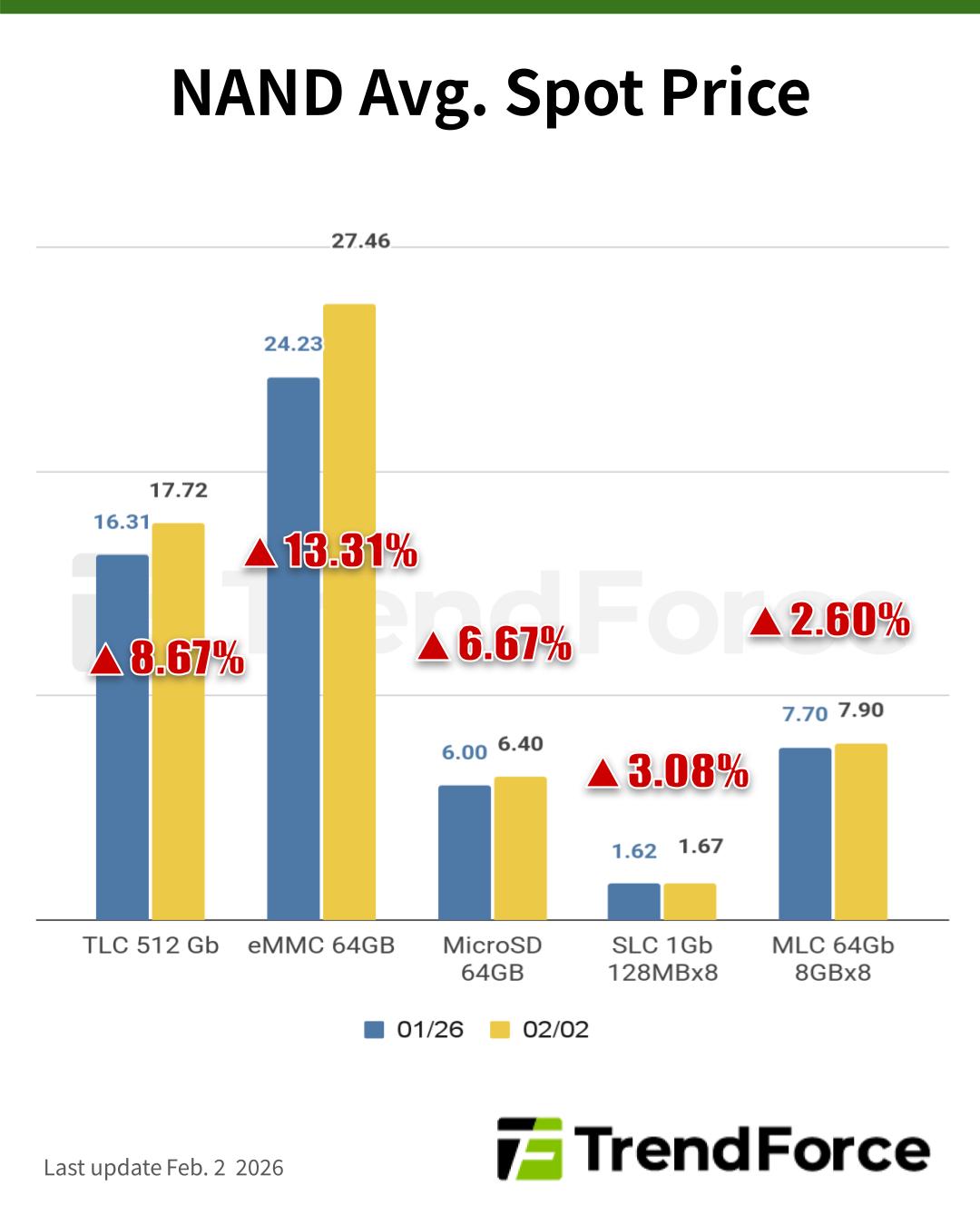

NAND Flash Spot Price:

Spot prices are climbing continuously alongside contract prices, though the high level has constituted a certain extent of deterrent to buyers, and dynamics of market purchases are gradually conservatizing under lower willingness in short-term transactions, when combining factors such as the lack of a sizable recovery in consumer demand, as well as the successive adjustments of capacity configuration among fabs prior to the Chinese New Year holiday. In comparison, the supply end remains confident towards the price trend, and has generally chosen to maintain their quotations instead of compromising prices for quantity. The market is thus filled with products but with no transaction sentiment. Spot prices of 512Gb TLC wafers rose by 8.67% this week, arriving at US$17.724.