Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] Samsung Trails SK hynix for 2025 but Tops Q4 with Record KRW 20T Earnings amid Chip Rebound

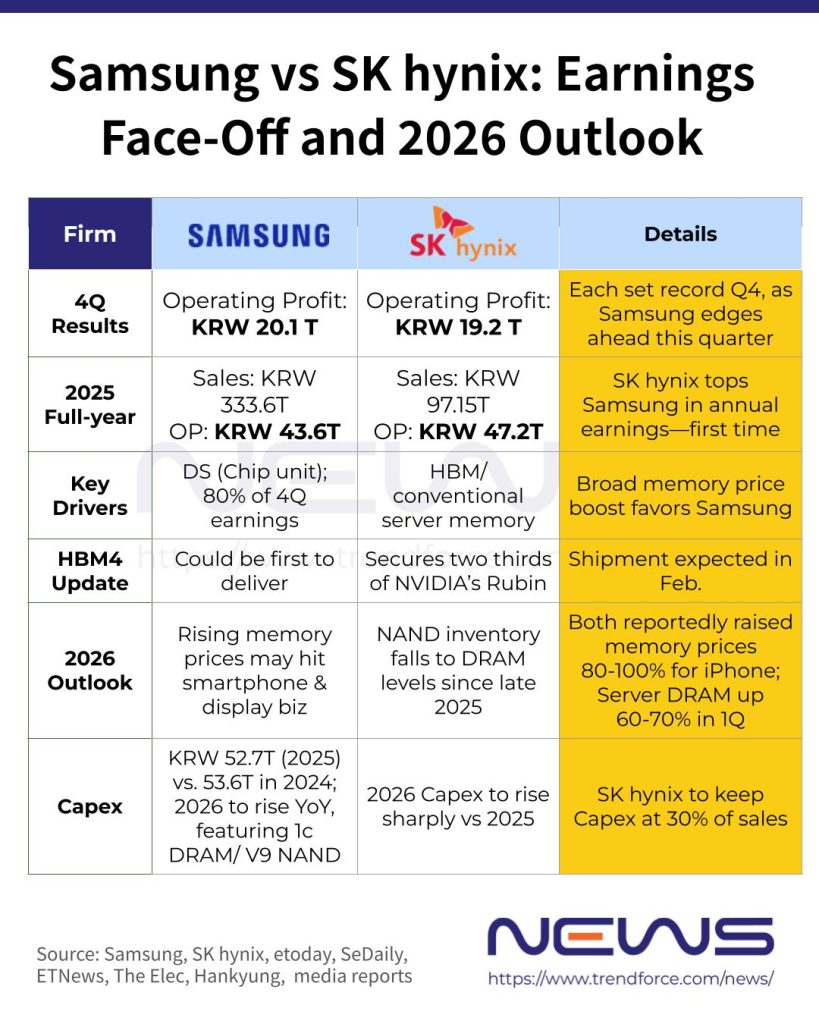

Riding the momentum from SK hynix’s impressive results yesterday, Samsung announced on Jan. 29 that fourth-quarter sales jumped 23.8% year on year to KRW 93.84 trillion, while operating profit more than tripled, soaring 209.2% to KRW 20.07 trillion, marking a record-breaking quarter.

The strong Q4 operating profit allowed Samsung to surpass SK hynix’s KRW 19.17 trillion for the same period. The result marks Samsung’s strongest quarterly operating profit in seven years, with both revenue and profit setting new all-time records for South Korean corporates, according to the Chosun Daily.

Meanwhile, for the full year, Samsung’s 2025 sales rose 10.9% to KRW 333.6 trillion, and operating profit climbed 33.3% to KRW 43.6 trillion, slightly trailing SK hynix’s annual operating profit of KRW 47.21 trillion.

Semiconductor Rebound Adds Momentum

Notably, Samsung’s strong Q4 performance marks a rebound of its DS division, as the Chosun Daily notes that the unit delivered about 80% of the company’s total operating profit. Reuters adds that the results highlight the world’s leading memory chipmaker’s robust pricing power, with profit growth expected to pick up pace this quarter.

According to Samsung, its Device Solutions Division saw quarterly sales jump 33%, with the Memory Business hitting record-high revenue and operating profit, fueled by stronger HBM and other high-value products, alongside rising market prices. In Q4, the division generated KRW 44 trillion in revenue and operating profit of KRW 16.4 trillion.

In detail, the report explains that Samsung’s rebound could be attributed to its overhaul of HBM architecture to claw back its technology edge, ultimately turning the tide with late-stage HBM3E deliveries to NVIDIA. The company also supplied HBM3E to Google and AMD over the past year, the report says, adding that more recently, Samsung finalized HBM4 development, reaching an industry-leading 11.7Gbps operating speed, and said mass shipments to NVIDIA will kick off in February.

While Yonhap News reports that SK hynix is expected to supply roughly two-thirds of NVIDIA’s HBM4 demand for the Vera Rubin platform, Samsung is making notable strides as well. Hankyung notes it could be the first to deliver HBM4 to clients next month. Dealsite also points out that both companies are likely to offer HBM4 at similar prices, highlighting that Samsung has caught up with SK hynix in pricing power despite trailing in volume.

Following the trend, Samsung’s DS Division is leading the way in capital spending. ETNews reports that the company invested KRW 52.7 trillion in 2025, slightly down from KRW 53.6 trillion in 2024, with the semiconductor unit alone accounting for KRW 47.5 trillion of the total. Hyundai Economic, notes that total capital spending for 2025 exceeded the initially planned 47.4 trillion won by 5.3 trillion won, or 11.2%.

Read more

- [News] SK hynix Smashes Records in 2025, Beats Samsung with KRW 47.2T Operating Profit

- [News] SK hynix Reportedly to Supply About Two-Thirds of NVIDIA HBM4; Samsung Targets Early Delivery

(Photo credit: Samsung)