Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] AI Drives Mature-Node Prices: SMIC Reportedly Up 10%, Vanguard Estimated Up 4–8% From Q1

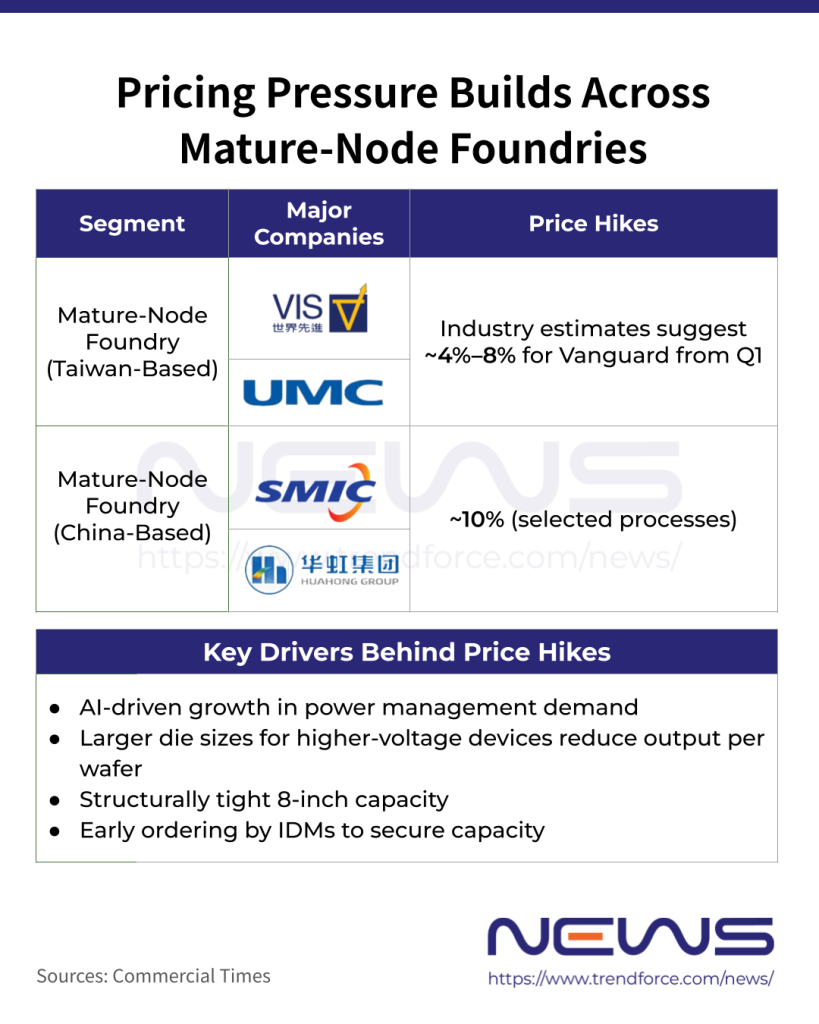

Mature-node foundries may be poised for a new wave of price hikes. According to Commercial Times, the expansion of AI applications is driving rapid growth in demand for power management components, with industry sources suggesting that mature-node pricing could rebound.

Among mature-node foundries, TSMC affiliate Vanguard International Semiconductor, which focuses primarily on 8-inch fabs, is widely viewed as a key bellwether. The report notes that price hikes at Vanguard could begin in the first quarter, estimated at around 4% to 8%.

Meanwhile, China’s leading foundries, SMIC and Hua Hong, continue to operate at full capacity, with prices for certain process already up by about 10%, as the report points out.

Vanguard’s monthly capacity stands at roughly 280,000 to 290,000 wafers, with about 130,000 to 140,000 wafers allocated to power device production. Driven by AI demand, utilization has remained near full since the fourth quarter of last year and has tightened further this year. Against this backdrop, IDM players such as Infineon and Renesas have placed orders with foundries earlier to secure critical capacity, the report notes

Currently, Taiwan-based foundries including UMC and Vanguard are in pre-earnings quiet periods and have declined to comment on market speculation, the report adds.

AI Power Components Lead Mature-Node Demand Recovery

Institutional investors note that AI-related power components are leading the demand recovery. Looking ahead, institutional investors further note that following the surge in demand for AI-related power components, foundries are facing rising capacity pressure. If automotive and industrial applications recover in tandem, along with the impact of non-China supply chain dynamics, the mature-node market could gradually move into a supply-demand reversal cycle.

On how demand for power management devices is pushing up foundry prices, the report notes, citing institutional investors, that AI data center power architectures are increasingly shifting toward high-voltage direct current (HVDC), driving a sharp rise in demand for high-voltage power components. As MOSFET voltage ratings move from 600V to 1200V, larger die sizes significantly reduce the number of chips per 8-inch wafer, effectively shrinking real supply despite unchanged nominal capacity and further tightening the market.

In addition, as foundries begin raising prices, OSAT providers in China and Taiwan have requested price hikes starting in February or March, ranging from 8% to 15%, according to Economic Daily News. The report notes that surging demand for AI servers has pushed packaging and testing capacity into severe undersupply, prompting leading OSAT players such as ASE to implement across-the-board price increases from this quarter, with hikes reaching up to 20%.

Read more

- [News] 8-Inch Foundries May Raise Prices 5–20%, Benefiting UMC, PSMC, Vanguard

- Rising AI-Driven Demand for Power ICs and Capacity Cuts Fuels Potential 8-Inch Foundry Price Hikes, Says TrendForce

(Photo credit: FREEPIK)