Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] JX Advanced Metals Reportedly Plans ¥5B Rapidus Investment, Plus Key Materials Supply

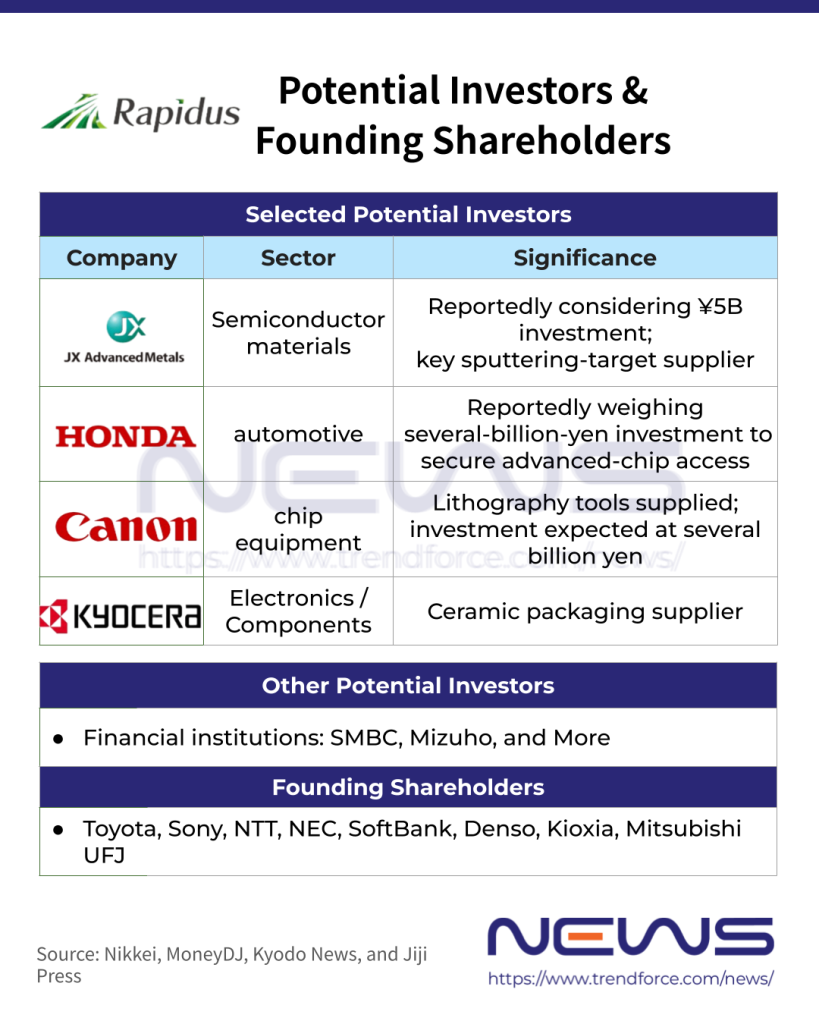

Japan’s government-backed foundry Rapidus is targeting mass production of 2nm chips in the second half of 2027. According to MoneyDJ, citing Nikkei, sources say Japanese chip materials supplier JX Advanced Metals is considering a ¥5 billion investment in Rapidus and may also supply materials to the company.

The report notes that Rapidus aims to raise ¥130 billion from private-sector companies within fiscal 2025 (by the end of March 2026). At present, around 30 companies are said to be considering investments in Rapidus, most of them banks. JX Advanced Metals would be among the relatively few materials suppliers participating as investors.

As the report highlights, JX Advanced Metals produces semiconductor materials such as sputtering targets, which are used in the manufacture of advanced logic chips, memory, and other semiconductor devices. JX Advanced Metals is said to hold around 60% of the global market share for sputtering targets.

JX Advanced Metals is preparing to expand production of sputtering targets, the report notes. Beyond sputtering targets, the company has also announced multiple plans to ramp output of indium phosphide (InP) substrates, crystalline materials used in optical communications equipment.

Rapidus Reportedly Attracts Growing Lineup of Corporate Investors

In addition to JX Advanced Metals, Nikkei reported in December that several companies are said to invest in Rapidus. New shareholders are expected to include Honda, Canon, Kyocera, and Chiba Bank, among others. Existing shareholders, such as Sony Group, are also expected to make additional investments. Meanwhile, NHK One also reports that Hokkaido Electric Power Company and Hokkaido-based Hokuyo Bank are considering investments.

Jiji Press also notes that Fujifilm Holdings is considering joining Rapidus as a new shareholder. Nagase & Co., which transports semiconductor materials to Rapidus’ Hokkaido plant, and Altech Corporation, a software provider to the semiconductor industry, are also said to be weighing investments.

Government Support and IPO Outlook

On the government front, Nikkei reports that Japan’s Ministry of Economy, Trade and Industry said last November that it will extend an additional ¥1 trillion (about $6.37 billion) in government support to Rapidus across fiscal years 2026–27. Beyond subsidies for technology development, the plan also includes additional capital injections, lifting total government support to ¥2.9 trillion.

MoneyDJ notes that, according to Rapidus’ business plan submitted to Japan’s Ministry of Economy, Trade and Industry, the company plans to begin mass production of 2nm chips in the second half of fiscal 2027, followed by 1.4nm nodes. Cumulative investment is expected to exceed ¥7 trillion, with Rapidus aiming to achieve profitability around fiscal 2030 and to pursue an IPO around fiscal 2031.

Read more

- [News] Rapidus Reportedly to Unveil Glass Substrate Interposer Prototype, Eyes 2028 Production

- [News] Canon Reportedly Mulls Multi-Billion-Yen Investment in Rapidus’s 2nm Push

(Photo credit: Rapidus)