Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] Price Hikes Hit Mature Nodes: SMIC, TSMC Affiliate VIS Reportedly Raise BCD Prices 10%

A fresh wave of foundry price hikes is spreading from advanced nodes to mature processes. While Security Times reports that China’s leading foundry SMIC has raised prices on certain production lines, chinastarmarket.cn adds that TSMC affiliate Vanguard International Semiconductor (VIS) has also notified customers of similar increases, at around 10%.

Chinastarmarket.cn also provides more details on SMIC’s price hikes, noting that the foundry giant has issued price-increase notices to downstream customers, with the hikes mainly concentrated on its 8-inch BCD (Bipolar-CMOS-DMOS) process platform and averaging around 10%.

Next Round of Foundry Price Hikes Looms

Chinastarmarket.cn attributes the current round of foundry price increases to several industry factors, adding that other major foundries are likely to follow suit. According to the report, the surge in AI infrastructure investment is a key reason, as AI servers and related systems require large volumes of power-management chips, which in turn are consuming a significant share of BCD capacity.

The report further explains that BCD is a monolithic process that integrates power, analog, and digital circuits on a single chip, cutting power loss, boosting performance, lowering packaging costs, and improving reliability.

According to Chinastarmarket.cn, China’s foundries with BCD platforms currently include SMIC, Hua Hong Semiconductor, United Nova Technology, and CR Micro.

Notably, beyond the confirmed price hikes on 8-inch BCD lines, industry participants cited by the report expect high-voltage CMOS (HV-CMOS) to be the next likely target, as current BCD demand is strong and prices are already higher than HV, making a similar increase for HV all but inevitable.

The report also points to supply-side constraints as a major factor, noting that TSMC is scaling back its 8-inch capacity to focus on advanced nodes, leaving a gap in the mature-process supply chain. Persistently high prices for metals like gold and copper are further driving costs, adding upward pressure on foundry prices, the report notes.

Foundries Gear Up for Price Hikes on Advanced Nodes

As the year draws to a close, foundries are actively negotiating price adjustments with clients. According to Commercial Times in November, TSMC has been notifying customers since September about a fourth consecutive year of price hikes for its sub-5nm nodes—including 2nm, 3nm, 4nm, and 5nm—set to take effect in January 2026, with average increases around 3–5%. The report also noted that TSMC’s 3nm family could see single-digit annual price rises, resulting in double-digit cumulative gains over time.

On the other hand, Commercial Times also revealed that Taiwan’s second-largest foundry UMC had asked suppliers to propose at least a 15% reduction starting in 2026, which reportedly cover various supply segments, including chemicals, specialty gases, substrate materials, consumables, and maintenance services.

Read more

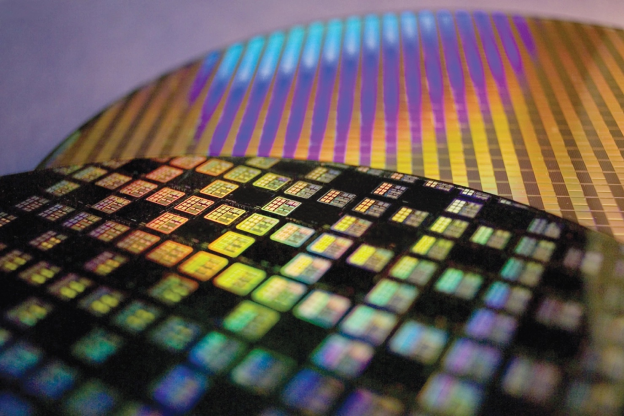

(Photo credit: TSMC)