Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

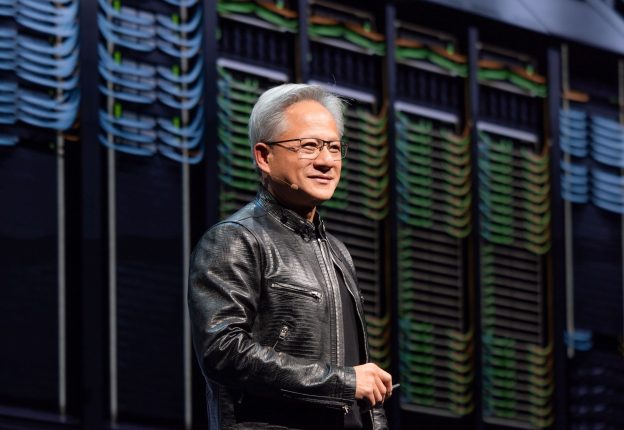

[News] NVIDIA Reportedly Preparing to Sell Full AI Server Systems in 2026, Raising Margin Risks for Partners

As Wistron released its earnings on the 12th, signs that its collaboration model with NVIDIA may be shifting drew industry attention. According to Wccftech, an analyst on Wistron’s Q3 earnings call suggested that beginning with next year’s Vera Rubin platform, NVIDIA could move toward directly supplying Level-10 systems to partners to standardize rack designs and significantly shorten time-to-market.

In response, the report notes that Wistron said it continues to handle the work; therefore, the reported collaboration model does not have a major impact and is generally positive for its business.

The reported shift could see NVIDIA supplying partners with fully assembled Level-10 (L10) VR200 compute trays—complete with compute hardware, cooling systems, and interfaces—leaving major ODMs with little design or integration work and potentially narrowing their margins in NVIDIA’s favor, as Tom’s Hardware points out.

If the shift is adopted and NVIDIA begins supplying partners with L10 compute trays—which likely represent around 90% of a server’s cost—partners would be left primarily with rack-level integration rather than full server design, as indicated by Tom’s Hardware. Its partners would still construct the outer chassis, integrate power supplies, and handle final assembly and testing, but while these tasks are operationally important, they offer little in terms of hardware differentiation.

Meanwhile, the purported change could accelerate the VR200 ramp, since partners would no longer need to complete all design work themselves, and production costs could decrease through economies of scale enabled by NVIDIA contracting directly with EMS providers, according to Tom’s Hardware.

Potential Shift in Procurement and Customization Dynamics

As noted by Economic Daily News, the shift could move procurement of server components such as cooling modules, chassis, and cables from CSPs and their designated server ODMs to NVIDIA itself, giving the company greater pricing leverage.

However, Economic Daily News also indicates that this change could lead to more standardized server designs, limiting CSP customers’ ability to customize or modify internal components. As a result, CSPs with higher customization requirements may become more inclined to adopt ASIC-based servers, while the enterprise market would likely continue to favor standardized AI server platforms.

Read more

- [News] CSPs’ ASIC Push Sparks Competition Among IC Designers, Margins Under Pressure

- [News] NVIDIA Dismisses AI Bubble Concerns, Reportedly Projects $500B in GPU Sales from Blackwell and Rubin

(Photo credit: NVIDIA)