Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] TSMC Posts Record Q3 Profit, EPS NT$17.44 Amid AI Surge, Tariff Concerns

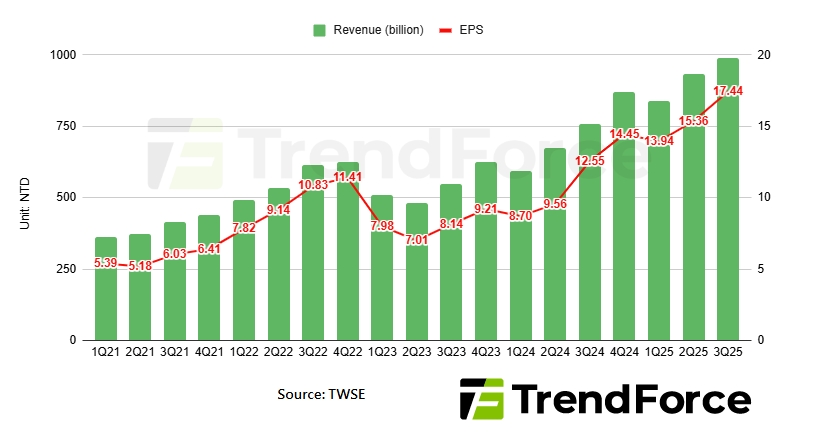

TSMC today announced consolidated revenue of NT$989.92 billion, net income of NT$452.30 billion, and diluted earnings per share of NT$17.44 (US$2.92 per ADR unit) for the third quarter ended September 30, 2025.

As Reuters reported, TSMC’s Q3 profit hit a record high on soaring demand for AI infrastructure—though U.S. tariffs could cloud its outlook.

Year-over-year, TSMC’s third quarter revenue increased 30.3%, while net income and diluted EPS increased 39.1% and 39.0% respectively. Compared to second quarter 2025, third quarter results represented a 6.0% increase in revenue and a 13.6% increase in net income. All figures were prepared in accordance with TIFRS on a consolidated basis.

In US dollars, third quarter revenue was $33.10 billion, which increased 40.8% year-over-year and increased 10.1% from the previous quarter.

Gross margin for the quarter was 59.5%, operating margin was 50.6%, and net profit margin was 45.7%.

In the third quarter, shipments of 3-nanometer accounted for 23% of total wafer revenue; 5-nanometer accounted for 37%; 7-nanometer accounted for 14%. Advanced technologies, defined as 7-nanometer and more advanced technologies, accounted for 74% of total wafer revenue.

(Photo credit: TSMC)