Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] Taiwan-Backed Photonics Chip Startups Target Cloud Giants with 2026 Launch

As semiconductor leaders NVIDIA and TSMC accelerate their photonics and co-packaged optics initiatives, emerging chip companies Celestial and OpenLight are positioning themselves to launch their debut processors by late 2025 through 2026, according to EE Times.

The report, citing senior executives, suggests both startups are developing cutting-edge photonic solutions that promise superior performance and power efficiency for hyperscale cloud operators such as Amazon, Microsoft, and Google.

Close Ties to Taiwan’s Chip Powerhouses

Notably, both Celestial and OpenLight have ties to Taiwanese chip powerhouses. According to EE Times, Celestial raised $255 million in August via TSMC’s VentureTech Alliance and Samsung Catalyst Fund, bringing its total funding to $520 million. The startup also taps TSMC’s 4nm and 5nm nodes to build the transmission and reception control circuits in its Photonic Fabric solution, the report adds.

It is worth noting that according to Celestial AI, the company announced in early 2025 the appointment of Lip-Bu Tan, current Intel CEO, to its Board of Directors.

Meanwhile, EE Times reports that OpenLight closed a $34 million funding round in the same period, with participation from Juniper Networks—now part of HPE—and Lam Capital, the venture arm of semiconductor equipment maker Lam Research. The startup has also partnered with ISE, the California-based subsidiary of Taiwan’s chip packaging leader ASE, the report notes.

Ambitious Roadmaps

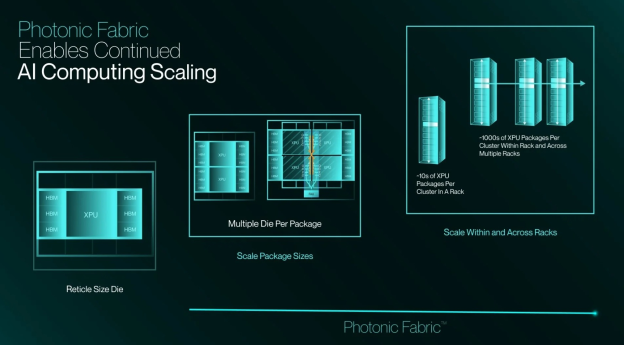

According to the report, Celestial expects to commercialize its inaugural silicon products by 2026, featuring the company’s Photonic Fabric technology, which enables optical scale-up networking—whether chip-to-chip within processor packages or server-to-server across data center racks.

According to COO Preet Virk, cited by EE Times, major cloud providers are eager to deploy Celestial’s tech upon availability. “Hyperscalers are prepared to integrate our solution the moment we can deliver, anticipated for mid-to-late next year,” Virk noted.

EE Times notes that Celestial focuses on “scale-up” networking within individual servers, which handle around 85% of data center traffic. The company positions its Photonic Fabric as a more power-efficient alternative to NVIDIA’s NVLink, claiming it uses just 25% of the energy for the same GPU-to-GPU communication, the report adds.

Celestial is also promoting its Optical Memory Interface Bridge (OMIB) as a competitor to NVLink, operating similarly to advanced packaging solutions like Intel’s EMIB, TSMC’s CoWoS, and Samsung’s I-Cube (IQE) technologies, the report notes.

On the other hand, EE Times suggests that OpenLight plans to deploy its recent funding to broaden its process design kit (PDK) component library, manufactured through foundry partner Tower Semiconductor. The expanded portfolio reportedly encompasses 400 gigabit-per-second (Gbps) modulators and indium phosphide solutions that enable on-chip laser integration through heterogeneous manufacturing processes.

Notably, OpenLight CEO Adam Carter, whose company initiates manufacturing this year, described substantial client interest in the firm’s indium phosphide technology for co-packaged optics (CPO) applications, according to EE Times.

Read more

- [News] Silicon Photonics in the Spotlight: TSMC Lifts the Curtain on COUPE at SEMICON Taiwan

- [News] TSMC Advances in Silicon Photonics: Broadcom and NVIDIA Set to Be First Customers

(Photo credit: Celestial AI)