Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

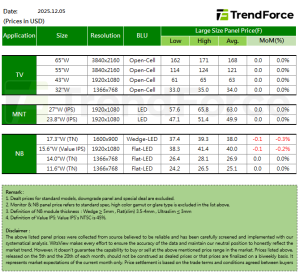

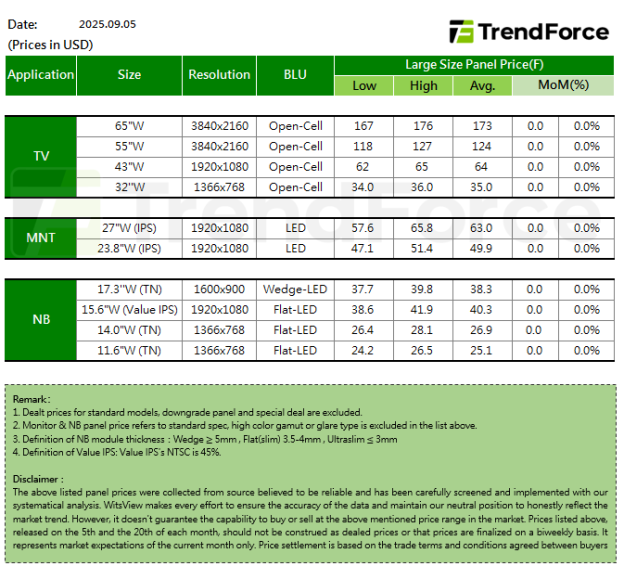

[Insights] Panel Prices in Early September: TV Expected to Hold Steady Amid Year-End Demand Prep

.TV

As September begins, TV brands are preparing for year-end promotional demand, helping to sustain relatively stable momentum in panel procurement. In response, panel makers have adopted a more proactive stance in production and shipments over the past two months, easing the downward pressure on panel prices seen since Q2. Based on current observations, TV panel prices are expected to remain flat across the board in September.

.MNT

Since the beginning of Q3, demand for MNT panels has been relatively weak. However, as most mainstream panel sizes remain unprofitable for manufacturers, production willingness among panel makers has stayed low. This has led to a tighter supply of mainstream FHD models, yet panel prices have struggled to rise—a somewhat unusual situation.

Additionally, with TV panel demand beginning to stabilize and strengthen in Q3, brand customers have recognized that there is limited room for further price declines in the short term. Both buyers and sellers seem to share a consensus on price stability, so MNT panel prices are expected to remain flat throughout September.

.NB

Notebook panel demand stayed strong in Q3. With semiconductor tariffs still uncertain, brand customers have been actively placing orders, hoping to use their demand to secure bigger discounts from panel makers. However, due to intense competition, panel suppliers have been offering ongoing hidden discounts, which are now shrinking. Despite steady demand, this makes it hard for manufacturers to raise prices. Overall, demand is expected to remain solid in September, and panel prices are likely to stay flat.