Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] Ahead of TSMC Earnings: 10 Brokers Weigh in on Q3 Outlook, Currency Pressures, Capex Plans & More

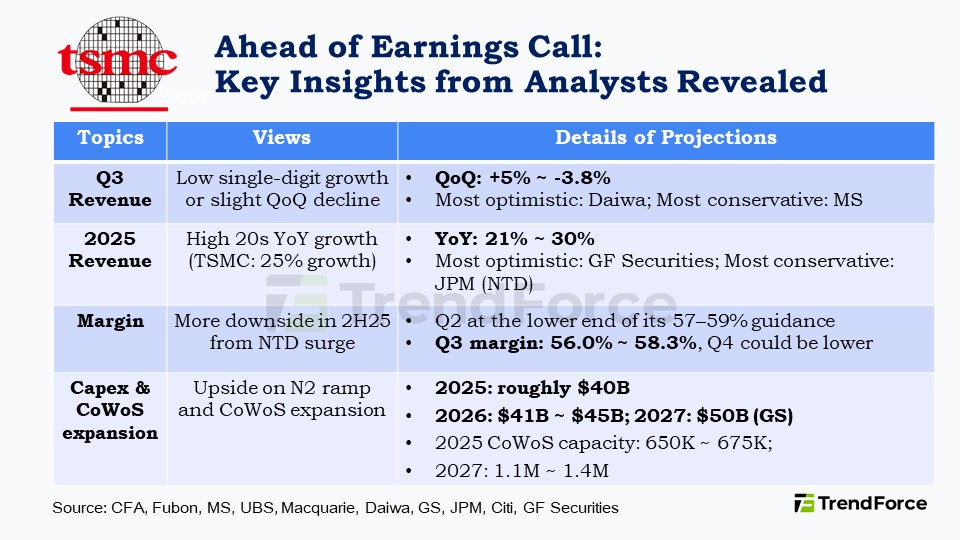

With TSMC’s earnings call just around the corner (July 17th), foreign and local brokers are lining up with key predictions. While the foundry giant’s Q2 revenue came in strong at $31.9 billion (NT$ 933.80 billion), surpassing guidance of $28.4–29.2 billion, analysts now expect Q3 sales to be roughly flat or even show a slight decline compared to Q2. Here’s a quick rundown of insights from ten leading brokerages on TSMC’s three key topics for tomorrow’s earnings call.

Q3 and Full-year Revenue Outlook

Analysts from JP Morgan, Morgan Stanley, and Fubon largely credit TSMC’s strong Q2 revenue to higher wafer prices and customers front-loading orders ahead of tariffs. But Q3 could prove more challenging, with brokerages expecting a flat quarter—ranging from low single-digit growth (CFA, UBS, Daiwa, GF Securities, Citi) to slight declines (MS, Fubon, GS).

Morgan Stanley is the most cautious, projecting a 3.8% drop in TSMC’s Q3 revenue, with Fubon close behind at 3.1%. Daiwa, on the other hand, is the most upbeat—expecting 5% quarter-over-quarter growth in USD terms, though it also warns of currency headwinds.

As the Economic Daily News highlights, TSMC’s first-half revenue has jumped about 40% year-over-year, well ahead of its full-year USD growth target of 25%. With Q2 beating expectations, most analysts now see 2025 revenue growth landing in the high 20s, with JP Morgan/ UBS and GF Securities the most upbeat, forecasting 29% and up to 30%, respectively.

Impact of NTD Strength and Price Hikes

Meanwhile, despite solid Q2 sales growth, analysts expect TSMC’s gross margin to land at the lower end of its 57–59% guidance, as currency headwinds were only partly offset by wafer price hikes.

According to Fubon, due to N2 mass production ramp-up and high electricity costs during Taiwan’s summer, gross margins are expected to decline further in the second half of 2025. On the other hand, GF Securities notes that due to New Taiwan dollar appreciation, TSMC’s gross margin in Q3 is expected to further decline to 56.1%.

However, wafer price hikes seem to be a certain trend. Fubon estimates TSMC raised blended wafer prices by 3% in Q2 and expects another increase in 2026, likely matching or exceeding 2025 levels, though the final scale is still under discussion.

In the meantime, Goldman Sachs expects TSMC to hike prices for advanced nodes and CoWoS, fueling revenue growth of 28.7% in 2025 and 17.1% in 2026.

Capex and CoWoS Expansion Plans

With TSMC guiding 2025 capex at $38–42B, analysts at UBS, Goldman Sachs, and Citi see room for further upside—fueled by both the N2 ramp and faster-than-expected CoWoS expansion. UBS raised its capex forecasts to $40B for 2025 and $42B for 2026. Goldman Sachs is even more bullish, projecting TSMC’s capex to climb to $42B in 2026 and $50B in 2027.

GS has raised its CoWoS shipment estimates for TSMC for 2025–2027 to 664K, 1.08M, and 1.566M units, up from the previous projections of 585K, 923K, and 1.287M. Similarly, capacity forecasts have also been increased to 675K, 1.2M, and 1.74M units, from the earlier estimates of 600K, 1M, and 1.41M.

On the other hand, Citi forecasts TSMC’s CoWoS capacity to grow over 20% in 2026, followed by a further 40% increase in 2027. Analysts at Citi estimate TSMC’s CoWoS capacity to reach 650K, 800K, and 1.1M units in 2025, 2026, and 2027, respectively.

Read more

- [News] Intel on the Move: Nova Lake Reportedly Tapes Out on TSMC’s 2nm, with 18A Yields Gaining Speed

- [News] TSMC Reportedly to Break Ground on U.S. Advanced Packaging Plants in 2028, Starting with SoIC

(Photo credit: TSMC)