Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[Insights] AI-Driven Memory Boom Ripples Through Hardware Markets, From Price Hikes to Product Delays

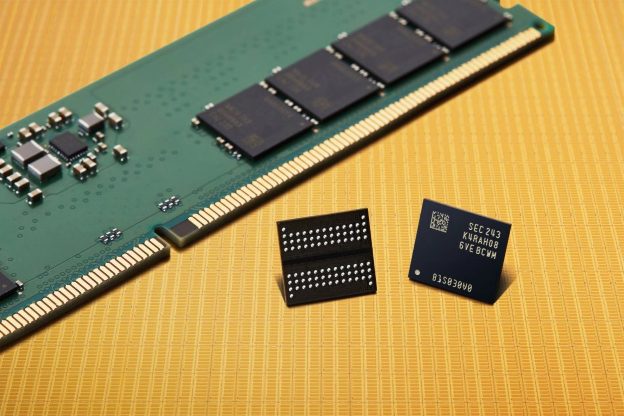

Rising memory prices have triggered a series of unusual phenomena across the industry. According to a column by Zhu Xi on TechNews, prices have been climbing since last year, driven by strong demand from AI servers and data centers. Beyond the expected drag on PC shipments this year, the near-runaway surge in memory prices has also produced a range of unexpected market developments, outlined below.

Brands Exit the Consumer Market

As TechNews notes, Micron Technology has announced its exit from the consumer memory market to focus resources on AI-driven demand. The company is also winding down Crucial, its nearly 30-year-old consumer memory and storage brand.

Memory Becomes a Target for Theft

Soaring prices have turned memory products into a new target for thieves. TechNews reports that Costco in the U.S. has removed memory modules from display PCs, reinstalling them only at purchase—echoing measures seen during the pandemic and crypto-mining boom.

Old PCs Gain New Value

With memory prices continuing to rise, many media outlets are urging consumers not to discard old PCs too quickly. Instead, users are encouraged to keep using them or remove and sell the memory to fund future upgrades. AMD has even stated that its latest 9850X3D delivers comparable performance when paired with older DDR5-4800 memory, meaning a memory upgrade is not strictly necessary, TechNews notes.

CPU Supply Tightens

Beyond memory makers, CPU vendors are also shifting resources toward AI. Intel CPUs have increasingly been reported to face shortages, with price increases emerging—adding further pressure to an already weak PC market.

Chip Refresh Cycles Slow

NVIDIA is reportedly delaying its RTX 50 Refresh, as VRAM price increases are believed to be even steeper than those for system memory. Because NVIDIA’s refresh models typically offer spec upgrades without price hikes—such as higher VRAM capacity—rising costs would squeeze margins for both NVIDIA and its AIB partners.

Following CES, OEMs issued price-hike notices to channel partners, with increases of 5%–15%. As a result, systems based on new platforms such as Panther Lake or the Arrow Lake Refresh expected in March are likely to carry higher prices. While platforms like Panther Lake have been well received, coverage often adds a caveat: final demand will hinge on launch pricing.

Read more

- [News] Samsung, SK hynix, Micron Reportedly Shift to Short-Term, Post-Settlement Deals for Big Techs

- [News] Micron Launches $24 Billion NAND Expansion in Singapore, Wafer Output Slated for 2028

(Photo credit: Samsung)