Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

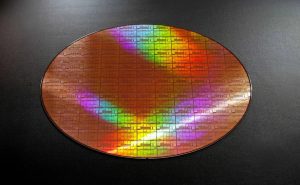

[News] Japanese Paper Maker Oji Holdings Reportedly Develops EUV Photoresist for 2nm Chips

Japan has long been strong in semiconductor materials, and some unexpected players are now entering the field. According to Nikkei, Oji Holdings plans to launch a materials business targeting chips at 2nm and beyond. The company has developed a photoresist made using wood-based components, with commercialization targeted for 2028. It aims to achieve annual sales of ¥10 billion in the 2030s.

Photoresist is a core semiconductor material and an essential component for circuit patterning. With domestic paper demand in Japan declining, Oji Holdings has positioned chemical production—leveraging wood-based raw materials and its existing facilities—as a key growth driver, as the report indicates.

The report highlights that currently dominant chemically amplified photoresists are believed to face limitations when forming ever-finer circuit patterns. Oji Holdings’ wood-derived photoresist has been confirmed to meet the performance requirements for chips at 2 nm and beyond.

Using wood-derived materials required overcoming significant challenges, as metals naturally present in plants are electrically conductive and pose a serious risk in chip manufacturing. Oji Holdings addressed this hurdle by improving its impurity-removal and refining technologies, the report notes.

Materials suppliers are racing to develop next-generation EUV photoresists. As the report notes, JSR has acquired a U.S. photoresist company and plans to build a manufacturing facility in South Korea, with production expected to begin in 2026. Sumitomo Chemical, meanwhile, is focusing on the development of organic small-molecule photoresists.

Hidden in Plain Sight: Japan’s Players in the Semiconductor Supply Chain

Beyond Oji Holdings, another unexpected player with an established presence in the chip industry is Kao Corporation. According to TechNews, in late 2025 Kao announced plans to set up a “Kao Chemical Products Precision Cleaning Center” in Hsinchu, Taiwan. The site will be the company’s second precision cleaning center globally, following its Wakayama facility in Japan, and is expected to begin operations in 2026. As TechNews notes, the center will feature high-specification equipment designed to meet the stringent cleaning requirements of advanced packaging technologies such as CoWoS, CoWoP, and FOPLP.

Toilet manufacturer Toto is also among these less obvious players tied to the semiconductor industry. According to Tom’s Hardware, the company’s expertise in ceramics has proven valuable in chip manufacturing. Toto supplies chucks used to hold silicon wafers in place during the fabrication process while helping minimize contamination. The report notes that the current wave of AI data center construction is driving growth in Toto’s electrostatic chuck business.

Japanese food and biotech company Ajinomoto is another example. Ajinomoto holds more than 95% of the global market share for ABF materials used in GPU and CPU substrates, Nikkei notes.

Read more

- [News] Japan Ramps Up Photoresist Investment for 2nm Chips — Tokyo Ohka Kogyo, JSR Lead the Charge

- [News] Japanese Firm Ajinomoto to Invest JPY 25 Billion by 2030 to Expand ABF Production for Advanced Packaging

(Photo credit: Oji Holdings)