Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

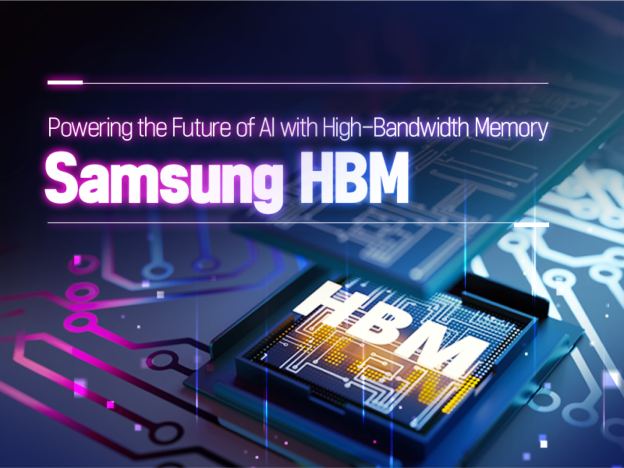

[News] Samsung HBM4 Reportedly to Ship First After Lunar New Year, Initial Share Projected at Mid-20%

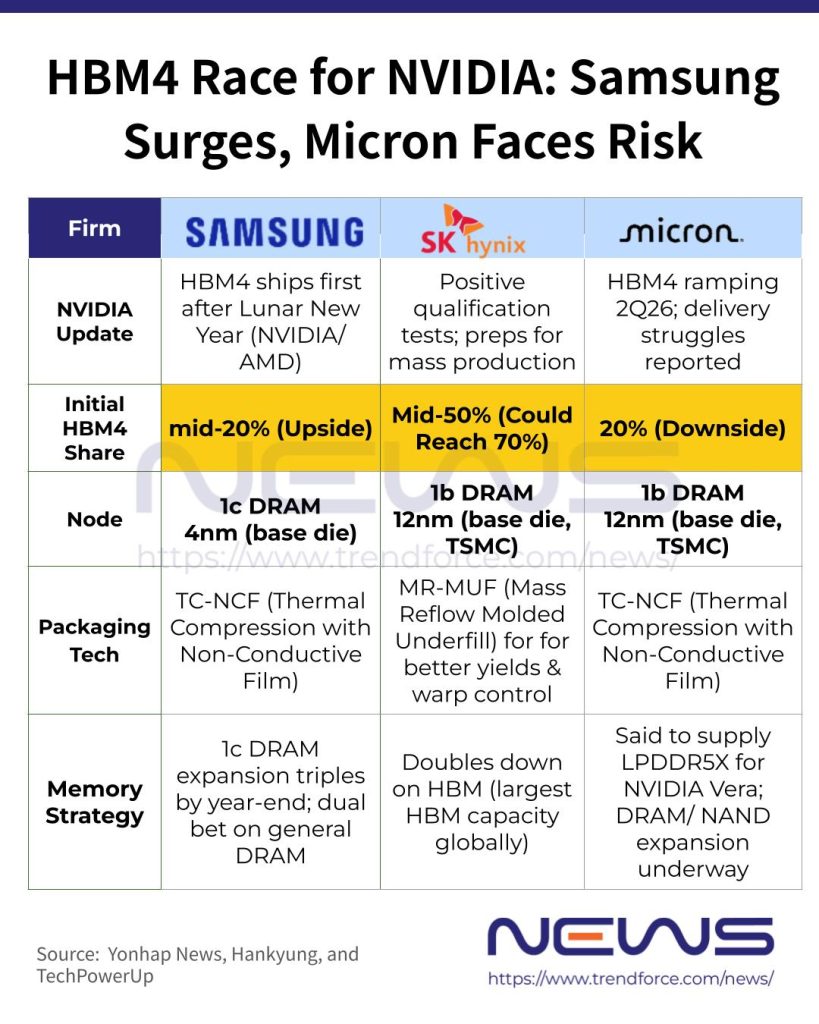

As NVIDIA prepares to debut Vera Rubin, its next-generation AI accelerator, at GTC 2026 in mid-March, the race for HBM4 supremacy between Samsung and SK hynix is drawing intense market attention. According to Yonhap News and Hankyung, Samsung is poised to become the world’s first company to mass-produce and ship HBM4 after the Lunar New Year—but its initial share is expected to hover in the mid-20% range.

Hankyung, citing industry sources, suggests that NVIDIA provisionally allocated HBM4 volume in late 2025. SK hynix is said to have received the largest share, in the mid-50% range, while Samsung holds the mid-20% range and Micron around 20%, the report adds.

Samsung HBM4 Highlights

Despite holding a smaller share, Samsung is making a strong comeback. Yonhap News reports it secured purchase orders after clearing NVIDIA’s quality tests ahead of schedule and plans to begin mass shipments of HBM4 as early as the third week of this month.

Beyond being first to market, its HBM4 is also touted as the highest-performing in the industry. The leap in performance, as per Yonhap, comes from a bold move: Samsung combined 1c (10nm-class, sixth-generation) DRAM with a 4nm foundry process for HBM4.

With this combination, Samsung’s HBM4 reaches data speeds of up to 11.7Gbps, well above the JEDEC standard of 8Gbps—37% faster than the benchmark and 22% ahead of the previous HBM3E (9.6Gbps), the report notes.

Yonhap adds that Samsung’s HBM4 also delivers a single-stack memory bandwidth of up to 3TB/s, roughly 2.4 times higher than its predecessor, and 36GB of capacity through 12-high stacking. With 16-high stacking, capacity could expand further to 48GB, according to Yonhap.

Dual-bet strategy

Samsung may not need to worry about its smaller HBM4 share. Hankyung notes that, unlike HBM, mainstream DRAM avoids complex packaging and offers far higher profit margins. With DRAM capacity reportedly 1.2× that of competitors, Samsung is taking a smart approach: showcase its HBM4 tech with NVIDIA while keeping the focus on the more profitable mainstream DRAM market, the report adds.

The higher cost isn’t just from packaging. Hankyung suggests Samsung’s 4nm base die still sits in the advanced foundry tier, and 1c DRAM is the most advanced DRAM available. Compared with rivals using 12nm foundry node and 1b DRAM, Samsung’s HBM4 comes with higher production costs and greater yield uncertainty, as per Hankyung.

Notably, like other memory giants under AI-driven demand, Samsung is also facing capacity constraints. Hankyung reports that 1c DRAM currently outputs about 70K wafers per month, roughly 10% of Samsung’s total DRAM capacity. Expansion at Pyeongtaek Line 4 is underway, but it will take a year for monthly output to reach around 190K wafers, the report adds.

With prices surging across the board—not just for HBM but for all memory—Samsung has room to maneuver and aims to efficiently allocate its capacity.

Where SK hynix and Micron Stand

Why did NVIDIA give SK hynix the lion’s share of HBM4 despite Samsung’s breakthrough? Hankyung explains that HBM production takes over six months, so suppliers must be assigned capacity well in advance. The allocations reportedly reflect NVIDIA’s assessment of each supplier’s track record, HBM4 capacity, and qualification success.

For now, Hankyung reports that SK hynix has delivered strong results in recent qualification tests. With NVIDIA planning to deploy large volumes of HBM4 in Vera Rubin later this year, it is critical that the supplier with the largest HBM production capacity—SK hynix—can deliver reliably. In this context, NVIDIA’s decision to favor SK hynix appears reasonable.

However, another memory giant, Micron, appears to be falling behind. Hankyung reports market chatter that Micron is struggling to supply HBM4 to NVIDIA, potentially boosting Samsung’s share to 30%. TechPowerUp adds that Micron might have no initial HBM4 allocation but will supply LPDDR5X for NVIDIA’s “Vera” CPUs, supporting up to 1.5TB and making up for its lost HBM4 share.

Read more

- [News] SK hynix Reportedly to Supply About Two-Thirds of NVIDIA HBM4; Samsung Targets Early Delivery

- [News] Samsung Reportedly Set to Begin Official HBM4 Shipments to NVIDIA and AMD in February

(Photo credit: Samsung)