Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] Samsung Reportedly Shifts Glass Substrate Project to Business Unit, Eyes 2027 Ramp-Up

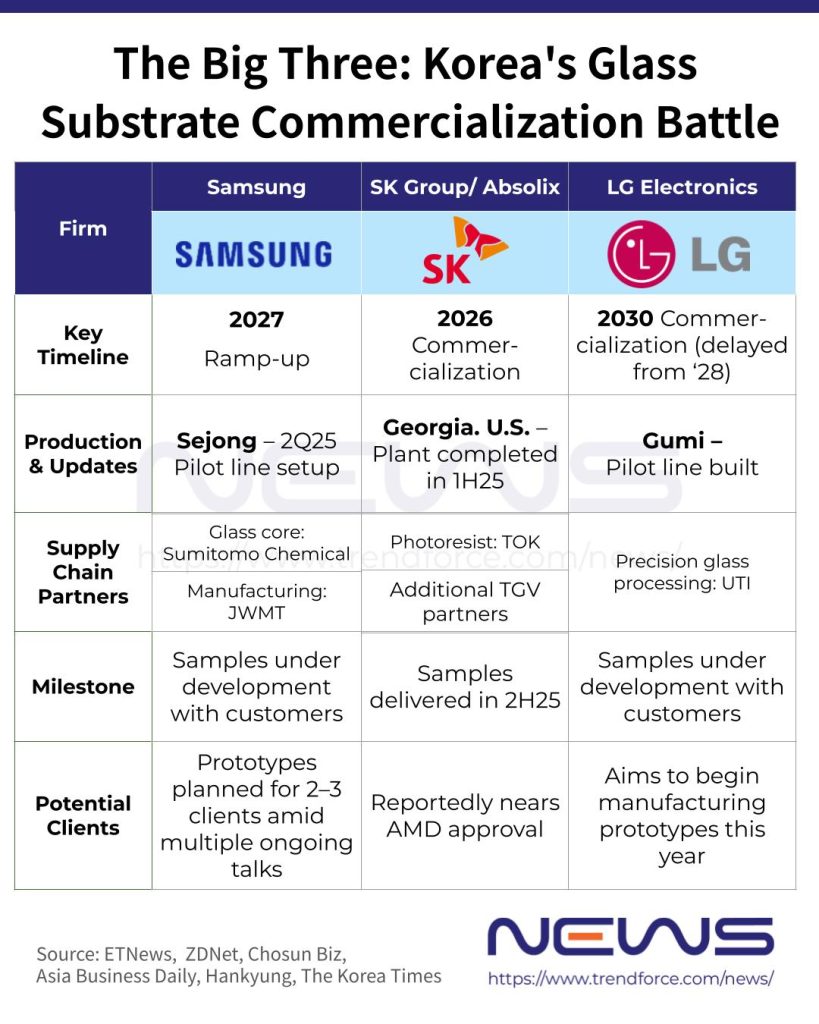

As chip heavyweights such as Intel accelerate their push into glass substrates, Samsung is also edging closer to commercialization. According to ETNews, Samsung Electro-Mechanics has begun gearing up for market entry, with the project reportedly shifting from an advanced R&D unit to a business-focused execution team—signaling a move from development to market deployment.

The report notes that Samsung expects the glass substrate era to enter full swing from 2027 onward. It is currently developing glass substrate samples with customers, including global semiconductor companies, as per ETNews.

From Materials to Manufacturing: Samsung’s Full Glass Substrate Push

As noted by ETNews, semiconductor glass substrates replace conventional plastic materials with glass, offering a major performance uplift. With reduced warpage and enhanced support for ultra-fine circuit patterning, they are quickly gaining traction as a next-generation substrate for AI chips. The report adds that major players—including Samsung Electronics, Intel, Broadcom, AMD, and Amazon Web Services (AWS)—are actively moving to adopt the technology.

As Samsung Electro-Mechanics prepares for a full market rollout, ETNews reports that it established a pilot line for glass substrate prototypes at its Sejong facility in 2025. In November, it also agreed to form a joint venture with Japan’s Sumitomo Chemical Group, aiming to speed up the production and supply of glass cores—a critical component of semiconductor glass substrates, the report notes.

Beyond securing key materials, Samsung is ramping up its manufacturing expertise. AlphaBiz reports that in late 2025, the company acquired a stake in JWMT — formerly Jungwoo M Tech — through its investment arm, Samsung Venture Investment Corporation (SVIC).

Notably, Alphabiz points out that JWMT, founded in 2002, is a leading player in advanced glass substrate production. The firm reportedly developed a proprietary LMCE technology that uses lasers to alter the glass’s physical properties and then selectively dissolves targeted areas with chemicals, bypassing direct drilling. JWMT also offers full-scale solutions, including plating processes, the report adds.

SKC Accelerates Glass Substrate Push

Meanwhile, Samsung’s archrival, SK Group, is also is ramping up efforts to mass-produce glass substrates through its subsidiary SKC. Chosun Biz notes that with mass production slated in 2026, ensuring stable supply while perfecting the technology remains the company’s top priority.

According to Chosun Biz, SKC’s Absolix unit is diversifying its photoresist (PR) supply, previously dependent on Japan’s TOK, by bringing in domestic suppliers. It is reportedly exploring additional partners for TGV (glass through-via) and plating processes as well, aiming for a dual-sourcing strategy.

Chosun Biz suggests that LG Innotek is also moving into glass substrates, expanding on its existing substrate and packaging business. Following an investment in UTI, a specialist in precision glass processing, the company is co-developing technology to strengthen glass substrates and is setting up a pilot production line to test mass production feasibility, the report adds.

Read more

- [News] Intel Reportedly Presents First Thick-Core Glass Substrate with EMIB, Targeting AI Data Centers

- [News] China Pushes Glass Substrate: BOE Reportedly Eyes Post-2026 Mass Production, Visionox Joins the Race

(Photo credit: Samsung Electro-Mechanics)