Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] SanDisk Beats Forecasts with 600%+ Profit Jump; First LTA Reportedly Sealed as Momentum Builds

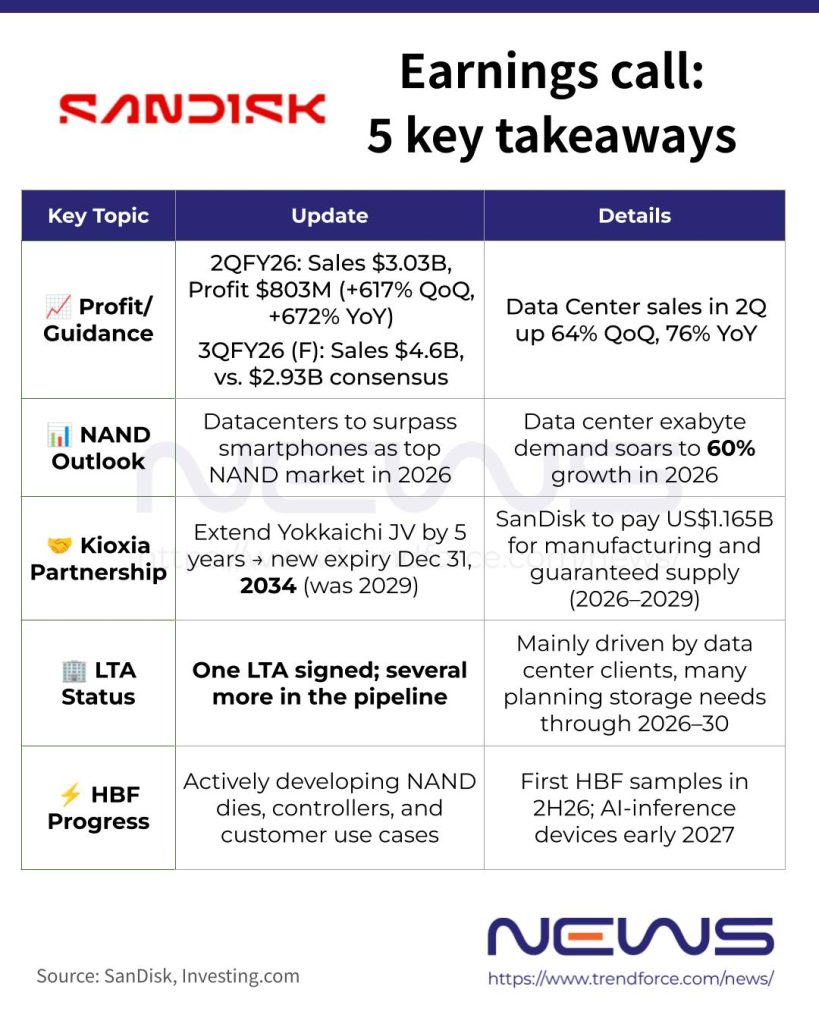

While Samsung and SK hynix’s freshly announced record 4Q25 results, NAND giant SanDisk emerges as another major beneficiary amid the AI boom. According to Barron’s, for the December quarter, SanDisk delivered a clear earnings beat, posting adjusted EPS of US$6.20, far above Wall Street’s US$3.62 consensus. Revenue reached US$3.03 billion, also topping analysts’ expectations of US$2.69 billion, the report adds.

Looking ahead, the company issued a current-quarter (3QFY26) revenue outlook with a midpoint of US$4.6 billion, sharply exceeding the US$2.93 billion average analyst forecast, Barron’s highlights, adding that as a pure-play NAND player, SanDisk’s surge is being fueled by the AI data-center boom, which is tightening memory and storage supply.

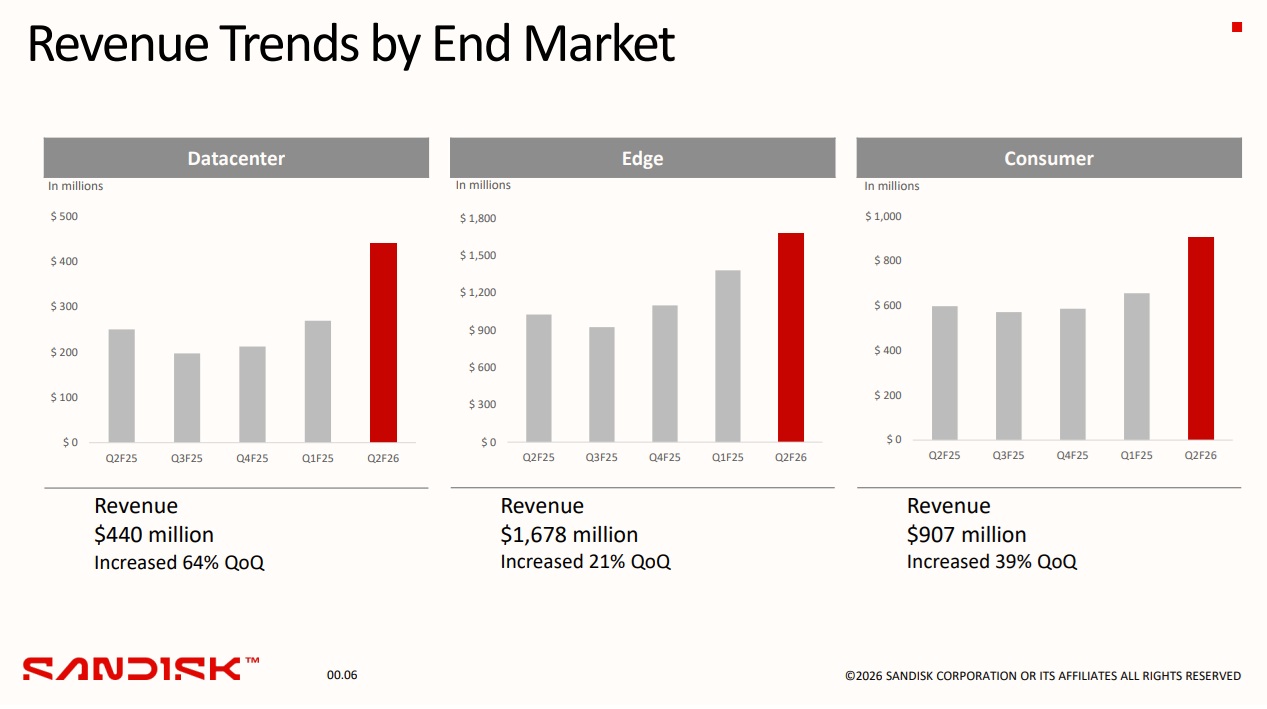

SanDisk reported net profit in 2QFY26 of US$803 million, up 617% QoQ and 672% YoY. By business segment, data center revenue reached US$440 million, up 64% from US$269 million in the prior quarter and 76% from US$250 million a year ago.

CEO David Goeckeler told Barron’s in December that data centers are set to overtake smartphones as the top source of NAND demand in 2026. He noted that high-end NAND for AI servers is already tight, with shortages expected to intensify in 2H26. New production capacity from SanDisk and rivals like Micron, however, isn’t expected until 2027–2028, keeping the market supply-constrained for several years, according to Barron’s.

(Credit: SanDisk)

Long-Term Deals Take Center Stage

Notably, as memory heavyweights like Samsung and SK hynix hesitate to lock in long-term deals amid tight supply, SanDisk seems to be making headway. Reuters cites CEO David Goeckeler saying that “customers are prioritizing supply over price.”

CFO Luis Vososo, speaking in a transcript cited by Investing.com, confirmed that SanDisk has signed and closed one long-term agreements (LTAs), noting that while terms remain undisclosed, it included a prepayment component, which the company views as key for such deals. Several additional agreements are reportedly in the pipeline, he added.

Meanwhile, the push for LTAs seems to be driven largely by data center customers, who are planning years in advance given their rapidly growing demand. CEO David Goeckeler, according to Investing.com, highlighted that data center exabyte demand forecasts for 2026 have climbed from mid-20% to high-60% growth. He noted that data center clients are more proactive in supply discussions, with many already mapping out storage needs well into 2026–2028—and even 2029–2030 with SanDisk.

Kioxia Collaboration Extended to Secure Supply

Notably, to secure long-term supply, SanDisk and Kioxia Corporation announced an extension of their Yokkaichi Plant joint venture by five years, moving the expiration from December 31, 2029, to December 31, 2034. Under the renewed agreement, SanDisk will pay US$1.165 billion to Kioxia for manufacturing services and guaranteed supply, with installments spread from 2026 to 2029.

SanDisk CEO David Goeckeler, according to Investing.com, called the extension a major milestone, highlighting that it aligns the Yokkaichi agreement with Kitakami, ensures strong supply visibility for the next nine years. Both fabs are operating at full capacity, with Kitakami expanding through the new K2 fab, supported by well-planned strategies for future growth, he said.

HBF Update

Goeckeler also gave a brief update on High Bandwidth Flash (HBF). According to the Investing.com transcript, the company is actively advancing development, working with customers on use cases, NAND die design, and controller development, with progress continuing steadily. Sandisk, teaming up with SK hynix, targets to deliver first samples of its HBF memory in the second half of calendar 2026 and expects samples of the first AI-inference devices with HBF to be available in early 2027.

Read more

- [News] Second-Tier No More: Kioxia and SanDisk Balance Alliance and Rivalry in AI NAND Race

- [News] Micron, SanDisk Reportedly Turn to PSMC to Fast-Track Memory Output Amid Tight Supply

(Photo credit: SanDisk)