Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] SK hynix Reportedly to Supply About Two-Thirds of NVIDIA HBM4; Samsung Targets Early Delivery

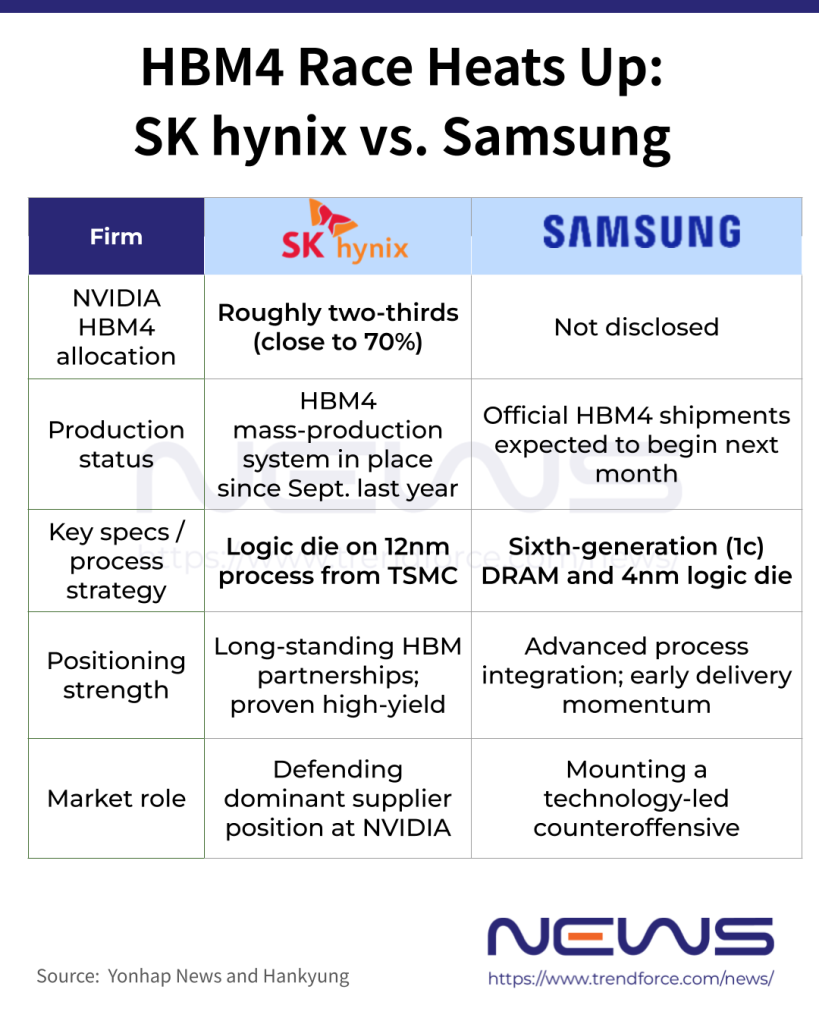

Competition over next-generation HBM4 is intensifying, with SK hynix and Samsung Electronics positioning for future supply to NVIDIA’s upcoming AI platforms. According to Yonhap News, sources say NVIDIA is expected to allocate roughly two-thirds of its HBM4 demand for the Vera Rubin platform to SK hynix, with the company’s share understood to be close to 70%.

The allocation would be well above earlier expectations, which had SK hynix supplying just over 50% of NVIDIA’s HBM4 requirements, the report adds.

Analysts cited by the report say the development reflects confidence in SK hynix’s long-standing HBM partnerships with major customers, including NVIDIA, as well as trust built on consistently high yields in large-scale production. The report adds that as the HBM market moves beyond pure technology competition, stable quality and mass-production capability are increasingly being recognized as the core competitive advantages.

The report notes that SK hynix put its HBM4 mass-production system in place in September last year and has since provided NVIDIA with large volumes of paid samples, which are said to have cleared final validation without issues. As a result, SK hynix is said to be moving toward full-scale production of its finalized HBM4 products to meet major customer schedules.

Samsung Mounts HBM4 Counteroffensive

Meanwhile, according to Hankyung, industry sources say Samsung is poised to begin official HBM4 shipments next month to major AI chip customers such as NVIDIA and AMD. This development follows Samsung’s successful completion of final qualification tests, prompting customers to place mass-production orders rather than request only sample volumes.

As Hankyung notes, Samsung is aiming for maximum performance by adopting sixth-generation (1c) DRAM on a 10nm-class process—placing it one generation ahead of competitors—and applying a 4nm foundry process for the logic die, putting it several generations ahead in control-core integration.

Notably, according to Dealsite, sources say SK hynix and Samsung Electronics are set to supply HBM4 to NVIDIA at comparable prices, indicating that Samsung’s pricing power has caught up with that of SK hynix. Although Samsung priced its 12-layer HBM3E products around 30% below SK hynix, it sought pricing parity in HBM4 talks with NVIDIA, resulting in similar price levels. Industry sources expect prices for 12-layer HBM4 products to exceed $600.

Expanding AI Ecosystem Lifts HBM Demand

Although SK hynix has secured the majority of NVIDIA’s supply, EBN notes that market conditions remain favorable for both Samsung Electronics and SK hynix. Rising AI chip demand from NVIDIA and other global tech companies, including AMD, Google, and Microsoft, has pushed HBM demand beyond expectations, lifting prices for HBM3E and HBM4.

EBN adds that Samsung Electronics’ share of the global HBM market is expected to surpass 30% this year. Backed by strong partnerships with companies such as AMD and Google, the firm could see a sharper rise in HBM sales if AI chip demand from these customers accelerates.

Read more

- [News] Samsung Reportedly Set to Begin Official HBM4 Shipments to NVIDIA and AMD in February

- [News] Samsung & SK hynix Earnings Showdown on 1/29: Profit, CAPEX, HBM4 in Focus

(Photo credit: SK hynix)