Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

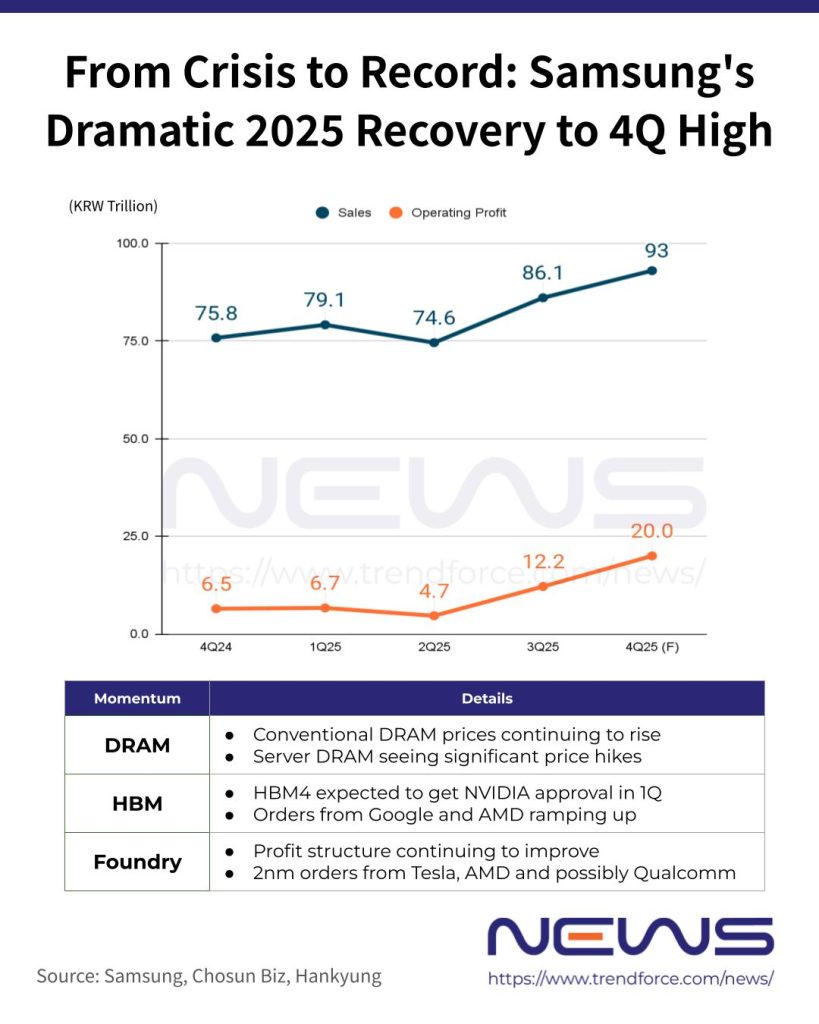

[News] Samsung’s Q4 Profit Soars 208% to Record 20 Trillion Won on Memory Rally and Foundry Turnaround

Amid a sharp rise in memory prices fueled by AI-driven demand, Samsung Electronics made history by becoming the first South Korean company to post quarterly operating profit of 20 trillion won ($13.82 billion), while sales also climbed to a record 93 trillion won, Chosun Biz reports.

The company said preliminary fourth-quarter revenue rose 22.71% from a year earlier, topping the 90 trillion won mark for the first time, while operating profit surged 208.17% year on year. According to Reuters, the results reflect a near threefold jump in quarterly profit, driven by tight supply conditions and a boom in AI-related demand that pushed up prices for mainstream memory chips.

Reuters notes that the operating profit, setting a new record, has topped the previous peak of 17.6 trillion won set in the third quarter of 2018. Chosun Biz adds that Samsung also swiftly surpassed its own quarterly sales record of 86.1 trillion won, which had been set in the third quarter of 2025.

Samsung said it will publish its full earnings report, including a detailed breakdown by business segment, on January 29, as per Reuters.

Major Momentum with Foundry and HBM Growth

According to Hankyung, Samsung’s Device Solutions (DS) business, which houses its semiconductor operations, is expected to have been the key driver. Although Samsung did not release segment-level data on the day, analysts cited by the report estimate that the division generated about 16 trillion to 17 trillion won in operating profit in the fourth quarter of 2025.

The report further notes that a sharp narrowing of losses at the foundry and system LSI divisions is also expected to have supported the overall earnings improvement. The combined quarterly deficit of the two units, which stood at around the mid-2 trillion won range through the first half of 2025, is estimated to have fallen to roughly 800 billion won in the fourth quarter, according to Hankyung.

In the foundry business, Samsung Electronics signed a 23 trillion won chip supply contract with Tesla in the United States in July last year, and is also set to take orders for AMD’s 2nm chips, the report adds.

Another report from Wccftech highlights Qualcomm as a potential customer. At CES 2026, CEO Cristiano Amon reportedly said the company has begun talks with Samsung Electronics to use its 2nm process for contract manufacturing. According to The Korea Economic Daily, placing orders for the Snapdragon 8 Elite Gen 5 on Samsung’s 2nm GAA node would mark the first renewal of their partnership in five years.

Alongside soaring prices for conventional DRAM, the Chosun Biz also points to Samsung’s HBM as a key momentum. The report notes that the company has also revamped its HBM lineup and began supplying the redesigned products to customers including Google and AMD in 2025. Analysts cited by the report add that Samsung is likely to obtain final quality approval for HBM4 from major clients such as NVIDIA and Google in the first quarter, with shipments expected to accelerate from the second quarter.

Notably, building on a strong Q4 2025 performance, analysts surveyed by Bloomberg project that Samsung’s earnings could more than double in 2026, reaching a record US$60 billion — roughly on par with forecasts for TSMC.

Read more

- [News] Samsung, SK Reportedly Hike Server DRAM Prices 60-70% – Google, Microsoft in the Queue

- [News] SK hynix, Samsung Reportedly Deliver Paid HBM4 Samples to NVIDIA Ahead of 1Q26 Contracts

(Photo credit: Samsung)