Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] SK hynix 2026 Outlook: HBM3E Dominates, HBM4 Dual Strategy Amid 3 Market Headwinds

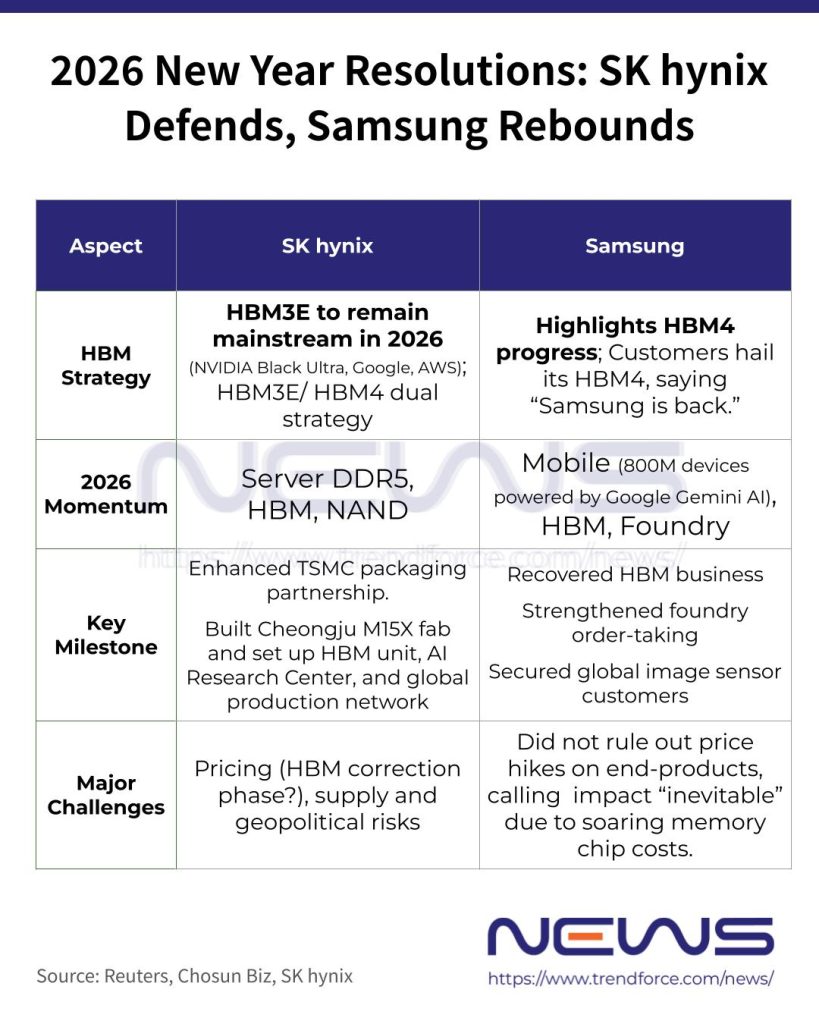

With general memory prices surging and HBM4 on the horizon, 2026 could be another landmark year for memory giants. In its New Year message released today (Jan. 5), SK hynix noted that HBM3E will remain the dominant product this year, even as HBM4 ramps up, with estimates suggesting it will account for about two-thirds of total HBM shipments in 2026, while HBM4 gradually gains traction.

SK hynix highlighted that with NVIDIA launching its “Blackwell Ultra” accelerators and big tech players like Google and AWS expanding in-house ASIC-based AI chip development, HBM3E is increasingly being adopted as the memory of choice. Citing UBS’s remarks, the company also expresses confidence that it is set to become the first supplier of HBM3E for Google’s latest TPUs, the v7p and v7e.

HBM3E/HBM4 Dual Strategy

SK hynix is pursuing a dual-generation approach, maintaining its lead in HBM3E while preparing for HBM4. According to the company, it secured the world’s first mass-production system for HBM4 last September, strengthened its packaging partnership with TSMC, built the Cheongju M15X fab, and established a dedicated HBM unit, a Global AI Research Center, and global production infrastructure. These moves position SK hynix to support both HBM3E and HBM4 at scale by 2026, it notes.

In SK hynix’s plans, its Cheongju M15X fab plays a particularly important role. Business Korea suggests that the company is set to complete the first clean room at its M15X fab in May 2026 and begin pilot operations. The facility, a key production hub with over 20 trillion won invested, will manufacture both HBM3E and HBM4. Sources cited by the report also indicate that 10nm-class 6th-generation (1c) DRAM lines, intended for the upcoming HBM4E, will be introduced at the site.

Memory Market Faces Triple Challenges in 2026

Notably, SK hynix highlighted three key challenges for 2026. Even as the memory supercycle continues, caution is rising over pricing, supply, and geopolitical risks. Some analysts and overseas media warn that HBM prices could enter a correction phase after 2026 as competition heats up and capacity expands, the company says.

The trend aligns with TrendForce’s latest research, which indicates that tight supply conditions in the memory market have recently driven a sharp rise in conventional DRAM prices. While HBM3E has also benefited from upward revisions to GPU and ASIC orders—pushing its prices higher—the ASP gap between HBM3E and DDR5 is expected to continue to narrow significantly in 2026, according to TrendForce.

At the same time, SK hynix noted that growing HBM investment is creating a positive ripple effect across the broader memory market. By channeling resources toward HBM, the supply–demand balance for standard DRAM is tightening. Institutional investors cited by the company expect server DDR5 modules to emerge as the second major pillar of the DRAM market in 2026, alongside HBM. NAND flash is also projected to grow in 2026, driven mainly by eSSD demand from AI data centers, SK hynix added.

Read more

- [News] SK hynix, Samsung Reportedly Deliver Paid HBM4 Samples to NVIDIA Ahead of 1Q26 Contracts

- [News] Samsung, SK hynix Reportedly Plan ~20% HBM3E Price Hike for 2026 as NVIDIA H200, ASIC Demand Rises

(Photo credit: SK hynix)