Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] Samsung, SK hynix Escape Worst-Case as China VEU Ends: Annual Review Risks Loom

With the U.S.’s VEU (Validated End User) designation for Samsung and SK hynix in China expiring December 31, 2025, the potential impact on the memory giants’ operations is drawing close scrutiny. According to Hankyung, the companies have avoided the worst-case scenario, as the U.S. will now permit equipment shipments under an annual review system.

First reported by Bloomberg in September, the U.S. Commerce Department proposed a “site license” plan to Korean officials under this system, replacing the indefinite authorizations previously granted to Samsung Electronics’ Xi’an NAND fab and SK Hynix’s Wuxi DRAM and Dalian NAND facilities.

According to Hankyung, companies must pre-submit the types and quantities of semiconductor equipment they need for the year, with the U.S. government reviewing these requests to grant export approvals.

Though this system reportedly reduces the risk of a full VEU revocation, the report notes that the U.S. government estimates removing Samsung Electronics and SK hynix’s Chinese fabs from the VEU list could require up to 1,000 export approvals annually. Even with the new annual approval system, industry observers cited in the report warn that operational uncertainties persist, as companies may struggle to accurately forecast the types and quantities of equipment and components they will need.

Additionally, the revision does not alter Washington’s stance. According to Hankyung, the U.S. government is reportedly maintaining its policy of prohibiting equipment exports for plant expansions or upgrades in China. Thus, as Global Economic points out, Korean chipmakers are pivoting from expansion to survival in China, as they are now prioritizing yields on legacy processes over fab upgrades.

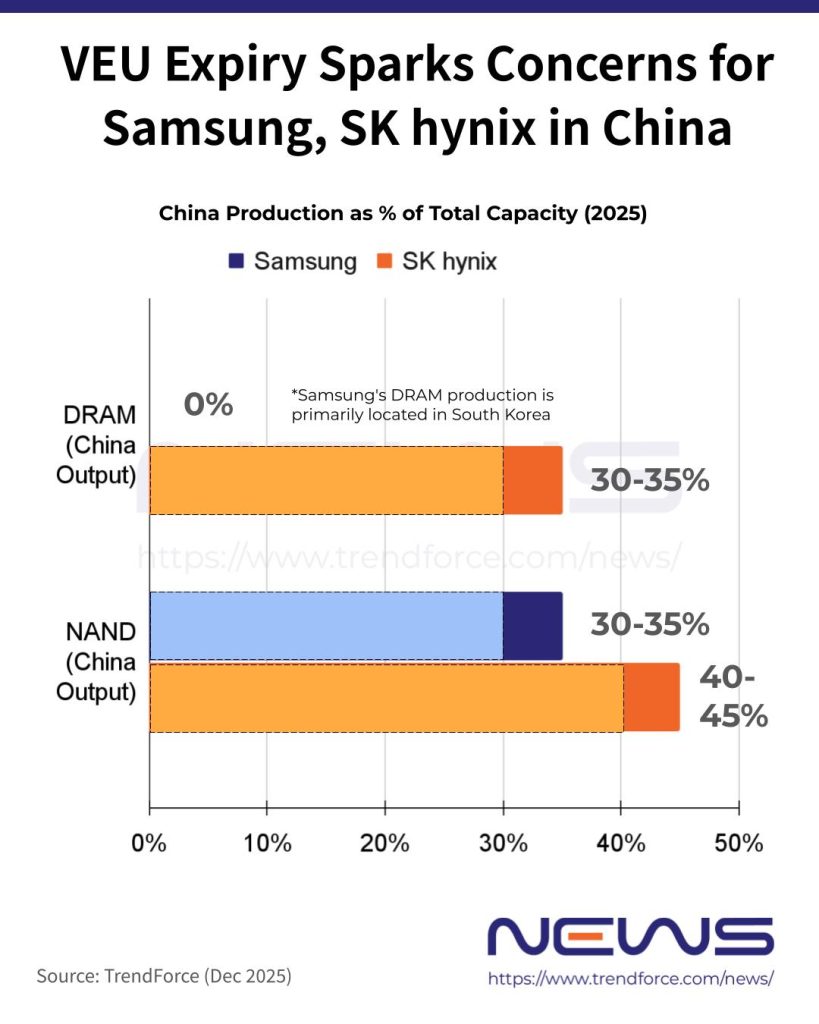

Samsung and SK hynix’s China Footprint

According to TrendForce, around 30–35% of Samsung’s total NAND output is expected to come from China in 2025. For SK hynix, roughly the same share of its DRAM output will come from China, while the country plays an even larger role in NAND production, projected to contribute 40–45% of its total NAND output that year.

Business Post reports that Samsung currently produces an estimated 270,000 NAND wafers per month across its Xi’an 1 and 2 plants, while SK hynix’s Dalian facility turns out about 100,000 wafers monthly.

Meanwhile, Hankyung notes that SK hynix’s Wuxi factory is not expected to undergo major process transitions in 2026, such as a shift to 1b DRAM, following the rollout of the 10nm-class 4th generation (1a) DRAM line starting in 2024. Under the current strategy, legacy DRAMs—like 1z and 1a—will continue to be produced at Wuxi, while cutting-edge lines, including 1b and 1c DRAMs, are reserved for SK hynix’s Icheon and Cheongju facilities, the report adds.

Read more

(Photo credit: SK hynix)