Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

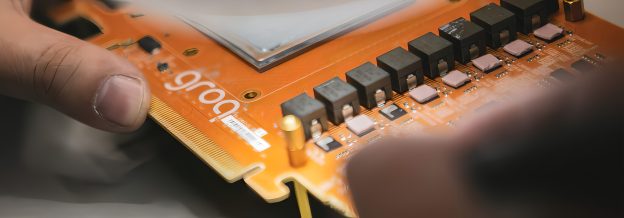

[News] Samsung Emerges as Potential Second Foundry for NVIDIA Alongside TSMC After Groq Licensing Deal

Will Samsung emerge as an alternative to TSMC for manufacturing NVIDIA chips? A recent move by Team Green has raised that possibility. According to Commercial Times, AI chip startup Groq has entered into a non-exclusive licensing agreement with NVIDIA, with key members of the Groq team joining NVIDIA to help advance the licensed technology. Given Groq’s close foundry partnership with Samsung, industry sources say this development implicitly suggests that NVIDIA may be exploring a second foundry supplier—potentially challenging TSMC’s long-standing dominance in NVIDIA’s manufacturing supply chain.

Recently, Groq announced that it has entered into a non-exclusive licensing agreement with NVIDIA covering its inference technology. The financial terms were not disclosed, CNBC notes, although CNBC adds that NVIDIA has agreed to acquire assets from Groq for US$20 billion in cash, according to Alex Davis, CEO of Disruptive, who led Groq’s latest financing round in September.

Groq Deal Highlights Samsung’s Potential Role in NVIDIA’s Supply Chain

Institutional investors cited by Commercial Times say the transaction differs from a direct acquisition. By securing Groq’s core intellectual property (IP) and recruiting several senior executives, including founder Jonathan Ross, a former core developer of Google’s TPU program, NVIDIA is able to obtain the underlying technology while sidestepping potential antitrust scrutiny.

As highlighted by Commercial Times, Groq signed an agreement with Samsung in August 2023 to jointly mass-produce next-generation language processing units (LPUs), with sources saying the LPUs built on Samsung’s 4nm process have already entered mass production. As Groq’s technology is integrated into NVIDIA’s ecosystem, Samsung could emerge as NVIDIA’s “second supply source” alongside TSMC. For NVIDIA, Commercial Times notes that the partnership not only positions Samsung as a counterbalance to TSMC—strengthening NVIDIA’s bargaining power—but also helps the company build a competitive edge in the inference market.

In addition, Reuters notes that Groq is among a group of emerging AI chip startups that do not rely on external HBM, allowing them to avoid the memory crunch affecting the global semiconductor industry. Instead, the company uses on-chip memory known as SRAM, which helps speed up interactions with chatbots and other AI models but also limits the size of the model that can be served.

Samsung Accelerates U.S. Foundry Plans, Deepens NVIDIA Ties

Commercial Times also notes that Samsung Foundry is actively preparing U.S. manufacturing capacity, with its Taylor, Texas fab accelerating progress and aiming to have 2nm production capacity in the U.S. ready by the end of 2026—potentially ahead of TSMC. Industry sources add that Samsung may leverage its strengths in memory manufacturing and pricing to secure more opportunities to produce AI chips for NVIDIA. In addition, Commercial Times notes that Samsung has recently also delivered SOCAMM2 samples to NVIDIA.

Read more

- [News] SOCAMM2 War Heats Up: Samsung Reportedly Delivers Samples to NVIDIA, Ramping Early 2026

- [News] NVIDIA Reportedly Denies USD 20B Groq Acquisition Rumors

(Photo credit: Groq)