Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[Insights] December Panel Prices: TV Panels Expected to Rise in January on Memory Supply Concerns

.TV

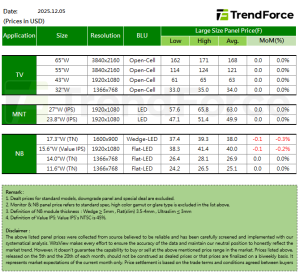

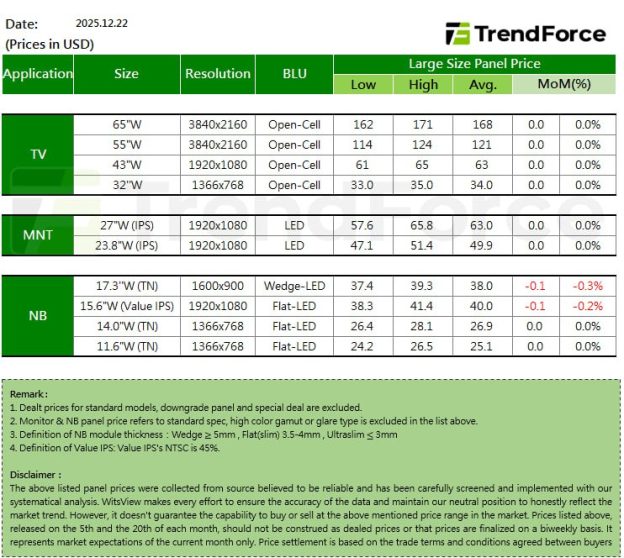

Since December, brand customers have increasingly viewed panel prices as having bottomed out, while also growing concerned that memory shortages and rising prices could spill over into TV products and intensify next year. As a result, some panel demand originally planned for 1Q26 has been brought forward. TV panel demand remains stable, and panel makers continue to operate at relatively high utilization rates, providing underlying support for panel prices.

With demand holding up, panel makers have begun to build expectations for price increases. TV panel prices for sizes from 32 inches to 65 inches are expected to remain flat this month. Meanwhile, with the Lunar New Year in February and fewer working days likely shifting some demand to January and March, January demand could still stay solid, raising the possibility that TV panel prices may start to edge higher as early as January.

.MNT

Although MNT panel demand in the fourth quarter remains relatively weak, a small number of customers have increased orders. Panel makers have been unwilling to make further price concessions, as mainstream monitor panels have been loss-making for an extended period, and brand customers are currently willing to accept stable pricing. As a result, MNT panel prices in December are expected to remain largely flat. At the same time, expectations that TV panel prices may begin to rise could help support MNT panel pricing, prompting panel makers to start building momentum for potential price increases, though outcomes will still depend on actual demand trends and buyer–seller negotiations.

.NB

Since December, notebook panel demand has begun to feel the impact of memory shortages and sharply rising memory prices, prompting some brands to accelerate shipments of mid- to low-end models ahead of planned system price hikes next year, which has temporarily lifted demand. However, with greater uncertainty surrounding demand in 2026 due to memory-related factors, panel makers have softened their pricing stance despite the short-term pickup, prioritizing customer relationships. As a result, notebook panel prices in December are expected to remain flat for TN panels, while IPS panels are projected to decline by about US$0.1–0.2, and prices may continue to face adjustment pressure as demand weakens further in 1Q26.