Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] TSMC’s Bold Pivot: Kumamoto Fab 2 Reportedly Leaps from 6nm to 2nm amid JASM Losses

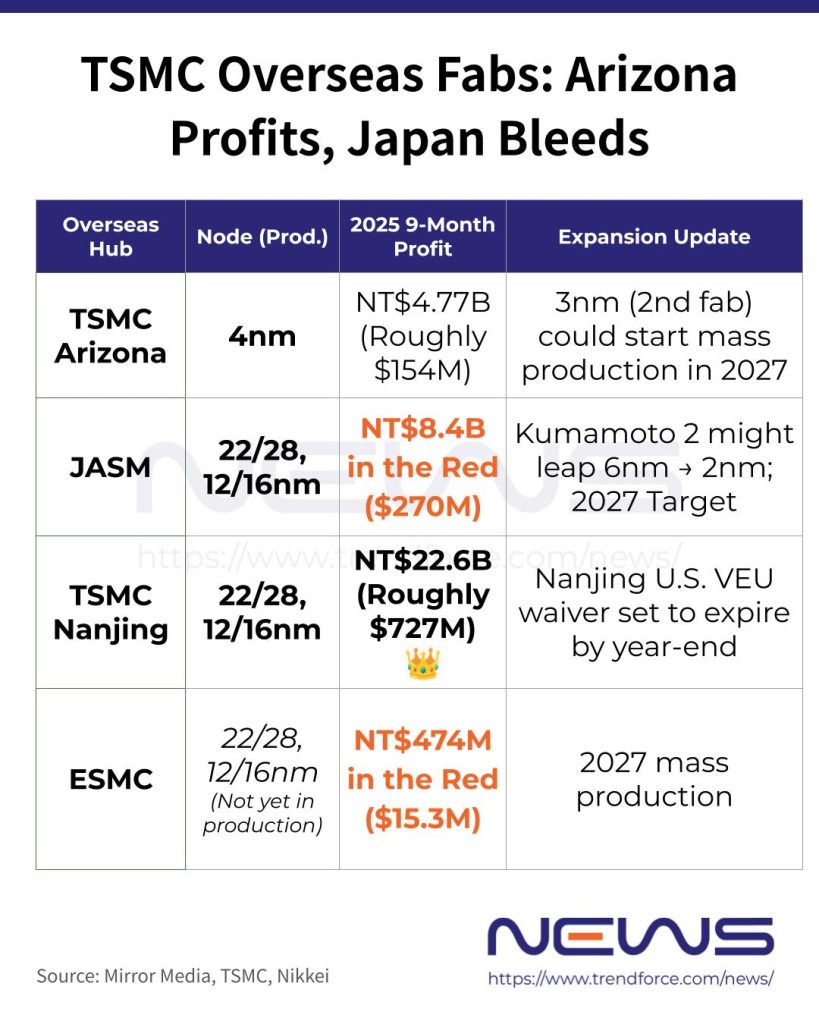

While TSMC’s Arizona expansion races ahead, its Japan operations are moving at a slower pace, drawing close attention. Plans for Kumamoto Fab 2, however, may be shifting. A Nikkei report had suggested a move to 4nm—originally planned for 6nm and 7nm—but Mirror Media now reports a bolder plan: the fab could skip 6nm entirely and go straight to 2nm.

According to Mirror Media, TSMC has submitted an internal assessment to Chairman C.C. Wei. If implemented, Kumamoto Fab 2 would shift from primarily serving Japanese auto clients to focusing on major AI chip customers such as NVIDIA and AMD, as noted by the report.

Arizona Profits, Kumamoto Bleeds

The rationale is clear: TSMC’s financial report shows that in the first three quarters of 2025, after ramping up 4nm production, its Arizona fab posted a net profit of NT$4.7 billion in the first half of 2025. In contrast, JASM reported a NT$6.2 billion loss over the same period.

As Mirror Media reports, TSMC inked the Kumamoto Fab 2 deal on Oct. 24, breaking ground on a 6nm facility—despite Taiwan’s 6nm lines running below 70% capacity and Kumamoto Fab 1’s 28nm operations sitting idle amid weak auto-chip demand. However, industry insiders cited by the report warn another 6nm fab would only deepen JASM’s losses, and the foundry giant seems to have changed its mind.

According to Mirror Media, by late November, TSMC had pivoted. The chipmaker reportedly scrapped the 6nm plan quietly, repositioning Kumamoto Fab 2 for advanced autonomous driving and AI chips.

What’s Driving the 2nm Jump

Unlike Nikkei’s report, Mirror Media suggests that Kumamoto Fab 2 is increasingly likely to skip 4nm and jump straight to 2nm. Industry observers cited by the report note that 4nm entered mass production in 2023, so a 4nm launch at Kumamoto in 2027 could risk missing AI customers’ shift to 2nm. TSMC has faced similar challenges before: 6nm utilization fell sharply just three years after launch as clients moved to newer nodes, highlighting the high risk of sticking with 4nm, the report adds.

Kumamoto 2nm: High Stakes Ahead

Nonetheless, Mirror Media also cautions that a shift to 2nm at Kumamoto Fab 2 would raise the stakes significantly, with Capex jumping from just over $10 billion to more than $25 billion.

Notably, Tom’s Hardware reports that Taiwanese authorities are weighing a stricter export rule that would limit the world’s top foundry to shipping only technologies two generations behind its leading-edge nodes. The policy is based on the government’s N-2 rule, which replaces the previous N-1 standard. Under N-2, TSMC would be allowed to export only process nodes trailing Taiwan’s cutting-edge by two generations—effectively technologies two to four years old, depending on how generations are counted, according to the Central News Agency.

On the other hand, Industry sources cited by the Mirror Media report say the move largely hinges on whether Japan is willing to offer additional subsidies. With few domestic AI customers, most output would be export-bound, which could in turn affect Tokyo’s willingness to provide support, as per Mirror Media.

The report also highlights that Rapidus, backed by the Japanese government and major semiconductor firms led by Sony, is targeting 2nm at its Hokkaido fab, with a mass-production timeline close to TSMC’s Kumamoto Fab 2. This reportedly sets the stage for a potential showdown over customers and government subsidies, forcing Japan’s semiconductor supply chain to choose between TSMC and Rapidus.

In response to reports of ongoing losses at Kumamoto Fab and rumors of a leap from 6nm to 2nm, TSMC said it does not comment on market speculation, adding that profitability is influenced by multiple factors, including utilization, depreciation, and ongoing capital investments, and that detailed updates will be provided at an appropriate time, according to Mirror Media.

Read more

- [News] TSMC Reportedly Weighs Shifting Kumamoto 2nd Plant from 6nm/7nm to 4nm Amid AI Demand

- [News] TSMC Reportedly Delays Kumamoto 2nd Fab Launch to 2029 Amid U.S. Expansion Push

(Photo credit: TSMC)