Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] Micron’s Exit Reportedly Opens Door for Huawei to Target Korea’s Consumer SSD Market

South Korea’s PC SSD market is undergoing significant shifts as major manufacturers raise prices and Micron’s recent announcement. According to South Korean outlet ZDNet, Micron—the world’s third-largest supplier—is preparing to exit the consumer SSD business, a move expected to create openings for Chinese SSD makers that compete heavily on price and volume.

The report notes that Micron plans to withdraw from the consumer SSD segment after February 2026, prompting mid-size Korean PC makers and consumers to seek replacement options. Citing industry sources, the report indicates that Micron’s exit is expected to substantially lower the entry barrier for Chinese SSD manufacturers.

Huawei Expands SSD Portfolio With New Korean Launch

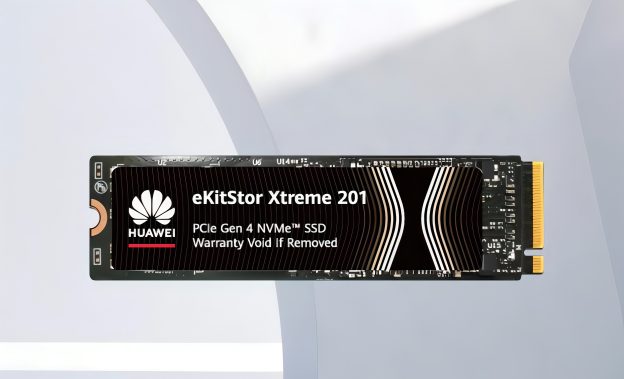

As the report notes, Huawei Korea held a launch seminar on December 2 for domestic partners, introducing three SSD products: the eKitStor Xtreme 201 for desktop PCs and laptops, and the portable eKitStor Shield 210.

Notably, the eKitStor Xtreme 201 is a PCI Express 4.0, M.2 2280 NVMe SSD. The 1TB model delivers peak read and write speeds of 7.4GB/s and 6.7GB/s, respectively—performance comparable to competing offerings, the report adds.

Huawei Boosts SSD Appeal in Korea With TLC NAND

As the report highlights, the previous domestic model, the “eKitStor Xtreme 200E,” struggled to gain traction among Korean consumers because it used QLC NAND flash, which is generally less favored for speed and reliability. In contrast, the Xtreme 201 adopts TLC (3-bits-per-cell) NAND flash.

Citing a Huawei Korea representative, the report notes that the Xtreme 201’s TLC NAND flash provides nearly three times the total write endurance of SSDs from Korean manufacturers with the same capacity.

The report adds that Huawei completed wireless certification for its SSD lineup in Korea at the end of November and plans to begin consumer sales later this month. Official pricing has yet to be finalized.

Meanwhile, as the report notes, SSD prices in Korea are unlikely to ease anytime soon. As of December 9, major SSD suppliers said manufacturers had already informed partners of supply price increases of 20% to 40%, taking effect between late October and early December.

TrendForce observes that in the fourth quarter, market sentiment is shifting from recovery to scrambling for components. Major NAND Flash suppliers are cautious about increasing production due to past volatility, resulting in enterprise SSD output growth significantly lagging demand. With the market tilted in favor of sellers, TrendForce predicts that average enterprise SSD contract prices will rise by more than 25% QoQ in Q4, potentially leading to another industry revenue record.

Read more

- Enterprise SSD Prices and Shipments Surge in 3Q25, Industry Revenue Climbs 28%, Says TrendForce

- [News] Micron to End Crucial Consumer Memory by Feb 2026, Redirects Supply to Enterprise amid AI Surge

(Photo credit: Huawei)