Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] Gold and CCL Price Surge Squeezes Substrate Makers as AI Fuels Demand for High-Value PCBs

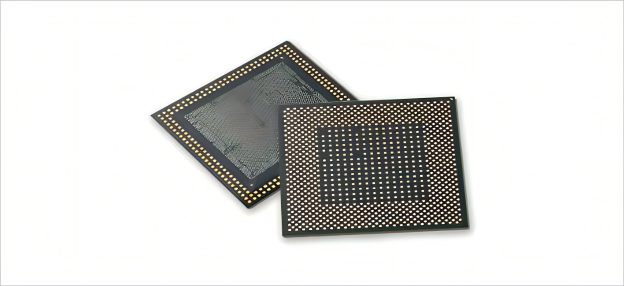

Raw material prices are climbing, and the semiconductor substrate industry is feeling the strain as the cost of critical inputs continues to rise. According to ZDNet, South Korea’s substrate makers are facing mounting pressure from sharp increases in raw material prices. Citing industry sources, the report notes that prices of major semiconductor substrate materials—including gold and CCL (copper-clad laminate)—have risen sharply in 2025. Gold and CCL together make up nearly half of the raw material costs for printed circuit boards (PCBs). The report adds that PCBs are essential components in DRAM, SSD modules, and system semiconductors.

Rising PGC and CCL Costs Meet Surging Demand for High-End PCB Materials

The report notes that potassium gold cyanide (PGC) is the most critical gold-based material for substrates. According to the report, South Korean PCB makers TLB and Simmtech say PGC prices have jumped from the 50,000-won-per-gram range in 2023 to 70,000 won in 2024, reaching 99,000 won per gram in the third quarter of 2025—almost a twofold increase.

Meanwhile, CCL has an even broader reach, as it is used not only in semiconductor module PCBs but also in package substrates. As the report notes, Samsung Electro-Mechanics and LG Innotek say the purchase price of CCL in the third quarter rose by the low-to-mid-10% range from a year earlier.

Citing institutional investors, Commercial Times states that as AI infrastructure enters a phase of rapid expansion, demand for PCBs and CCLs is climbing across servers, switches, and AI accelerators. Demand is particularly strong for high-end HDI, ultra-low-Dk/Df materials, server motherboards, and high-layer-count boards. The report adds that for high-end CCL, the increase in raw material costs is expected to be successfully passed through.

TrendForce notes that PCBs are entering a period of fundamental change as AI server design evolves. From NVIDIA’s cableless Rubin platform to hyperscalers’ ultra-high-layer HDI ASIC servers, PCBs are shifting from passive carriers to critical performance enablers. TrendForce adds that 2026 will be a turning point, when technological innovation becomes the primary driver of PCB value.

Substrate Makers Turn to High-Value Products Amid Cost Pressures

Despite the sharp rise in material costs, ZDNet notes that substrate makers remain confident they can offset the pressure by increasing the share of high value-added products in their portfolios.

ZDNet notes that demand is increasingly centered on higher-value memory products, providing a buffer against rising material costs. According to the report, the mass commercialization of 1c DRAM in 2026 is expected to accelerate adoption of high-performance 8 Gbps-class DDR5. At the same time, production of second-generation SoCAMM (SODIMM-CAMM) PCBs—Nvidia’s next-generation memory module designed for AI servers—will also begin. Moreover, the report points out that demand for FC-BGA, a package substrate that connects a flipped chip to fine metal bumps, is rising sharply as global tech companies ramp up development of their own ASICs.

Read more

- Rubin’s Cableless Architecture and ASIC High-Layer HDI Designs Push PCBs to the Center of AI Compute Power, Says TrendForce

- [News] BT Substrate, Fiberglass Prices Reportedly Eye 20% Hike amid AI Boom and Supply Shortage

(Photo credit: Samsung Electro-Mechanics)