Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

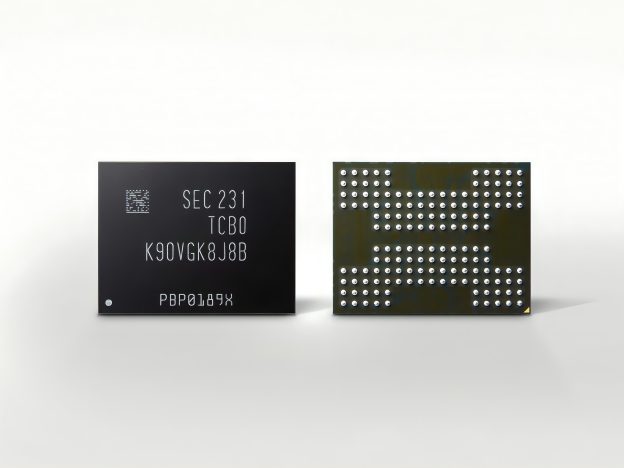

[News] Samsung Reportedly Boosts V8 NAND Line Utilization by More Than 10% in Q3 Amid AI Demand

As data center expansion accelerates and cloud leaders shift focus from AI training to inference, demand for high-capacity memory is surging, fueling a swift recovery in the global NAND Flash market. According to ZDNet, sources indicate that Samsung Electronics has ramped up operations at its main NAND facility in Pyeongtaek, increasing the utilization rate of its 8th-generation (V8) NAND line by more than 10% in the third quarter compared with the previous quarter.

The report notes that Samsung’s V8 NAND production lines operated at a moderate 60–70% utilization rate in the second quarter. By the third quarter, however, that figure reportedly climbed to around 80%. Sources cited in the report expect this upward momentum to continue into the fourth quarter. Meanwhile, orders for materials and components used in NAND production have also been rising since mid-year.

Samsung’s V8 NAND—featuring 236 layers and launched into mass production in late 2022—stands alongside the 6th-generation (V6) version as one of the company’s key NAND products. The report estimates its monthly production capacity at roughly 100,000 wafers.

AI-Driven Demand Lifts Samsung’s V6 and V8 NAND Production

The report notes that Samsung’s V8 NAND has indirectly benefited from the AI-driven rebound in NAND demand, which is largely fueled by enterprise SSDs (eSSDs) used in AI infrastructure. These server-grade eSSDs typically adopt QLC (Quad-Level Cell) NAND that stores four bits per cell—enabling higher storage density than TLC (Triple-Level Cell) NAND.

Samsung’s V8 NAND mainly employs a TLC design and is primarily used in consumer products, with no QLC-based version introduced to date. Nevertheless, as NAND supply continues to shift toward eSSDs, consumer SSD inventories have been rapidly declining, the report adds.

TrendForce notes that as traditional high-capacity HDDs face significant shortages, cloud service providers (CSPs) are increasingly turning to NAND Flash suppliers, driving stronger demand for nearline SSDs. According to TrendForce, NAND Flash contract prices across all product categories are expected to rise by an average of 5–10% in the fourth quarter of 2025.

Read more

- [News] Korea, U.S. DRAM Giants Reportedly Halt Pricing for a Week, Memory Module Makers Follow

- AI Storage Demand Accelerates HDD Replacement as NAND Flash Suppliers Shift Toward High-Capacity Nearline SSDs, Says TrendForce

(Photo credit: Samsung)