Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

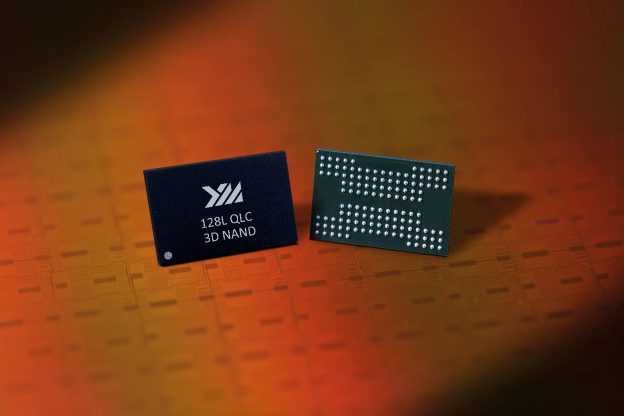

[News] China’s YMTC Launches $3B Wuhan Phase III Venture, Signaling NAND Expansion Ambitions

As China accelerates its memory ambitions with DDR5 capacity reportedly on the rise, domestic NAND powerhouse YMTC has made another bold move. According to Star Market Daily, Changcun Phase III (Wuhan) Integrated Circuit Co., Ltd. was officially established on September 5, with Chen Nanxiang, YMTC’s Chairman, named as its legal representative.

The new company reportedly boasts a registered capital of RMB 20.72 billion (nearly $3 billion) and will operate across IC manufacturing, sales, design, and chip product distribution. South China Morning Post reports that YMTC held a 50.2% stake in the venture, with state-owned Hubei Changsheng Phase III Investment Development Co. holding the remaining 49.8%.

Star Market Daily notes this represents YMTC’s next major expansion following its Wuhan Phase II launch in 2021. However, Phase III takes a different approach—YMTC invested directly from the start, unlike the previous phase which initially involved multiple stakeholders, the report adds.

The report explains that in 2023, Big Fund and Hubei Changsheng Development withdrew from Phase II, leaving YMTC to shoulder the full RMB 60 billion investment alone before dissolving that entity.

Market Impact: YMTC’s Phase III Push

Notably, eefocus sees this move as a clear signal of YMTC’s Phase III expansion. The company currently churns out nearly 130,000 wafers per month—about 8% of the global 3D NAND market—and plans to ramp production to 150,000 wafers by 2025, aiming for a 15% share of global NAND supply by the end of 2026, according to eefocus.

Previous environmental filings cited by the report also show YMTC’s total planned capacity at around 300,000 wafers per month, with each phase targeting 100,000. The launch of Phase III, thus, marks a steady push toward doubling total capacity, reinforcing domestic demand for self-reliant storage solutions, as per eefocus.

Chosun Biz reports that YMTC is also pushing the envelope in 3D NAND flash technology by stacking more layers. In the race for density, SK hynix tops the charts with 321 layers in mass production, Samsung Electronics follows with 286 layers, and YMTC has now reached 270 layers, the report notes.

Read more

- [News] China’s YMTC Dominates Hybrid Bonding Patents, Pressuring South Korean Memory Giants Samsung and SK hynix

- [News] China’s YMTC Reportedly Joins NAND Price Hike, Set to Increase Over 10% in April

(Photo credit: YMTC)