Popular Keywords

- About Us

-

Research Report

Research Directory

Semiconductors

LED

Consumer Electronics

Emerging Technologies

- Selected Topics

- Membership

- Price Trends

- Press Center

- News

- Events

- Contact Us

- AI Agent

About TrendForce News

TrendForce News operates independently from our research team, curating key semiconductor and tech updates to support timely, informed decisions.

- Home

- News

[News] Intel Reportedly Sets 2026 as Key Test for 14A, But Might Rely on TSMC “Forever”

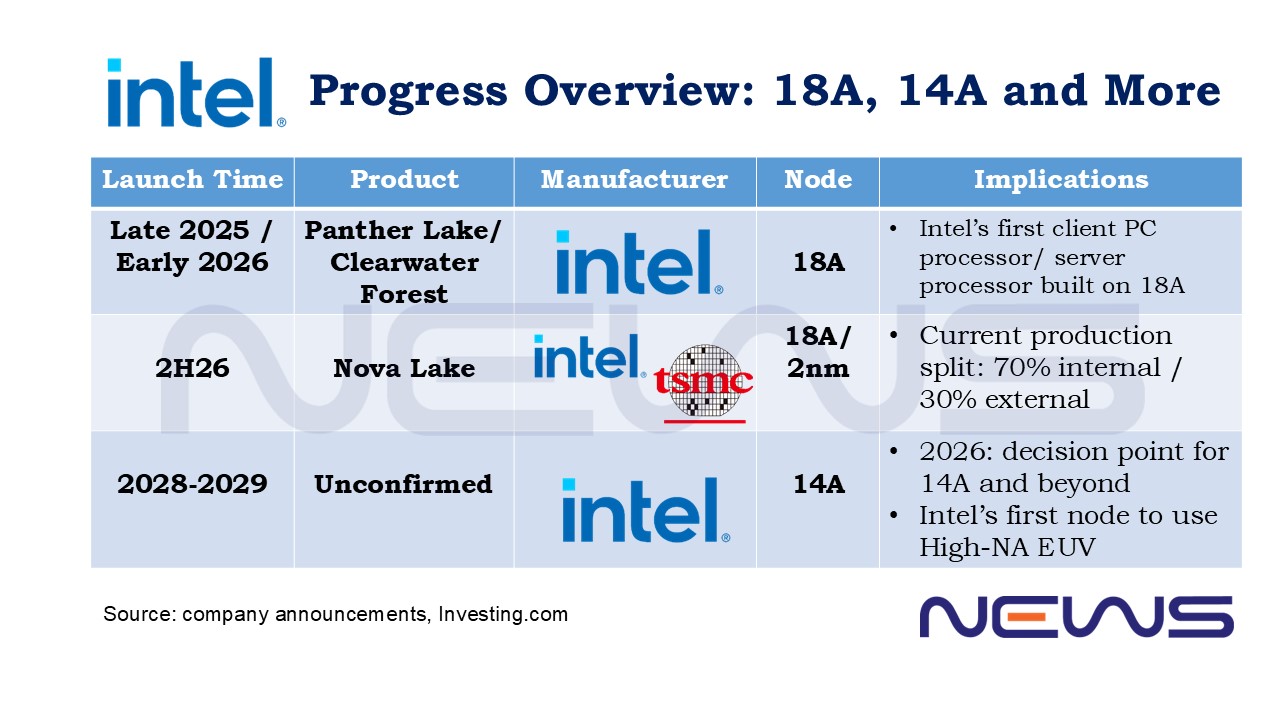

Supported by SoftBank’s $2 billion investment and the U.S. government’s 10% ownership stake, Intel has provided a more detailed outlook on its foundry business and key process node roadmap. According to Bloomberg and Investing.com, Team Blue views 2026 as a pivotal year for its manufacturing technology, which will determine whether it is ready to advance with 14A.

Notably, the company also confirmed it will continue to rely heavily on external foundries, potentially placing orders with TSMC “forever,” as per Investing.com.

14A Update: More Confidence

As Bloomberg reports, citing Intel CFO Dave Zinsner, the company will only build 14A manufacturing capacity if it secures commitments from external customers.

According to Investing.com, citing Zinsner, this move could be attributed to the higher production costs of 14A, partly because 14A will use advanced High-NA EUV tools, unlike 18A. Additionally, the increased number of lithography steps and overall investment raise the cost per wafer, making higher production volumes necessary to balance expenses, the report adds.

When asked whether Intel might abandon advanced node production if 14A falls short, Zinsner emphasized that CEO Lip-Bu Tan has become increasingly confident in the process. This optimism stems from continued improvements in 18A yields and encouraging early results from 14A, along with growing customer interest—reducing the likelihood of the worst-case scenario, according to Investing.com.

Outsourcing Strategy and TSMC Partnership

Meanwhile, as per transcript of the latest investor conference from Investing.com, Zinsner acknowledged that Intel’s chip production will continue to rely heavily on external foundries, particularly TSMC. “We will be putting products on TSMC, you know, forever, really. They’re a great partner for us,” he said.

According to Investing.com, Intel estimates that it currently produces around 70% of its chips in-house, with the remaining 30% outsourced to external foundries. The report notes that TSMC manufactures the entire Lunar Lake lineup, and most of Arrow Lake is also outsourced.

Notably, Economic Daily News reported in April that Intel has joined AMD and Apple as part of TSMC’s first wave of 2nm clients, as its Compute Tile for Nova Lake, set to launch in 2026, has already entered trial production at TSMC’s Hsinchu fab.

Intel’s Panther Lake, expected to be built on its 18A process, may be the company’s next major in-house flagship chip, with mass production targeted for the second half of 2025.

Recent Financial Boost

Intel recorded a significant boost in capital inflows this quarter, largely driven by several major financial moves, according to Investing.com. CFO David Zinsner revealed that the company raised nearly $1 billion from the sale of Mobileye shares and expects to finalize the Altera deal in the coming weeks, which could add another $3.5 billion.

The report also notes that a $2 billion investment from SoftBank is expected by the end of the quarter, pending regulatory approvals.

Earlier this quarter, Intel received $5.7 billion in funding from the U.S. government. These capital injections have notably strengthened Intel’s cash position, providing the financial flexibility to pursue its debt-reduction strategy. The company plans to let $3.8 billion in debt mature this year without refinancing, as per Investing.com.

Read more

- [News] ASML Confirms First High-NA EUV EXE:5200 Shipment, Reportedly Prepping for Intel’s 14A in 2027

- [News] Intel Earnings Call Bombshell: Could Exit Advanced Nodes if 14A Fails, Eyes TSMC Outsourcing Beyond 18A

(Photo credit: Intel)